Title: Puerto Rico Inquiry of Credit Cardholder Concerning Billing Error — Detailed Description Introduction: In this detailed description, we will explore the Puerto Rico inquiry of credit cardholder concerning billing error and various types that can occur. This article provides an overview of the process, key information, and relevant keywords to assist credit cardholders in understanding their rights and resolving billing errors. 1. Understanding the Puerto Rico Inquiry of Credit Cardholder Concerning Billing Error: When a credit cardholder in Puerto Rico notices a billing error on their credit card statement, they have the right to dispute the charges and request a correction. The Puerto Rico Inquiry of Credit Cardholder Concerning Billing Error pertains to the process and guidelines set forth by local regulations to protect cardholders' interests. 2. Key Information and Documentation Needed: To initiate the Puerto Rico inquiry process, cardholders should gather relevant information and documentation, including: — Credit card account details (card number, billing address, etc.) — Copy of the credit card statement with the disputed charges highlighted — Supporting evidence (receipts, invoices, contracts) that prove the error or unauthorized charges — Written explanation of the billing error or discrepancy 3. Puerto Rico Inquiry Process: The Puerto Rico inquiry process typically involves the following steps: a. Notification: Cardholders must notify their credit card issuer within a specified timeframe (as per local regulations) after discovering the billing error. b. Written Dispute: Cardholders are advised to submit a written dispute to their credit card issuer, clearly explaining the nature of the billing error, providing any supporting evidence, and requesting a correction or credit. c. Investigation: Once the dispute is received, the credit card issuer is responsible for investigating the claim within a stipulated timeframe. The investigation may involve reaching out to merchants and verifying the cardholder's claim. d. Provisional Credit: During the investigation, the credit card issuer may choose to provide a provisional credit to the cardholder, offering temporary relief while determining the validity of the claim. e. Final Resolution: Upon completion of the investigation, the credit card issuer must inform the cardholder of their findings. If the disputed charges are found to be erroneous, they will be corrected, and any provisional credit will be made permanent. In case of a justified billing error, the cardholder will receive an explanation along with any necessary adjustments. 4. Types of Puerto Rico Inquiry of Credit Cardholder Concerning Billing Error: While the specific types of billing errors can vary, some common categories include: a. Unauthorized Charges: Instances where fraudulent or unauthorized charges appear on the credit card statement. b. Incorrect Amounts: When the charged amount differs from the actual purchase price or agreed-upon transaction value. c. Duplicate Charges: Multiple charges for the same transaction appearing on the statement, resulting in overfilling. d. Merchandise/Service Not Received: Payments made for goods or services that were never delivered or performed as agreed. e. Calculation Errors: Errors in the calculation of interest, fees, or other charges applied to the credit card account. f. Late Fees or Penalties: Incorrect application of late fees or penalties for payments that were made on time. Conclusion: By understanding the Puerto Rico inquiry of credit cardholder concerning billing error, cardholders can protect their rights, resolve disputes, and ensure accurate credit card statements. By following the appropriate steps and providing the necessary information, individuals can seek a fair resolution while promoting transparency and accountability in credit card transactions.

Puerto Rico Inquiry of Credit Cardholder Concerning Billing Error

Description

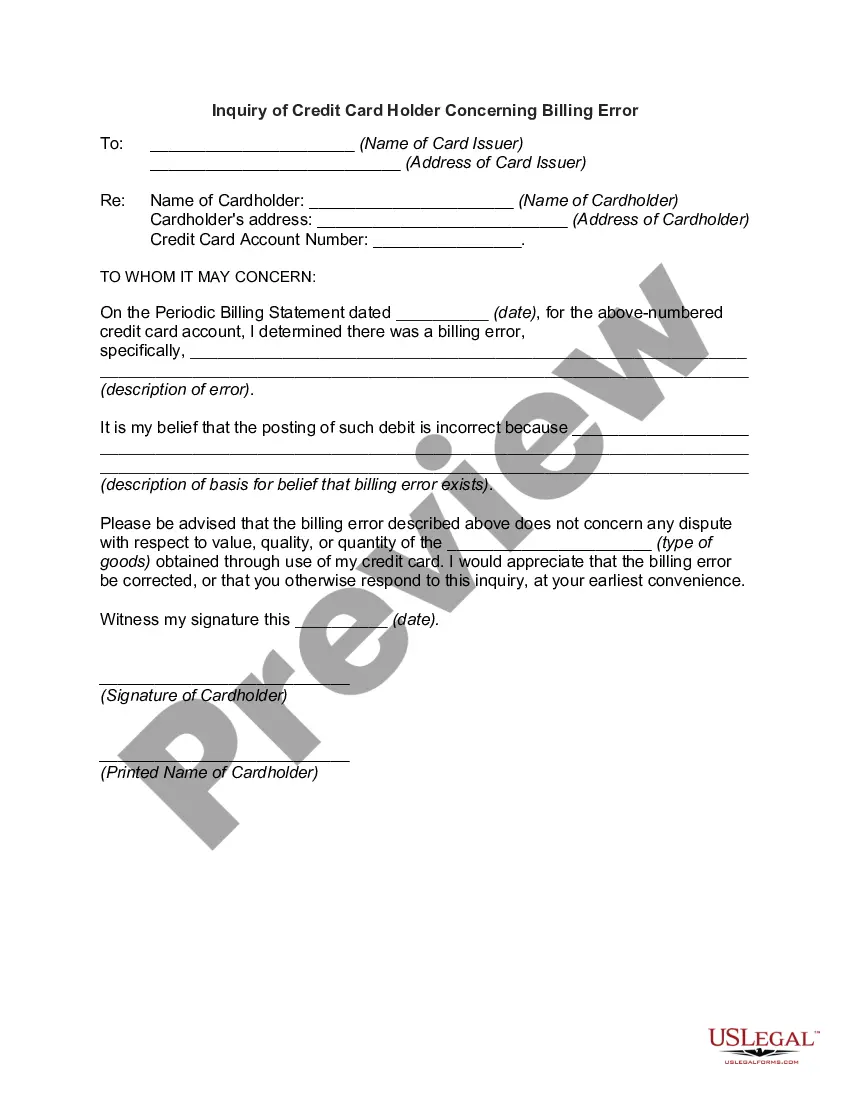

How to fill out Puerto Rico Inquiry Of Credit Cardholder Concerning Billing Error?

US Legal Forms - one of several largest libraries of authorized types in the States - provides a wide range of authorized file templates you are able to acquire or printing. Using the web site, you can get thousands of types for company and individual reasons, categorized by groups, claims, or key phrases.You can find the most up-to-date variations of types just like the Puerto Rico Inquiry of Credit Cardholder Concerning Billing Error in seconds.

If you already have a registration, log in and acquire Puerto Rico Inquiry of Credit Cardholder Concerning Billing Error in the US Legal Forms collection. The Down load switch will show up on each and every form you see. You have access to all formerly delivered electronically types within the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, here are simple directions to get you started out:

- Ensure you have selected the correct form for the area/region. Go through the Review switch to check the form`s information. Look at the form explanation to ensure that you have selected the right form.

- If the form doesn`t satisfy your requirements, make use of the Search industry towards the top of the display to obtain the one that does.

- Should you be satisfied with the form, confirm your choice by clicking the Get now switch. Then, select the costs strategy you want and offer your references to register for an accounts.

- Approach the purchase. Utilize your bank card or PayPal accounts to complete the purchase.

- Choose the format and acquire the form in your product.

- Make alterations. Complete, change and printing and signal the delivered electronically Puerto Rico Inquiry of Credit Cardholder Concerning Billing Error.

Each and every design you added to your money lacks an expiry time which is your own property for a long time. So, in order to acquire or printing yet another backup, just check out the My Forms section and then click about the form you want.

Obtain access to the Puerto Rico Inquiry of Credit Cardholder Concerning Billing Error with US Legal Forms, one of the most extensive collection of authorized file templates. Use thousands of specialist and status-distinct templates that fulfill your business or individual requirements and requirements.

Form popularity

FAQ

Call the number on the back of your credit card to speak directly with the issuer. You can typically report the charge by phone, mail or filling out a form on your issuer's website. Be sure to act quickly as you have 60 days from when the billing statement was sent out to call in the dispute.

In a courtroom setting, there are consequences for falsifying testimony. Those who make false claims under oath could face fines or even jailtime, depending on the severity of the case. Consumers who file frivolous chargebacks don't typically get hit with those kinds of penalties.

Call the number on the back of your credit card to speak directly with the issuer. You can typically report the charge by phone, mail or filling out a form on your issuer's website. Be sure to act quickly as you have 60 days from when the billing statement was sent out to call in the dispute.

You normally have 60 days from the date a charge appears on your credit card statement to dispute it. This time limit is established by the Fair Credit Billing Act, and it applies whether you're disputing a fraudulent charge or a purchase that didn't turn out as expected.

Section 1026.13(c)(2) requires creditors to investigate the dispute, correct any errors found, and notify the consumer of the outcome no later than two complete billing cycles or 90 days after receiving the billing error notice.

Your card can be declined if you've hit the card's credit limit, or the upper threshold of charges you can put on the card. It's your bank's way of saying you cannot borrow any more money until you make a payment.

Report unauthorized charges as soon as you notice themeither to the merchant or your credit card issuer. Follow up the dispute with a letter to your credit card issuer to ensure your rights are fully protected. Take steps to protect your credit card information to prevent future unauthorized charges.

Billing Errors on Credit Card Statements. You must notify a credit card company of any billing error no later than 60 days after it transmitted the first statement that reflects the alleged error. Otherwise, the credit card company has no obligation to investigate or respond.

You have incorrectly entered your CVV code. 3. You have incorrectly entered your expiration date. 4.