Puerto Rico Finance Lease of Equipment: A Comprehensive Guide Introduction: In Puerto Rico, finance leasing of equipment is a commonly used financial arrangement that allows businesses to acquire necessary equipment without bearing the burden of upfront purchase costs. It is a form of long-term rental agreement where the lessor purchases the equipment and leases it to the lessee for a fixed period. The lessee pays regular lease payments and at the end of the lease, they may have the option to purchase the equipment or extend the lease agreement. Types of Puerto Rico Finance Lease of Equipment: 1. Capital Lease: A capital lease, also known as a finance lease, is the most common type of finance lease used in Puerto Rico. It is a lease agreement that transfers the risks and rewards of asset ownership to the lessee. In this type of lease, the lessee is responsible for maintaining and insuring the equipment and may have the option to purchase it at the end of the lease term. A capital lease is typically used for higher-value equipment or assets that have a long economic life. 2. Operating Lease: An operating lease is a short-term lease agreement where the lessor maintains ownership of the equipment. It is commonly used for equipment that has a shorter useful life or is likely to become outdated quickly. In an operating lease, the lessor bears the risks associated with the equipment's ownership, such as maintenance and repair costs. At the end of the lease term, the equipment is typically returned to the lessor, and the lessee may have the option to upgrade to newer equipment or enter into a new lease agreement. 3. Sale and Leaseback: Another type of finance lease in Puerto Rico is the sale and leaseback arrangement. This occurs when a business sells its existing equipment to a lessor and then leases it back for continued use. The business, which now becomes the lessee, receives funds from the sale of the equipment, offering a quick infusion of cash while retaining access to the equipment it needs for its operations. Benefits of Puerto Rico Finance Lease of Equipment: 1. Preservation of Working Capital: By opting for a finance lease, businesses in Puerto Rico can conserve their working capital as they do not need to make a significant upfront payment to acquire the equipment. Instead, regular lease payments can be structured to align with the business's cash flow, allowing for better financial management. 2. Flexibility and Upgradability: Finance leasing allows businesses to adapt to changing technological advancements by easily upgrading or replacing leased equipment at the end of the lease term. This flexibility ensures that the business remains competitive in its industry without being tied down by outdated equipment. 3. Tax Advantages: Lease payments for equipment in Puerto Rico may be tax-deductible, reducing the overall tax burden for businesses. Additionally, leasing can offer certain tax depreciation benefits, enabling businesses to further optimize their financial position. Conclusion: The finance lease of equipment in Puerto Rico provides businesses with a practical and cost-effective solution to acquire essential equipment without incurring substantial upfront costs. Whether opting for a capital lease, operating lease, or sale and leaseback arrangement, businesses can benefit from increased financial flexibility, tax advantages, and the ability to maintain state-of-the-art equipment.

Puerto Rico Finance Lease of Equipment

Description

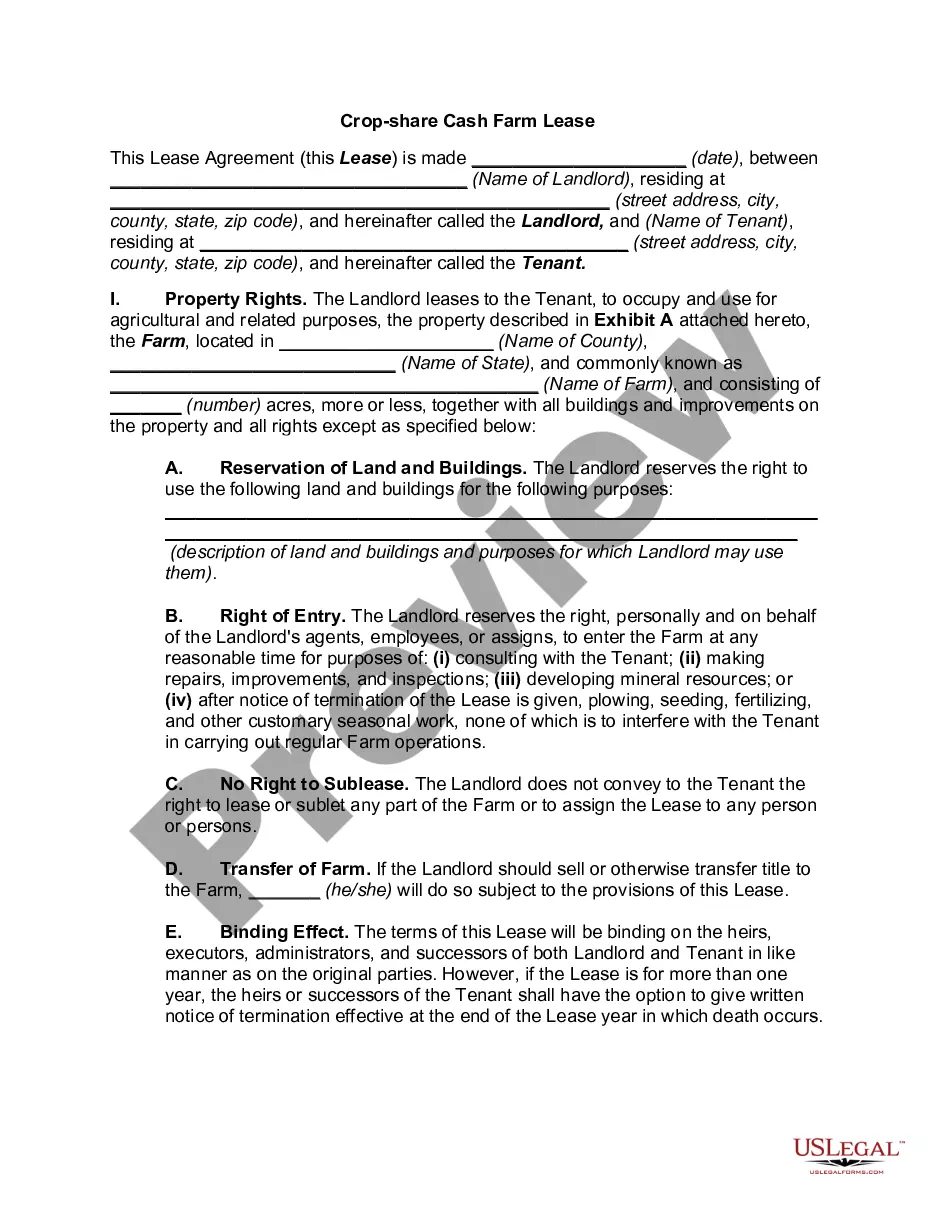

How to fill out Puerto Rico Finance Lease Of Equipment?

Discovering the right authorized document format can be quite a struggle. Obviously, there are tons of layouts available on the Internet, but how do you obtain the authorized kind you need? Take advantage of the US Legal Forms website. The assistance gives a large number of layouts, such as the Puerto Rico Finance Lease of Equipment, which you can use for enterprise and personal needs. Each of the varieties are checked out by pros and meet up with federal and state needs.

If you are already authorized, log in to your bank account and click the Obtain key to find the Puerto Rico Finance Lease of Equipment. Utilize your bank account to search with the authorized varieties you possess acquired earlier. Visit the My Forms tab of your bank account and have one more duplicate of your document you need.

If you are a whole new user of US Legal Forms, allow me to share basic recommendations for you to follow:

- Very first, make certain you have selected the appropriate kind for your personal city/area. It is possible to look through the shape making use of the Preview key and look at the shape explanation to make certain it will be the best for you.

- In the event the kind fails to meet up with your requirements, use the Seach field to get the proper kind.

- When you are certain the shape is proper, click the Acquire now key to find the kind.

- Select the prices strategy you want and type in the needed information. Make your bank account and pay money for an order making use of your PayPal bank account or credit card.

- Choose the document file format and download the authorized document format to your product.

- Complete, edit and printing and sign the acquired Puerto Rico Finance Lease of Equipment.

US Legal Forms is definitely the greatest collection of authorized varieties for which you will find a variety of document layouts. Take advantage of the service to download skillfully-created papers that follow status needs.

Form popularity

FAQ

A capital lease (or finance lease) is an agreement where the lessor has agreed that the ownership of the asset will be transferred to the lessee when the lease period is over. It allows the lessee the choice of buying the asset at a bargain price that is lower than the market value at the end of the lease period.

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

A finance lease (also known as a capital lease or a sales lease) is a type of lease in which a finance company is typically the legal owner of the asset for the duration of the lease, while the lessee not only has operating control over the asset, but also some share of the economic risks and returns from the change in

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.

A finance lease is a contract between a lessor (a funder or finance company) and a lessee (your business), where the lessee requires the use of business equipment, vehicles, or machinery. The lessor provides the use of such equipment in exchange for pre-agreed regular payments.

Key TakeawaysCapital leases transfer ownership to the lessee while operating leases usually keep ownership with the lessor. For accounting purposes, short-term leases under 12 months in length are treated as expenses and longer-term leases are capitalized as assets.

Step 1: The lessee selects an asset that they require for a business. Step 2: The lessor, usually a finance company, purchases the asset. Step 3: The lessor and lessee enter into a legal contract in which the lessee will have use of the asset during the agreed upon lease.

When you lease equipment, the lessor is effectively putting up a lump sum of money on your behalf, which you will pay off with interest over time. The effective interest rate on a lease can be anywhere from the low single digits to more than 30%, with the average is around 6% to16%.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...