A Puerto Rico LLC Operating Agreement for Husband and Wife is a legal document that outlines the rights, responsibilities, and ownership structure of a limited liability company (LLC) established jointly by a couple in Puerto Rico. This agreement serves as a written contract that governs the day-to-day operations, decision-making processes, and distribution of profits and losses within the LLC. The Puerto Rico LLC Operating Agreement for Husband and Wife is crucial for clarifying key aspects of the business relationship and protecting the interests of both spouses. It provides a framework to address various scenarios, such as management responsibilities, capital contributions, profit-sharing arrangements, and dispute resolution procedures. This agreement also helps in establishing the LLC's legal status as a separate entity from the owners, ensuring limited liability protection. Different types of Puerto Rico LLC Operating Agreements for Husband and Wife may include: 1. Single-Member LLC Operating Agreement: This agreement is suitable when only one spouse will be the official owner or member of the LLC, while the other spouse plays a passive or non-participatory role. It defines the rights and responsibilities of the sole owner, including decision-making authority, profit allocation, and tax obligations. 2. Joint-Member LLC Operating Agreement: In cases where both spouses actively participate in the management and operation of the LLC, a joint-member agreement is appropriate. This type of agreement outlines how decision-making authority, profit distribution, and other responsibilities will be shared between the couple. 3. Equal Partnership LLC Operating Agreement: If both spouses intend to have an equal ownership stake in the LLC and share its management equally, an equal partnership LLC operating agreement is suitable. This agreement outlines the equal rights, responsibilities, and decision-making authority of each spouse, as well as the equitable distribution of profits and losses. 4. Specialized Roles LLC Operating Agreement: In some cases, spouses may have different areas of expertise or prefer to contribute to the LLC in specific ways. A specialized role LLC operating agreement allows for the designation of specific responsibilities, such as one spouse managing finances while the other focuses on marketing and sales. This agreement clearly defines each spouse's unique contributions and ensures effective cooperation. 5. Dissolution or Buyout Agreement: While not specific to spouses, a dissolution or buyout agreement can be relevant if the couple wishes to include terms for the eventuality of a divorce or marital dissolution. This agreement outlines the process for dividing and transferring ownership interests in the event of a termination of the marital relationship. In conclusion, a Puerto Rico LLC Operating Agreement for Husband and Wife establishes the legal foundation for a jointly owned business, providing clarity, protection, and guidance for the couple's entrepreneurial journey. It is important to consult with a legal professional to ensure compliance with Puerto Rico's specific laws and regulations regarding LCS and to tailor the agreement to suit the unique needs and goals of the couple.

Operating Agreement Llc Puerto Rico Template

Description

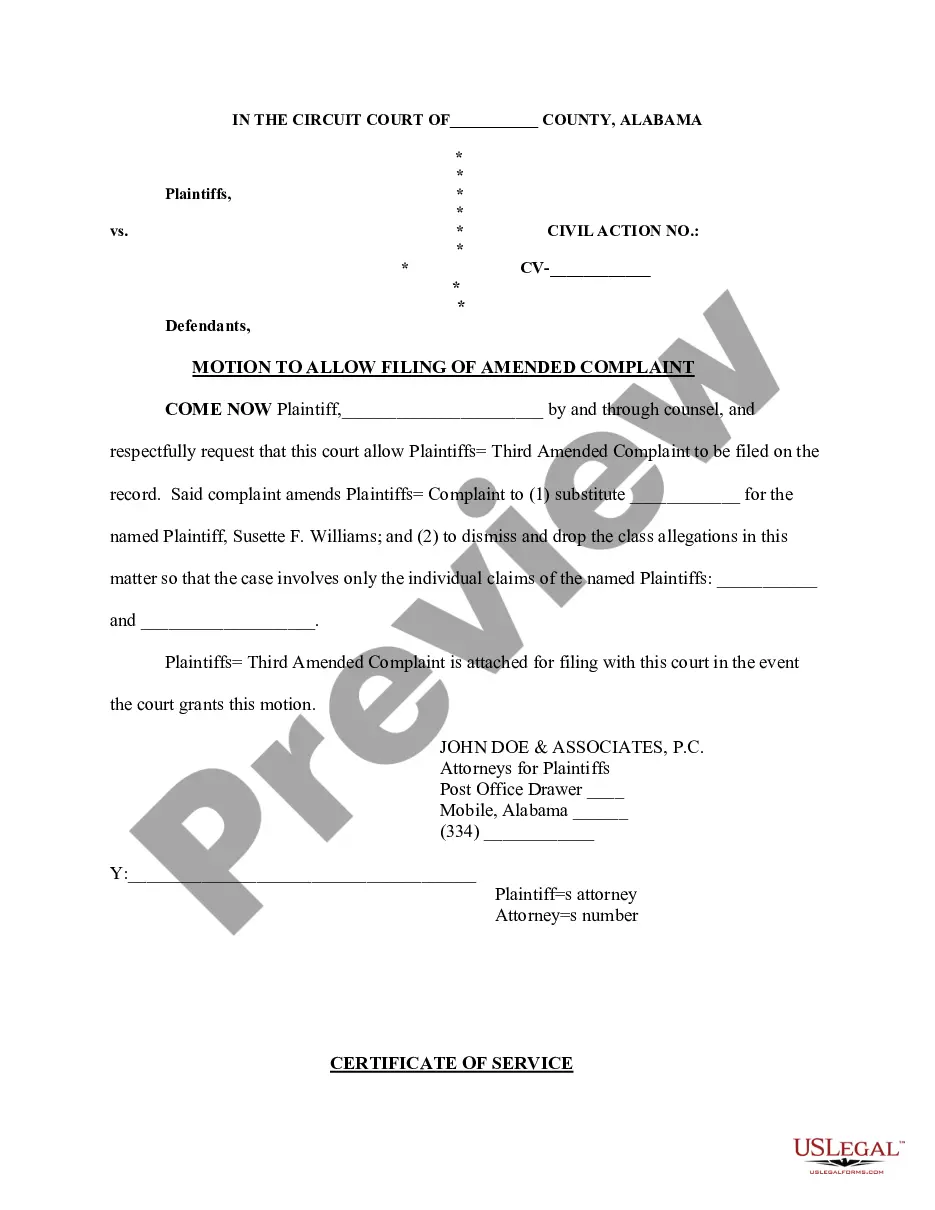

How to fill out Puerto Rico LLC Operating Agreement For Husband And Wife?

US Legal Forms - one of several biggest libraries of authorized forms in the United States - provides a wide array of authorized record web templates you are able to download or printing. Making use of the site, you can get a huge number of forms for organization and person purposes, categorized by categories, says, or search phrases.You will find the newest versions of forms such as the Puerto Rico LLC Operating Agreement for Husband and Wife in seconds.

If you already possess a subscription, log in and download Puerto Rico LLC Operating Agreement for Husband and Wife in the US Legal Forms catalogue. The Obtain switch can look on every single form you view. You get access to all earlier acquired forms within the My Forms tab of your own profile.

If you want to use US Legal Forms the very first time, allow me to share basic guidelines to help you get began:

- Be sure you have chosen the best form for your personal city/county. Select the Review switch to examine the form`s information. Read the form explanation to actually have chosen the correct form.

- In case the form does not fit your specifications, use the Look for industry at the top of the monitor to obtain the one who does.

- If you are satisfied with the shape, confirm your choice by visiting the Purchase now switch. Then, select the rates program you favor and offer your qualifications to register on an profile.

- Process the deal. Utilize your Visa or Mastercard or PayPal profile to finish the deal.

- Choose the format and download the shape in your product.

- Make adjustments. Load, revise and printing and indicator the acquired Puerto Rico LLC Operating Agreement for Husband and Wife.

Every web template you added to your bank account does not have an expiry date and is your own permanently. So, if you wish to download or printing another backup, just go to the My Forms portion and then click around the form you want.

Gain access to the Puerto Rico LLC Operating Agreement for Husband and Wife with US Legal Forms, probably the most substantial catalogue of authorized record web templates. Use a huge number of professional and state-specific web templates that satisfy your organization or person demands and specifications.

Form popularity

FAQ

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

10 Must Haves in an LLC Operating Agreement Member Financial Interest. What percentage ownership does each member have? Corporate Governance. Corporate Officer's Power and Compensation. Non-Compete. Books and Records Audit. Arbitration/Forum Selection. Departure of Members. Fiduciary duties.More items...

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

An operating agreement does not need to be notarized in Florida.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

An operating agreement is a legally binding document that limited liability companies (LLCs) use to outline how the company is managed, who has ownership, and how it is structured. If a company is a multi-member LLC , the operating agreement becomes a binding contract between the different members.

There is no requirement that the operating agreement is notarized. Even without being notarized, the document is still considered legally enforceable among the parties. However, some businesses will still have the signatures notarized to make things feel more official.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.