Puerto Rico Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

If you have to full, down load, or print out lawful papers web templates, use US Legal Forms, the most important selection of lawful types, that can be found on the Internet. Use the site`s simple and practical look for to get the paperwork you will need. Different web templates for business and specific purposes are sorted by types and states, or keywords. Use US Legal Forms to get the Puerto Rico Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty in just a handful of mouse clicks.

In case you are currently a US Legal Forms consumer, log in to the accounts and click on the Download switch to obtain the Puerto Rico Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty. You can also access types you earlier delivered electronically inside the My Forms tab of your own accounts.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for that right town/country.

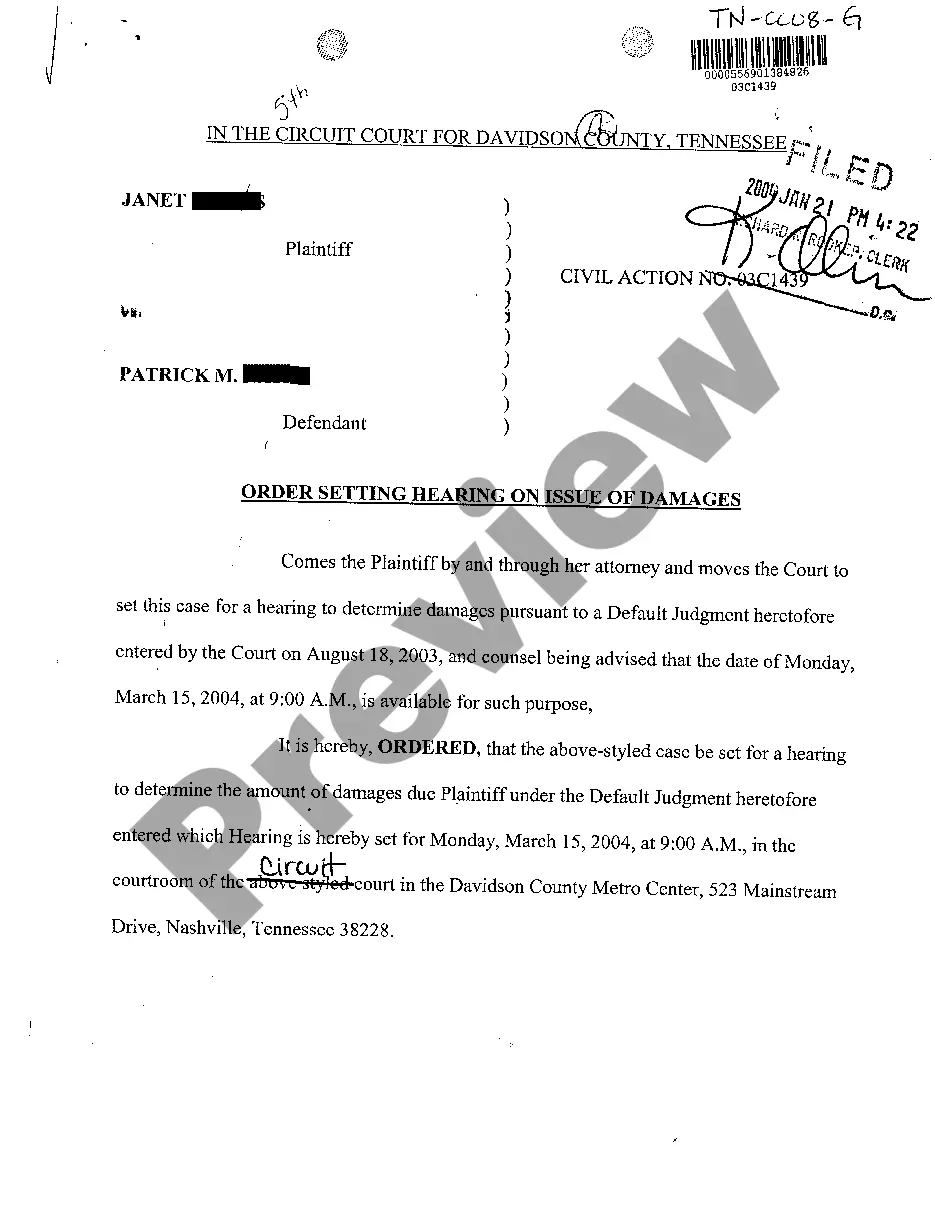

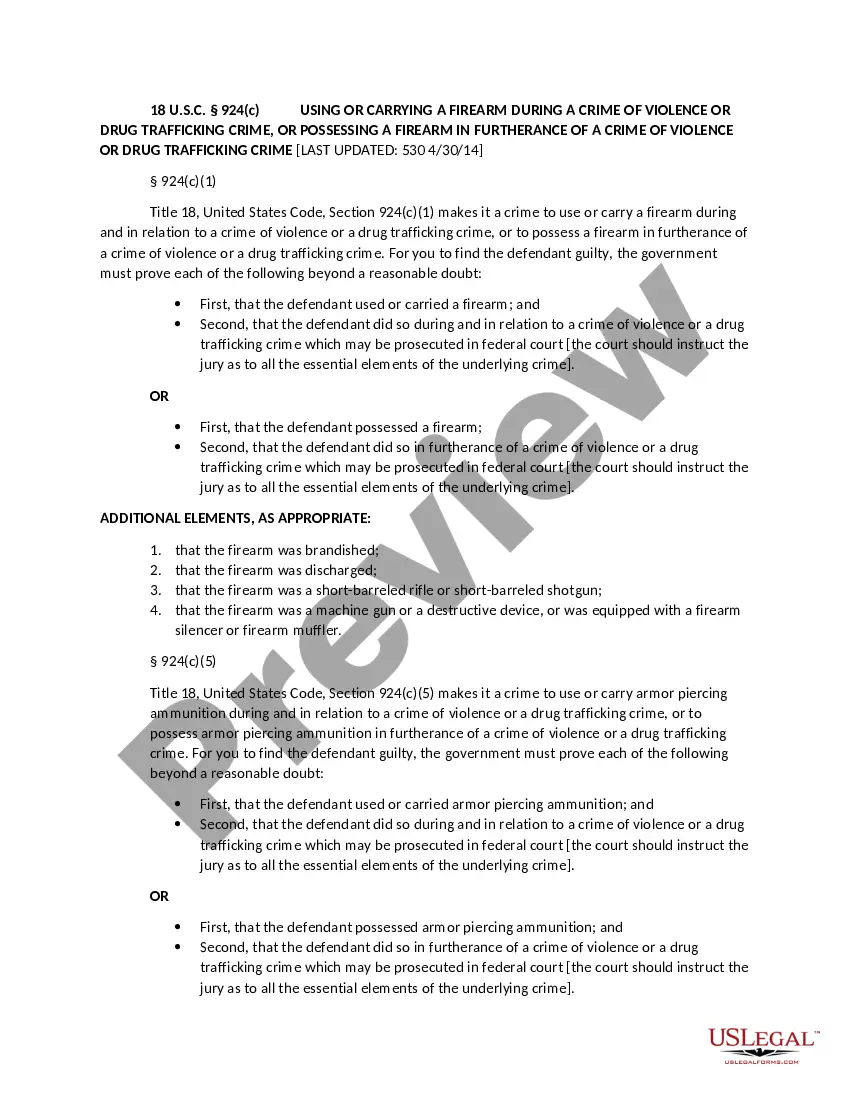

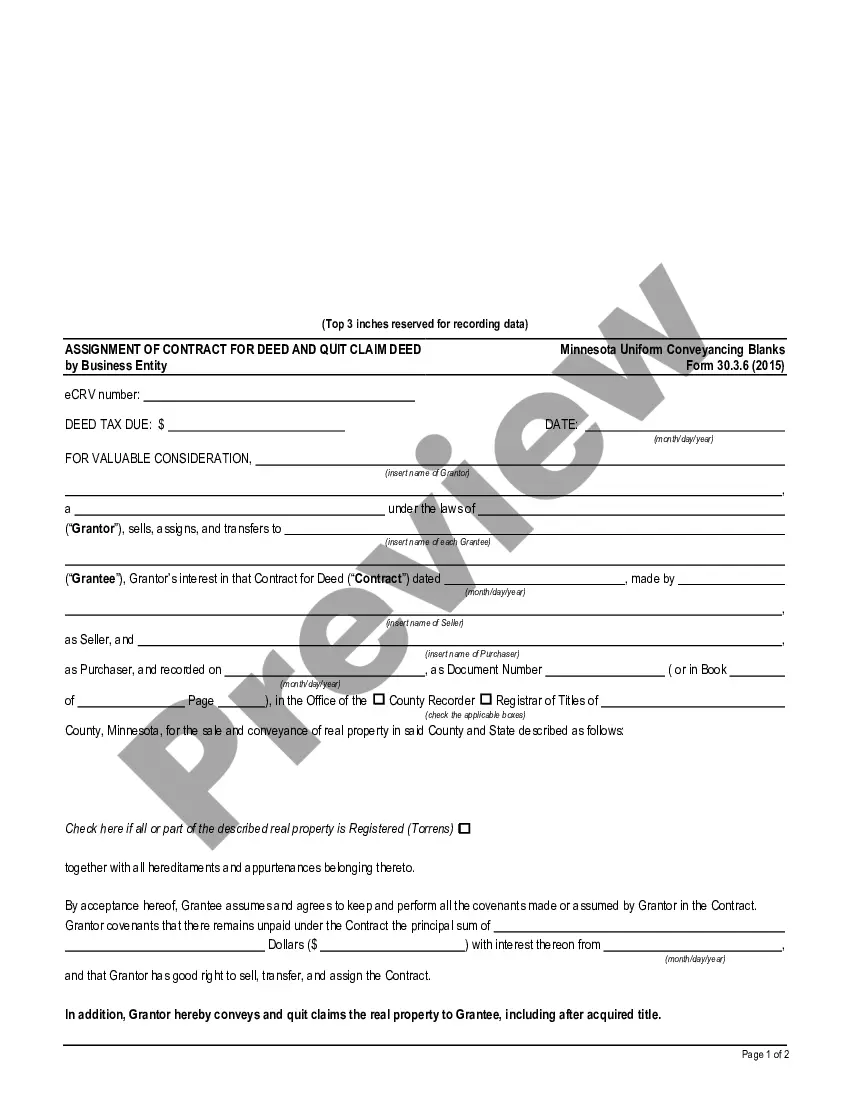

- Step 2. Utilize the Review option to look through the form`s content. Never neglect to read the explanation.

- Step 3. In case you are not satisfied with all the develop, use the Search field near the top of the monitor to locate other models in the lawful develop template.

- Step 4. Once you have found the shape you will need, click on the Acquire now switch. Choose the prices program you prefer and add your accreditations to register for the accounts.

- Step 5. Process the financial transaction. You may use your bank card or PayPal accounts to accomplish the financial transaction.

- Step 6. Choose the file format in the lawful develop and down load it on your product.

- Step 7. Full, edit and print out or indicator the Puerto Rico Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty.

Each lawful papers template you acquire is your own for a long time. You have acces to every develop you delivered electronically inside your acccount. Click on the My Forms area and select a develop to print out or down load once more.

Compete and down load, and print out the Puerto Rico Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty with US Legal Forms. There are many skilled and condition-certain types you can utilize for the business or specific needs.