Puerto Rico Certificate of Borrower (CFB) is a legal document required in commercial loan transactions involving borrowers from Puerto Rico. This certificate provides important information about the borrower's legal status, financial position, and compliance with local regulations, ensuring transparency and mitigating risks for the lender. Key components of the Puerto Rico Certificate of Borrower often include: 1. Legal Identification: The certificate includes the borrower's legal name, address, taxpayer identification number, and registration details. This information confirms the borrower's existence and legitimacy. 2. Organizational Information: If the borrower is a legal entity, the certificate outlines its type (corporation, partnership, etc.), formation date, and jurisdiction of formation. This data helps assess the borrower's legal structure and ensures compliance with Puerto Rican regulations. 3. Authorization: The certificate may include authorization from the borrower's board of directors or other governing body, authorizing the loan transaction and associated collateral. This demonstrates internal approval and ensures the loan is within the borrower's legal capacity. 4. Financial Information: The certificate may request specific financial details, such as audited financial statements, income statements, balance sheets, or cash flow projections. These documents enable the lender to assess the borrower's creditworthiness and ability to repay the loan. 5. Regulatory Compliance: Puerto Rico-specific regulations or licensing requirements may necessitate the inclusion of certain certifications or disclosures. For example, the certificate may confirm compliance with local tax laws, environmental regulations, or industry-specific permits. 6. Liens and Collateral: The certificate typically discloses existing liens, claims, or encumbrances on the borrower's assets. It may also describe the collateral to secure the loan, such as real estate deeds, equipment titles, or intellectual property registrations. Different types of Puerto Rico Certificates of Borrower regarding Commercial Loan may include: 1. General Commercial Loan Certificate: This is a standard certificate applicable to various types of commercial loans and borrowers in Puerto Rico. 2. Real Estate Loan Certificate: Specifically designed for commercial real estate loans, this certificate may require additional documentation related to property titles, surveys, zoning compliance, or environmental assessments. 3. Professional Services Loan Certificate: For borrowers engaged in professional practices such as law firms, medical practices, or architectural firms, this certificate may include specific disclosures related to professional licenses, malpractice insurance, or client representations. 4. Construction Loan Certificate: When funding construction projects, this certificate may include detailed information about the borrower's qualifications, contractor agreements, construction permits, and progress monitoring mechanisms. In conclusion, the Puerto Rico Certificate of Borrower is a vital component of commercial loan transactions involving borrowers from Puerto Rico. It ensures lenders have a comprehensive understanding of the borrower's legal and financial background, regulatory compliance, and collateral status. Different types of certificates may exist, tailored to specific loan purposes or borrower types.

Puerto Rico Certificate of Borrower regarding Commercial Loan

Description

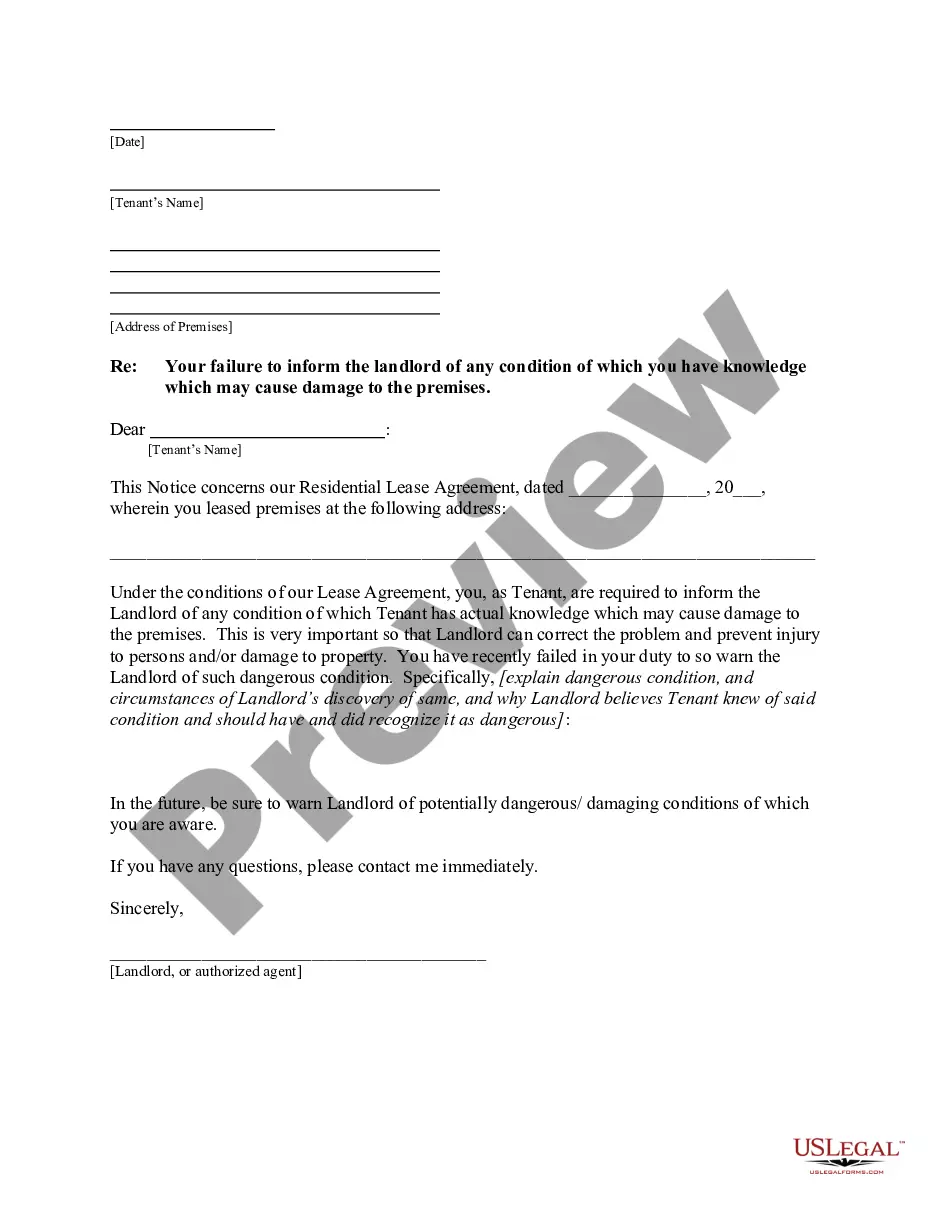

How to fill out Puerto Rico Certificate Of Borrower Regarding Commercial Loan?

Choosing the right authorized record format could be a battle. Needless to say, there are plenty of web templates available on the net, but how can you discover the authorized type you need? Use the US Legal Forms website. The assistance offers a large number of web templates, including the Puerto Rico Certificate of Borrower regarding Commercial Loan, that you can use for organization and personal requires. All the forms are inspected by specialists and meet federal and state needs.

If you are currently listed, log in to your account and click the Down load key to find the Puerto Rico Certificate of Borrower regarding Commercial Loan. Utilize your account to appear from the authorized forms you might have bought formerly. Proceed to the My Forms tab of your own account and obtain an additional duplicate in the record you need.

If you are a fresh consumer of US Legal Forms, listed here are straightforward recommendations that you can adhere to:

- Initial, be sure you have selected the correct type for your town/region. It is possible to look over the form utilizing the Review key and read the form description to make sure this is basically the best for you.

- In case the type does not meet your expectations, utilize the Seach area to get the correct type.

- When you are positive that the form is proper, go through the Acquire now key to find the type.

- Select the prices strategy you would like and enter the essential details. Build your account and buy the transaction using your PayPal account or charge card.

- Select the document format and down load the authorized record format to your product.

- Full, change and produce and indicator the acquired Puerto Rico Certificate of Borrower regarding Commercial Loan.

US Legal Forms may be the most significant local library of authorized forms where you can discover a variety of record web templates. Use the service to down load professionally-made files that adhere to status needs.

Form popularity

FAQ

Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan. Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements. What Documents Are Required For A Personal Loan? - Bankrate bankrate.com ? loans ? documents-required-... bankrate.com ? loans ? documents-required-...

What information do I have to provide a lender in order to receive a Loan Estimate? your name, your income, your Social Security number (so the lender can pull a credit report), the property address, an estimate of the value of the property, and. the desired loan amount.

Date of agreement : Like most legally binding contracts, a loan agreement should also mark the date of initiation along with signatures by all parties. Amount of loan : Loan documents should include the exact amount of loan. Interest rate : Interest rate on the amount loaned should be mentioned in the document.

This includes requiring lenders to provide written information about interest rates, and all fees and finance charges associated with a loan or credit card. Requiring lenders to disclose the maximum interest rate upfront on variable-interest loans backed by the borrower's home.

Borrower Certification means, with respect to any request for a Loan, a certification of the Borrower stating that (i) no Default or Event of Default will occur or be continuing after giving effect to such Loan, and (ii) the proceeds of such Loan will be used solely for Permitted Uses. Borrower Certification Definition - Law Insider lawinsider.com ? dictionary ? borrower-certi... lawinsider.com ? dictionary ? borrower-certi...

Here are the some of the basic documents you will to get pre-approved before searching for a home: Last 30 Days Pay Stubs. Last 2 Years Complete Tax Returns with W2 and 1099 Forms. Last 2 Months Bank Statements (All Pages) Legible Copy Of Driver's License and Social Security Card.