Puerto Rico Challenge to Credit Report of Experian, TransUnion, and/or Equifax: An In-depth Overview Introduction: A Puerto Rico challenge to the credit report of Experian, TransUnion, and/or Equifax refers to the process of disputing inaccurate or incorrect information contained in credit reports provided by these major credit reporting agencies. Located in the Caribbean, Puerto Rico is a U.S. territory where individuals face similar challenges when dealing with credit reporting agencies. By understanding the various types of challenges and utilizing the appropriate strategies, Puerto Rican residents can rectify errors on their credit reports, leading to improved financial standing and better future credit prospects. Types of Puerto Rico Challenges crediting Reports: 1. Identity Discrepancy Challenge: — Description: This challenge involves disputing inaccurate personal identifying information (PIN) on the credit report, such as name misspellings, incorrect addresses, or incorrect social security numbers. — Keywords: Puerto Rico identity discrepancy challenge, incorrect PIN dispute, inaccurate personal information dispute. 2. Account Accuracy Challenge: — Description: This challenge aims to address inaccuracies related to individual accounts listed on the credit report. It involves disputing incorrect account balances, payment history, or account status (open or closed). — Keywords: Puerto Rico account accuracy challenge, incorrect account balances dispute, disputed payment history, wrong account status. 3. Fraudulent Activity Challenge: — Description: This challenge focuses on combatting fraudulent activity on credit reports. It includes disputing unfamiliar or fraudulent accounts, inquiries, or charges that may have resulted from identity theft or unauthorized use of personal information. — Keywords: Puerto Rico fraudulent activity challenge, disputed unauthorized accounts, identity theft dispute, fraudulent charges. 4. Credit Builder Loan Challenge: — Description: This unique challenge in Puerto Rico involves disputing the absence or insufficient consideration of credit builder loans on credit reports. By challenging the exclusion of credit builder loans, individuals can ensure equitable representation of their responsible credit behavior. — Keywords: Puerto Rico credit builder loan challenge, missing credit builder loan dispute, equitable credit reporting dispute. Strategies to Challenge Credit Reports: 1. Gather evidence: Collect all supporting documents, including bills, statements, or identification documentation, to substantiate your claims during the challenge process. 2. Write a formal dispute letter: Draft a detailed letter highlighting the specific errors and inaccuracies on your credit report, providing a clear explanation for each discrepancy, and stating the desired resolution. 3. Contact the credit reporting agencies: Submit your dispute letter, along with attached supporting evidence, to Experian, TransUnion, and/or Equifax, either through their websites or by mailing a physical copy to their respective dispute departments. 4. Follow up: Monitor the progress of your dispute and maintain communication with the credit reporting agencies until the resolution is reached. Consider requesting updated credit reports after the challenges to ensure the corrections have been implemented. Conclusion: By engaging in a Puerto Rico challenge to the credit report of Experian, TransUnion, and/or Equifax, individuals can rectify inaccuracies and uphold the integrity of their credit history. Employing the appropriate strategies and considering the different types of challenges discussed can help Puerto Rican residents navigate the credit dispute process efficiently and effectively. Remember, accurate credit reports positively influence financial opportunities, loan approvals, and overall financial well-being.

Puerto Rico Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

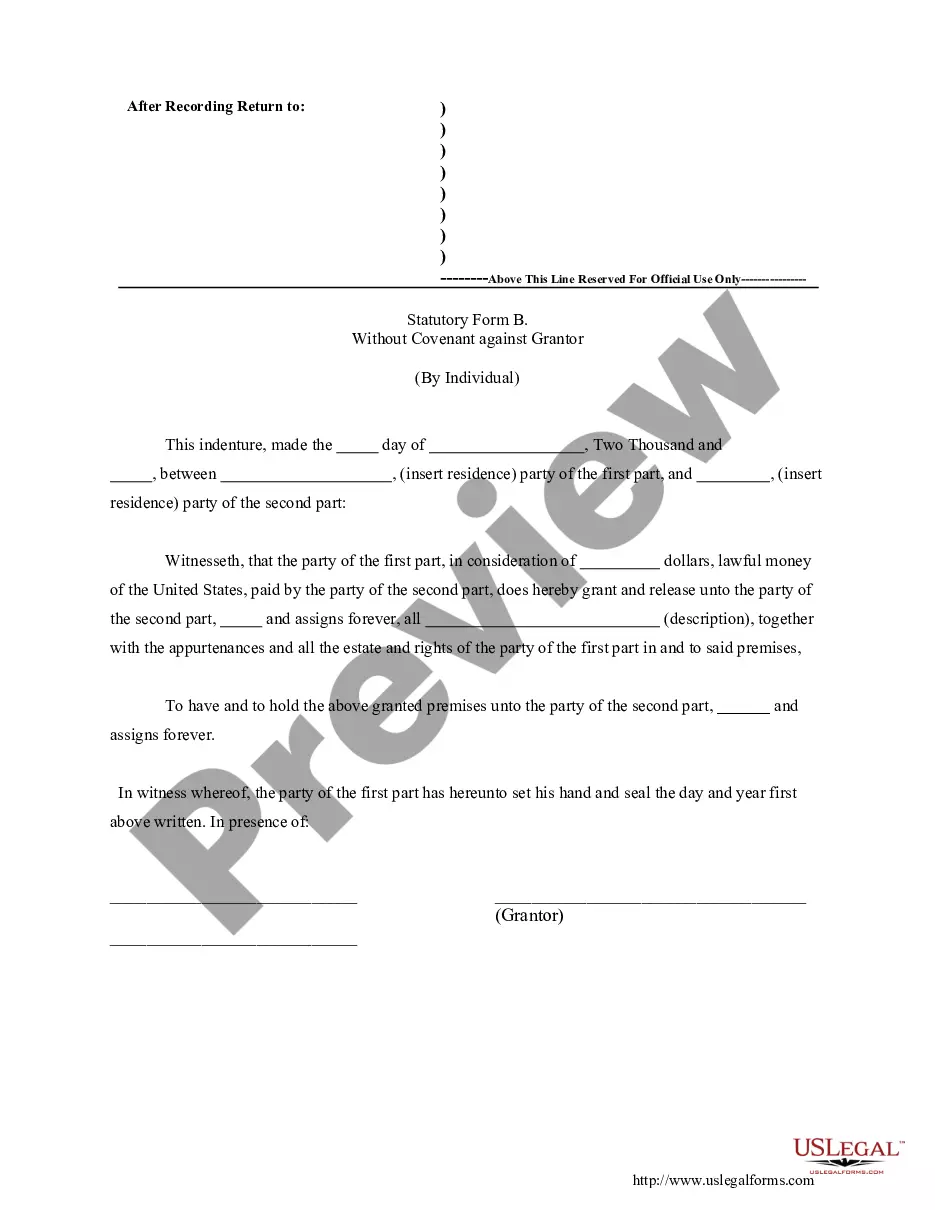

How to fill out Puerto Rico Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Finding the right authorized papers web template can be quite a battle. Obviously, there are tons of themes available on the Internet, but how will you find the authorized type you require? Utilize the US Legal Forms website. The services offers a huge number of themes, for example the Puerto Rico Challenge to Credit Report of Experian, TransUnion, and/or Equifax, which can be used for enterprise and personal demands. Every one of the varieties are checked out by specialists and meet federal and state demands.

If you are already signed up, log in in your accounts and click on the Acquire option to get the Puerto Rico Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Make use of accounts to appear with the authorized varieties you have acquired earlier. Proceed to the My Forms tab of your respective accounts and get another duplicate from the papers you require.

If you are a fresh consumer of US Legal Forms, here are basic directions for you to follow:

- Very first, ensure you have selected the right type for your personal metropolis/area. You may examine the shape using the Review option and browse the shape information to guarantee this is basically the best for you.

- In the event the type will not meet your expectations, use the Seach discipline to find the proper type.

- When you are certain the shape would work, select the Get now option to get the type.

- Choose the rates program you need and enter the necessary details. Create your accounts and pay money for the order utilizing your PayPal accounts or credit card.

- Choose the file structure and obtain the authorized papers web template in your system.

- Complete, revise and printing and signal the acquired Puerto Rico Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

US Legal Forms will be the greatest catalogue of authorized varieties for which you can see different papers themes. Utilize the service to obtain expertly-made paperwork that follow status demands.