Puerto Rico Employment of Executive with Stock Options and Rights in Discoveries: The Puerto Rico Employment of Executive with Stock Options and Rights in Discoveries is a unique employment arrangement that offers executives the opportunity to not only be compensated through a traditional salary and benefits package but also to receive additional incentives in the form of stock options and rights in discoveries. This employment arrangement provides executives with the chance to align their financial interests with the success of the company by granting them stock options. Stock options are the right to purchase a specific number of company shares at a predetermined price, usually referred to as the exercise price or strike price. By granting executives stock options, the company encourages them to contribute to its long-term growth and success. In addition to stock options, executives may also be granted rights in discoveries, which can further enhance their compensation package. These rights in discoveries typically refer to the executives' entitlement to a share of the profits or royalties generated from any innovative discoveries or inventions made during their employment tenure. The Puerto Rico Employment of Executive with Stock Options and Rights in Discoveries can be categorized into different types, depending on the specific terms and conditions set by the company. Some common types include: 1. Standard Stock Option Plan: Under this type of employment arrangement, executives are granted stock options at a predetermined exercise price. The options usually have a vesting period, which means executives need to work for a certain period of time before they can exercise or sell the options. 2. Performance-Based Stock Option Plan: In this type of plan, executives' stock options are tied to specific performance targets set by the company. Executives may need to achieve certain financial milestones, meet sales targets, or contribute to the successful development of new products or technologies to be eligible for the stock options. 3. Restricted Stock Units (RSS): Instead of traditional stock options, executives may be granted RSS. Unlike stock options, RSS are not a right to purchase shares; rather, they represent an agreement to receive shares at a future date. The actual shares are typically delivered after a vesting period or upon the achievement of specific performance goals. 4. Stock Appreciation Rights (SARS): SARS provide executives with the opportunity to receive the appreciation in the company's stock value without having to purchase any shares. When the stock price increases, executives can exercise their SARS for a cash payment equal to the difference between the stock price at the time of exercise and the grant price. Companies in Puerto Rico often utilize the Puerto Rico Employment of Executive with Stock Options and Rights in Discoveries as a means to attract and retain top talent. This unique compensation package not only provides executives with a competitive salary but also aligns their interests with the company's success through stock options and rights in discoveries.

Puerto Rico Employment of Executive with Stock Options and Rights in Discoveries

Description

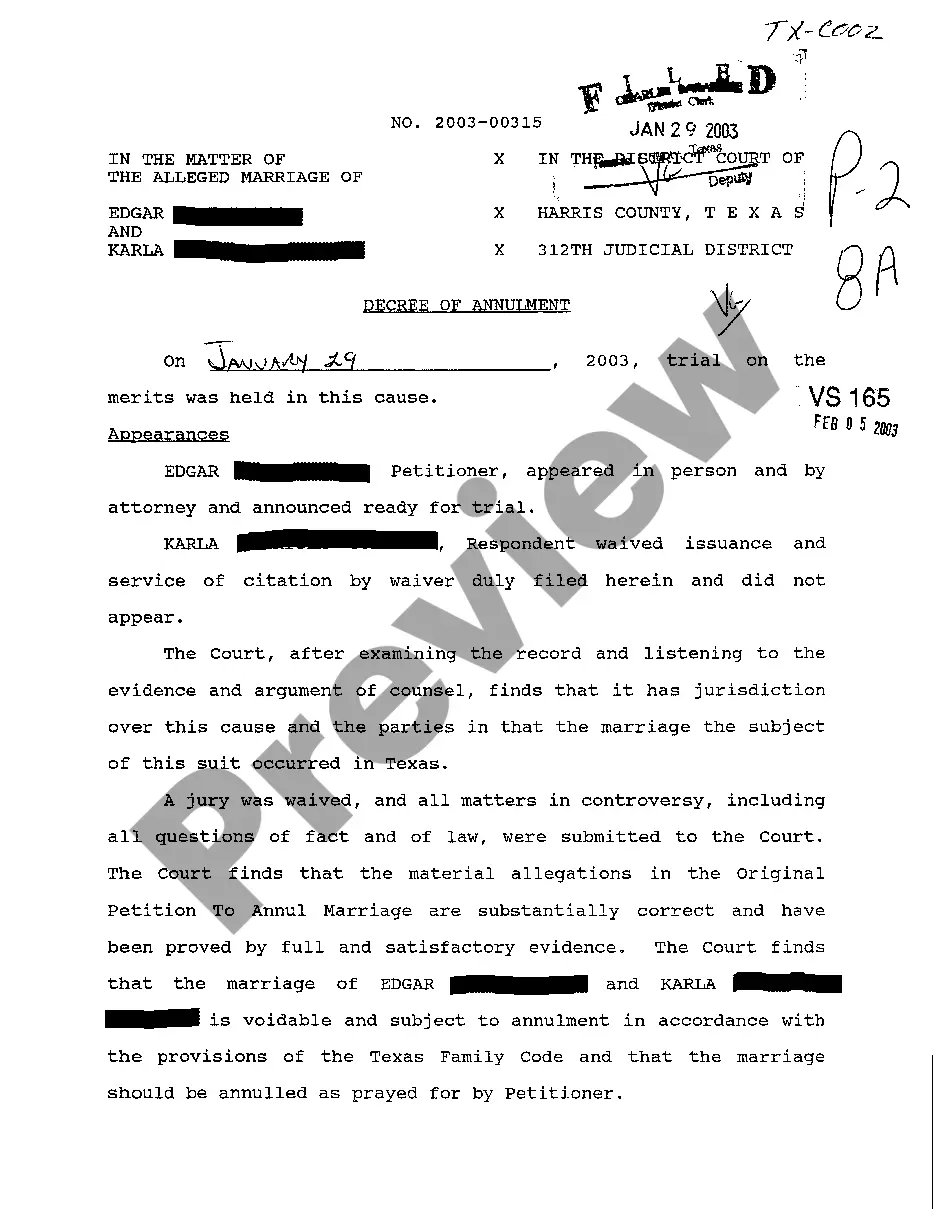

How to fill out Puerto Rico Employment Of Executive With Stock Options And Rights In Discoveries?

If you have to complete, obtain, or print authorized document web templates, use US Legal Forms, the largest assortment of authorized types, that can be found on the Internet. Utilize the site`s easy and practical lookup to obtain the documents you will need. Various web templates for business and individual uses are categorized by classes and suggests, or keywords. Use US Legal Forms to obtain the Puerto Rico Employment of Executive with Stock Options and Rights in Discoveries in just a number of click throughs.

Should you be presently a US Legal Forms consumer, log in for your bank account and click on the Acquire switch to obtain the Puerto Rico Employment of Executive with Stock Options and Rights in Discoveries. You may also gain access to types you in the past acquired in the My Forms tab of your bank account.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have chosen the shape for your proper metropolis/nation.

- Step 2. Take advantage of the Review choice to examine the form`s articles. Don`t forget about to see the information.

- Step 3. Should you be not happy together with the develop, use the Research discipline near the top of the display screen to locate other versions from the authorized develop web template.

- Step 4. After you have discovered the shape you will need, click the Purchase now switch. Choose the pricing strategy you prefer and add your qualifications to register on an bank account.

- Step 5. Method the transaction. You should use your bank card or PayPal bank account to complete the transaction.

- Step 6. Pick the formatting from the authorized develop and obtain it on the gadget.

- Step 7. Full, modify and print or sign the Puerto Rico Employment of Executive with Stock Options and Rights in Discoveries.

Each authorized document web template you purchase is yours eternally. You might have acces to every single develop you acquired inside your acccount. Click on the My Forms section and select a develop to print or obtain once again.

Contend and obtain, and print the Puerto Rico Employment of Executive with Stock Options and Rights in Discoveries with US Legal Forms. There are thousands of professional and status-particular types you can utilize to your business or individual demands.

Form popularity

FAQ

To the extent the plan is considered qualified for Puerto Rico purposes, the exercise of the stock options will not trigger income taxation. Such income will be recognized only upon the sale of the shares, at which time it will be reported as a capital gain.

Five Advantages of Employee Stock Ownership Plans (ESOPs)Increased Productivity. Most ESOPs we work with are in industries that recognize strong employee loyalty but low 401(k) participation.Alternate Exit Strategy for Aging Owners.Tax Advantages.Attracting Top Talent and Employee Retention.No Change in Governance.25-Jan-2021

The Employee Stock Option Plan (ESOP) is an employee benefit plan. It is issued by the company for its employees to encourage employee ownership in the company. The shares of the companies are given to the employees at discounted rates. Any company can issue ESOP.

Investing in an ESPP can be a good idea, but it should complement your financial goals. These goals can be either long-term or short-term objectives for your overall financial health. Depending on when you buy and sell your shares, your ESPP could fit well into both.

ESOP (Employee stock option plan) is an employee benefit plan offering employees the ownership interest in the organization. It is similar to a profit sharing plan. Under these plans the company, who is an employer , offers its stocks at negligible or low prices.

It's worth internalizing these pros and cons if you're considering an employee stock ownership plan for your closely-held company.PRO: Sellers are Paid Fair Market Value (FMV)CON: ESOPs Cannot Offer More than FMV.PRO: An Employee Trust is a Known Buyer.CON: An ESOP Transaction Process is Highly Structured.More items...

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Key Takeaways. Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

The better strategy with stock optionsStock options are an excellent benefit if there is no cost to the employee in the form of reduced salary or benefits. In that situation, the employee will win if the stock price rises above the exercise price once the options are vested.

The Employee Stock Option Plan (ESOP) is an employee benefit plan. It is issued by the company for its employees to encourage employee ownership in the company. The shares of the companies are given to the employees at discounted rates. Any company can issue ESOP.