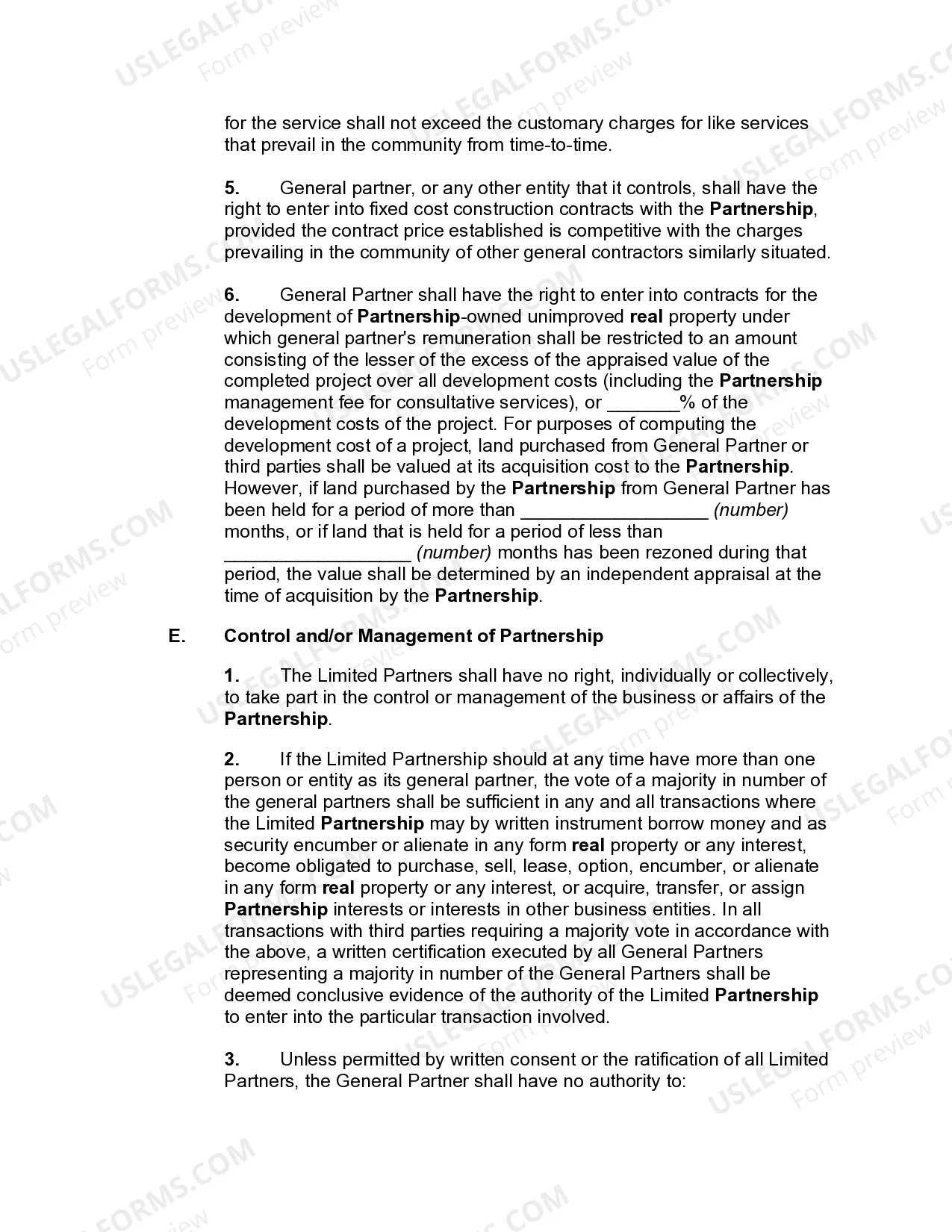

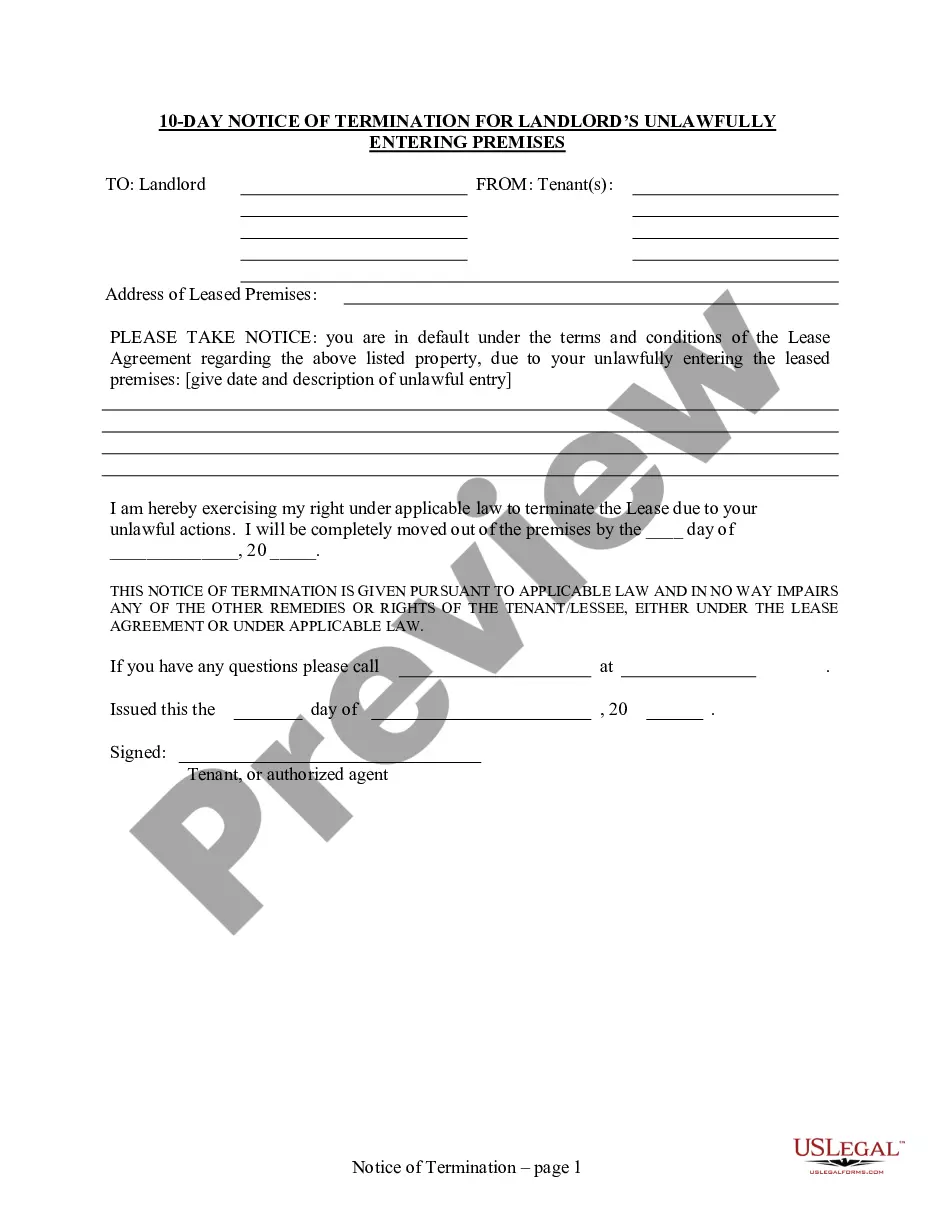

Puerto Rico Limited Partnership Agreement for Real Estate Development

Description

How to fill out Limited Partnership Agreement For Real Estate Development?

You may devote time on the Internet trying to find the lawful papers template which fits the state and federal specifications you want. US Legal Forms offers 1000s of lawful kinds that happen to be analyzed by pros. It is simple to acquire or printing the Puerto Rico Limited Partnership Agreement for Real Estate Development from my assistance.

If you already have a US Legal Forms bank account, you may log in and then click the Obtain switch. Next, you may complete, edit, printing, or signal the Puerto Rico Limited Partnership Agreement for Real Estate Development. Each and every lawful papers template you buy is your own for a long time. To acquire another copy associated with a bought form, check out the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms site the first time, stick to the straightforward guidelines beneath:

- Initial, make certain you have chosen the right papers template for your region/city of your choice. Look at the form outline to ensure you have picked out the appropriate form. If available, utilize the Review switch to look throughout the papers template also.

- If you want to discover another edition in the form, utilize the Research industry to obtain the template that meets your needs and specifications.

- After you have identified the template you want, click on Buy now to continue.

- Choose the rates prepare you want, type in your references, and sign up for your account on US Legal Forms.

- Full the deal. You can use your bank card or PayPal bank account to fund the lawful form.

- Choose the format in the papers and acquire it to your gadget.

- Make modifications to your papers if required. You may complete, edit and signal and printing Puerto Rico Limited Partnership Agreement for Real Estate Development.

Obtain and printing 1000s of papers templates making use of the US Legal Forms website, that offers the most important collection of lawful kinds. Use skilled and status-distinct templates to take on your organization or personal requirements.