Puerto Rico Investment Management Agreement for Separate Account Clients

Description

How to fill out Investment Management Agreement For Separate Account Clients?

You can spend hours online attempting to locate the legal document template that fulfills the state and federal requirements you need.

US Legal Forms provides a vast collection of legal forms that have been reviewed by experts.

It is easy to acquire or print the Puerto Rico Investment Management Agreement for Separate Account Clients from this service.

If available, use the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- You can then complete, modify, print, or sign the Puerto Rico Investment Management Agreement for Separate Account Clients.

- Each legal document template you purchase is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents section and click on the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/region of choice.

- Check the form details to confirm you have chosen the right type.

Form popularity

FAQ

A managed account (or separately managed account) is a portfolio of individual securities, such as stocks or bonds, that is managed on your behalf by a professional asset management firm. Unlike with a mutual fund or exchange-traded fund, you directly own the individual securities.

A managed account is an investment account that is owned by an investor but managed by somebody else. The account owner can either be an institutional investor or an individual retail investor. A professional money manager hired by the investor then oversees the account and the trading activity within it.

Portfolio Managers build and maintain investment portfolios, while investment advisors sell a specific product. 1 Investment advisors play an important role in the financial markets, but are not in a position to support the needs of a client's long-range financial objectives. That's the job of the Portfolio Manager.

They are the product of relationships formed across the investment management business. They allow an investment manager to contract with other investment managers to offer funds with specific investment objectives. Sub-advisory relationships allow for one alternative in launching new funds for investors.

An investment management agreement to be used in connection with a private equity fund's appointment of an investment manager. This agreement sets out the terms and conditions by which a fund vehicle agrees to pay advisory and management services fees and out-of-pocket expenses to an investment manager entity.

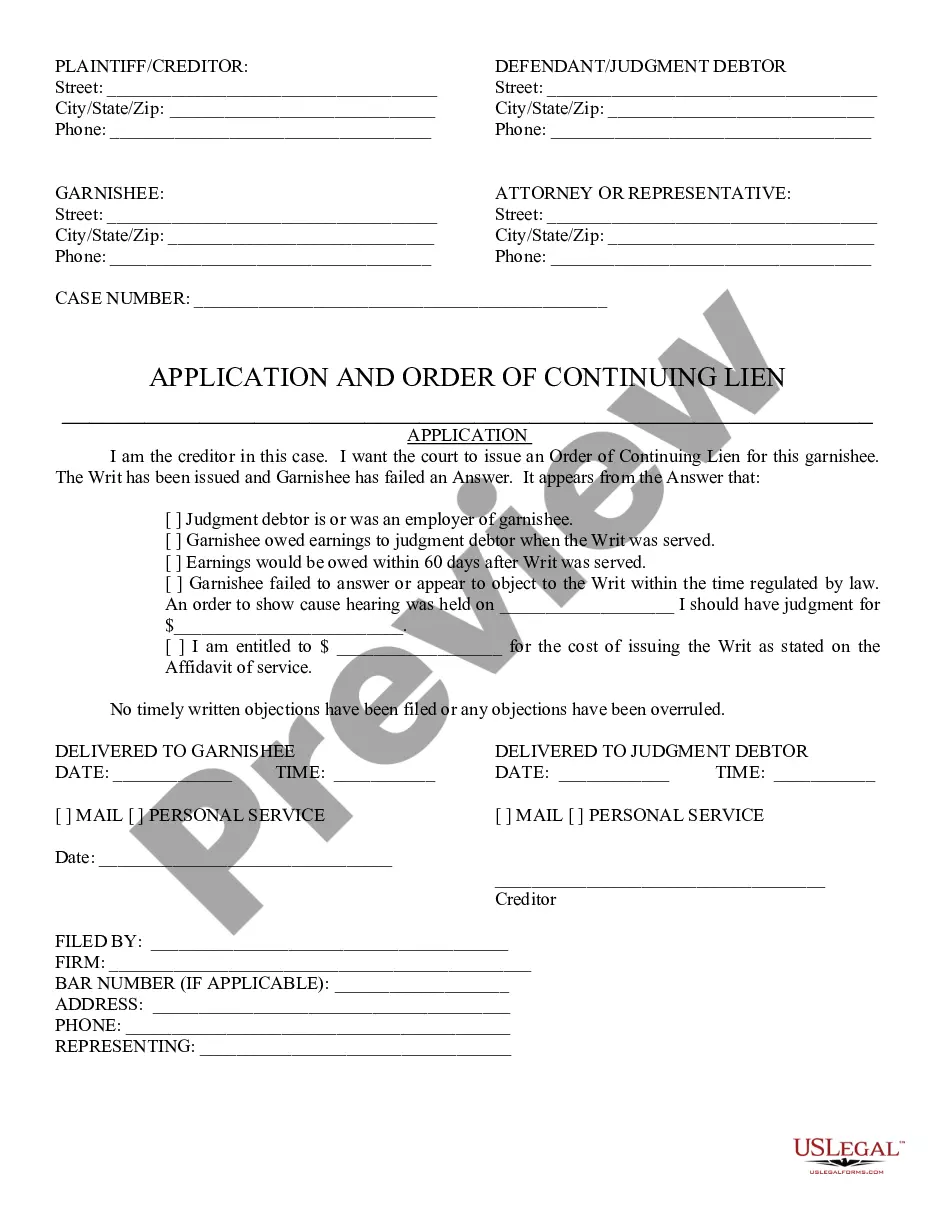

Managed Account Agreement means an agreement between a Filer and a Client, pursuant to which the Filer provides discretionary management services to the Client; Sample 1. Managed Account Agreement means a written agreement in respect of an Account.

Managed money offers a degree of tax efficiency, flexibility, convenience and peace of mind that few other investment options can provide. These features have made fee-based investing and managed-money investment vehicles quite popular among affluent, tax-sensitive investors.

Key Takeaways. Investment managers are people or organizations who handle all activities related to financial planning, investing, and managing a portfolio for individuals or organizations. Clients of investment managers can be either individual or institutional investors.

The difference between the two is that a managed brokerage account is owned by a single investor, either an institutional or retail investor or an individual, whereas a licensed financial broker-deal firm operates a full-service brokerage account.

I would say that a manager is likely to have people reporting to them and budget responsibilites, whereas an advisor is more likely to just convey advice, guidance and information to help an organisation to remain compliant.