[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Designation] [Company Name] [Company Address] [City, State, ZIP] Subject: Finalization of Accounting for [Year] — Puerto Rico Dear [Recipient's Name], I hope this letter finds you in good health. I am writing to provide a detailed description of the finalization of accounting process for [Year], specifically for Puerto Rico. As the accounting period for the year is coming to a close, it is essential to ensure that all financial transactions are accurately recorded and accounted for in compliance with Puerto Rico's accounting regulations. In Puerto Rico, the finalization of accounting involves several key steps to accurately determine the financial position and performance of a company. These steps may include, but are not limited to: 1. Financial Statement Preparation: Our accounting team will compile and prepare the financial statements, including the balance sheet, income statement, and cash flow statement, reflecting the company's financial performance in [Year]. These statements adhere to the Generally Accepted Accounting Principles (GAAP) specific to Puerto Rico. 2. Adjusting Entries: We will review all accounts to identify any necessary adjustments required to ensure the accuracy of financial reporting. This may include accruals, deferrals, provisions, or corrections to prior entries. 3. Fixed Asset Evaluation: As part of the finalization process, our team will evaluate the fixed assets owned by the company and record any depreciation or impairment charges in accordance with Puerto Rico's accounting standards. 4. Inventory Reconciliation: If your business deals with inventory, we will conduct a thorough inventory count to reconcile physical stock with recorded figures, identifying any variances and adjusting the accounts accordingly. 5. Tax Compliance: We will review all financial data to ensure compliance with Puerto Rico's tax laws and regulations. This includes verifying that all deductions, credits, and exemptions are accurately recorded and in line with the applicable tax codes. It is important to note that there might be different types of Puerto Rico Sample Letters for Finalization of Accounting based on the specific requirements of each business. These variations may arise due to factors like the nature of the company, sector/industry, ownership structure, or corporate governance policies. Please be assured that our experienced team is well-versed in Puerto Rico's accounting regulations and will diligently adhere to the necessary standards to ensure accuracy and compliance throughout the finalization process. Should you have any questions or require further information, please do not hesitate to reach out to us. We value your satisfaction and look forward to assisting you in finalizing your accounting for [Year]. Thank you for your attention, and we appreciate the opportunity to serve you. Yours sincerely, [Your Name]

Puerto Rico Sample Letter for Finalization of Accounting

Description

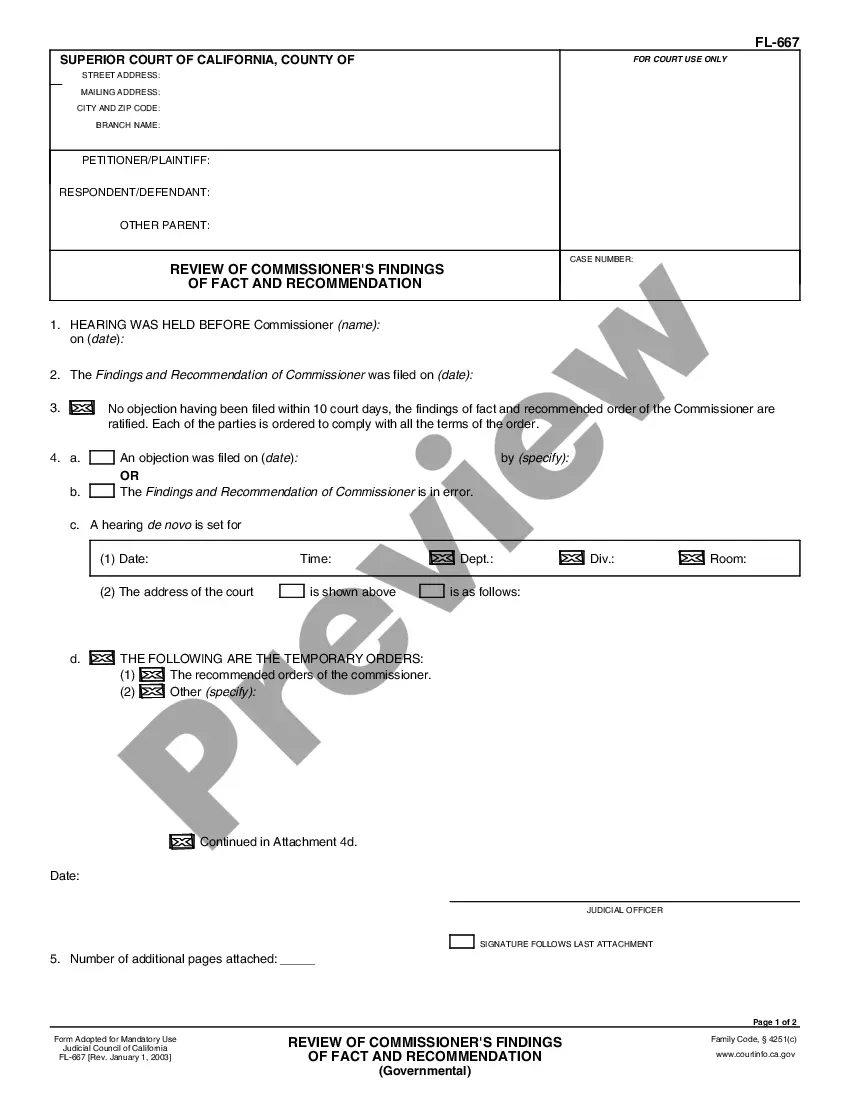

How to fill out Puerto Rico Sample Letter For Finalization Of Accounting?

US Legal Forms - one of many most significant libraries of authorized varieties in the States - gives a variety of authorized file templates you are able to download or print out. Utilizing the internet site, you can get 1000s of varieties for company and person uses, categorized by classes, suggests, or search phrases.You will find the latest types of varieties like the Puerto Rico Sample Letter for Finalization of Accounting within minutes.

If you have a registration, log in and download Puerto Rico Sample Letter for Finalization of Accounting from your US Legal Forms catalogue. The Download switch will show up on every develop you look at. You have accessibility to all earlier acquired varieties in the My Forms tab of your respective account.

If you would like use US Legal Forms for the first time, allow me to share straightforward directions to help you began:

- Make sure you have picked the correct develop for your personal metropolis/state. Go through the Preview switch to analyze the form`s information. See the develop description to actually have selected the correct develop.

- In the event the develop doesn`t fit your requirements, take advantage of the Look for industry at the top of the screen to obtain the one that does.

- Should you be happy with the shape, verify your option by simply clicking the Get now switch. Then, select the rates prepare you want and provide your qualifications to sign up on an account.

- Procedure the transaction. Make use of Visa or Mastercard or PayPal account to complete the transaction.

- Pick the structure and download the shape on your own system.

- Make alterations. Fill up, change and print out and indicator the acquired Puerto Rico Sample Letter for Finalization of Accounting.

Every template you added to your money does not have an expiration particular date and is your own property for a long time. So, if you would like download or print out another duplicate, just check out the My Forms segment and click on the develop you require.

Get access to the Puerto Rico Sample Letter for Finalization of Accounting with US Legal Forms, one of the most substantial catalogue of authorized file templates. Use 1000s of professional and status-particular templates that meet up with your small business or person requirements and requirements.

Form popularity

FAQ

An accounting engagement letter is a legally binding document outlining the scope, terms and conditions of a professional relationship between an accountant and a client. Both parties must sign and date the letter to be a binding arrangement.

Part 10), Section 10.33, Best Practices for Tax Advisors, states that a practitioner should communicate clearly with the client regarding the terms of the engagement; a signed engagement letter provides clarity and prevents scope creep.

Your engagement letter should clearly outline the services you will provide, in this case, bookkeeping, payroll, or any related service. Outline what the engagement is and when it will begin and end, and expected delivery dates of the work performed.

Dear [Client], We are pleased to confirm our engagement to provide [accounting / bookkeeping services] to your business, [Business Name]. The purpose of this letter is to outline the terms of our relationship and the services that we will be providing to you.

The introduction of your engagement letter has two purposes ? to lay out the purpose of the letter to the client, and to set the tone of the letter. The introduction doesn't need to be complicated. Simply state that the purpose of the letter is to document key components of the engagement such as scope and pricing.

Accounting engagement letters should include terms which limit the firm's liability as much as possible. Statements such as ?we will rely on the information provided by the client? or ?we will not audit or verify the information? are often included to show the scope of the project does not include auditing services.