Puerto Rico Sample Letter for Debt Collection

Description

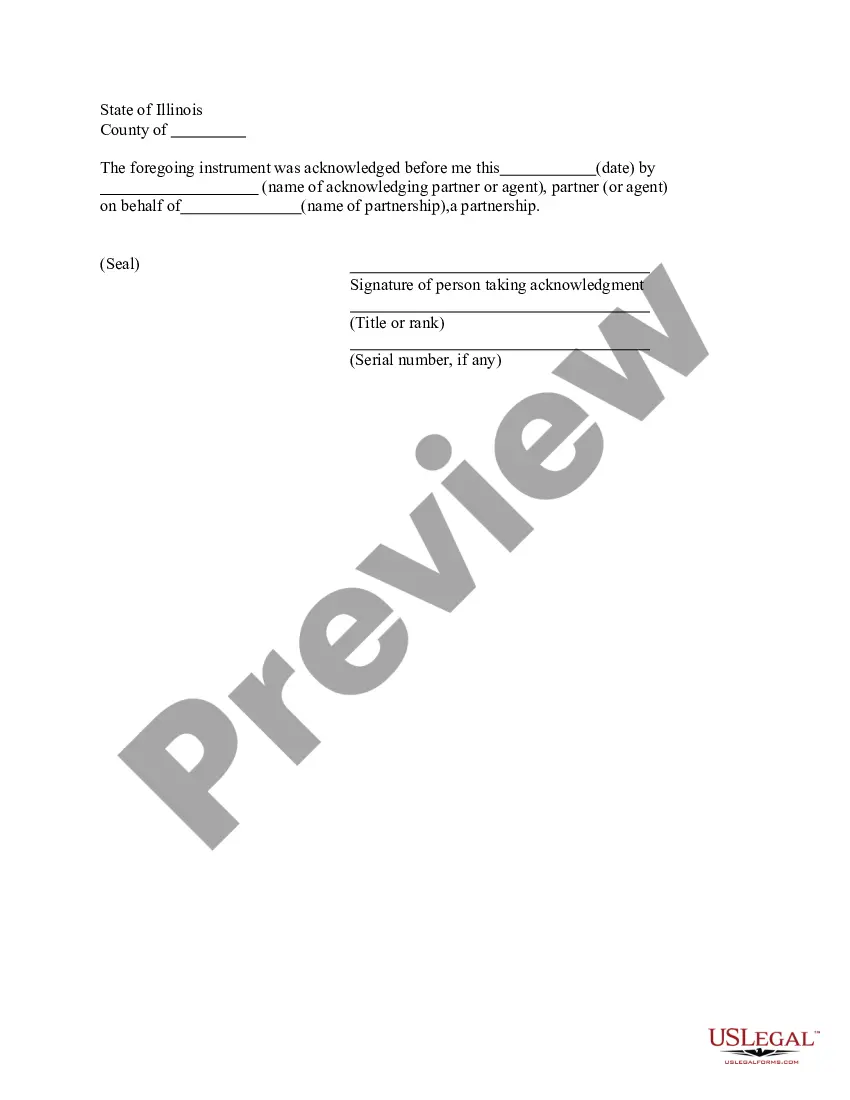

How to fill out Sample Letter For Debt Collection?

If you wish to total, down load, or printing lawful document themes, use US Legal Forms, the largest selection of lawful types, that can be found on the web. Make use of the site`s simple and easy practical look for to discover the files you will need. Different themes for company and specific reasons are sorted by classes and says, or search phrases. Use US Legal Forms to discover the Puerto Rico Sample Letter for Debt Collection within a handful of click throughs.

When you are already a US Legal Forms client, log in to the accounts and click on the Acquire key to obtain the Puerto Rico Sample Letter for Debt Collection. You can also access types you previously saved from the My Forms tab of your own accounts.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for your right town/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s content material. Do not neglect to learn the description.

- Step 3. When you are not happy with the type, use the Search area on top of the screen to locate other models of your lawful type design.

- Step 4. Once you have located the shape you will need, click the Purchase now key. Select the prices strategy you favor and include your qualifications to register for the accounts.

- Step 5. Procedure the transaction. You may use your credit card or PayPal accounts to perform the transaction.

- Step 6. Find the file format of your lawful type and down load it on the system.

- Step 7. Full, change and printing or indicator the Puerto Rico Sample Letter for Debt Collection.

Each and every lawful document design you get is your own property eternally. You might have acces to each type you saved within your acccount. Go through the My Forms area and decide on a type to printing or down load once more.

Remain competitive and down load, and printing the Puerto Rico Sample Letter for Debt Collection with US Legal Forms. There are thousands of professional and status-certain types you can use to your company or specific requires.

Form popularity

FAQ

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

If you ask a debt collector to stop all contact ? regardless of the communications channel ? the collector must stop. Keep in mind, though, that you may still owe the debt. If you don't want a debt collector to contact you again, write a letter to the debt collector saying so.

You have two tools you can use to dispute a debt: first, a debt validation letter the debt collector is required to send you, outlining the debt and your rights around disputing it; then, a debt verification letter. You can submit a written request to get more information and temporarily halt collection efforts.

Write the collector a goodwill letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage. There's no guarantee your request will be accepted, but there's no harm in asking. A record of on-time payments since the debt was paid will help your case.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.