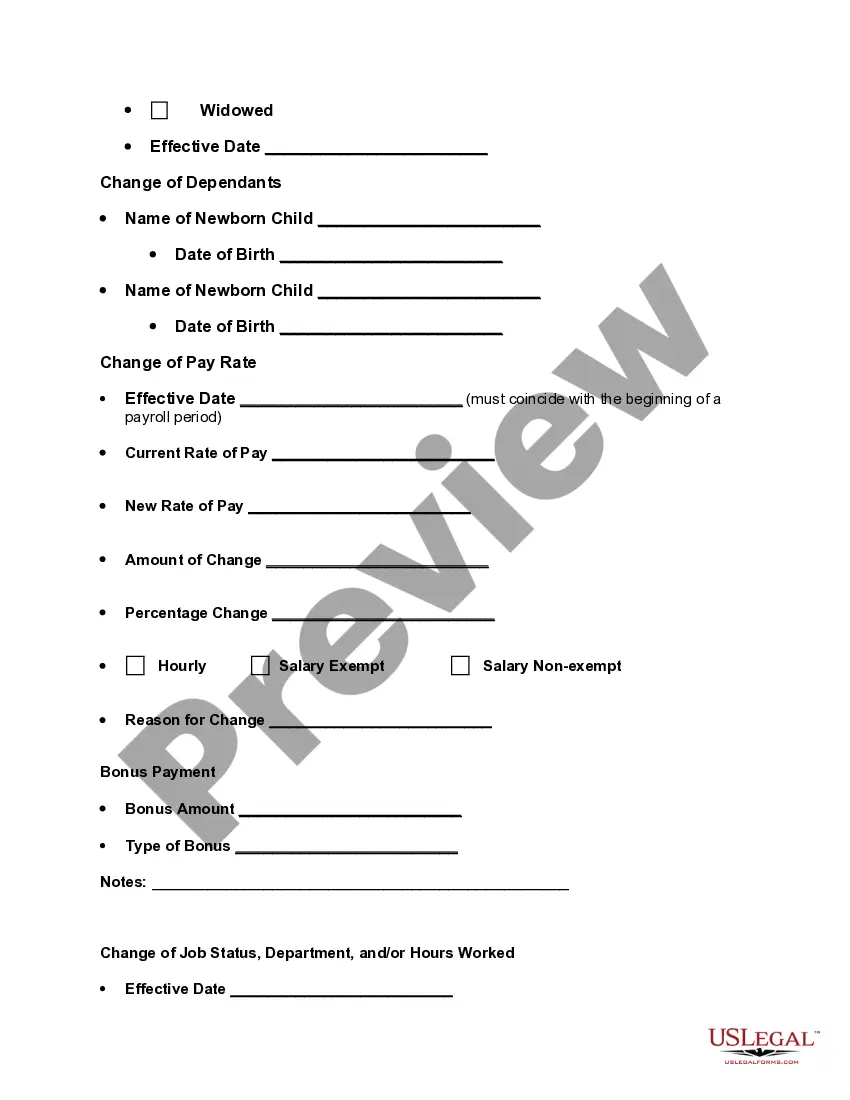

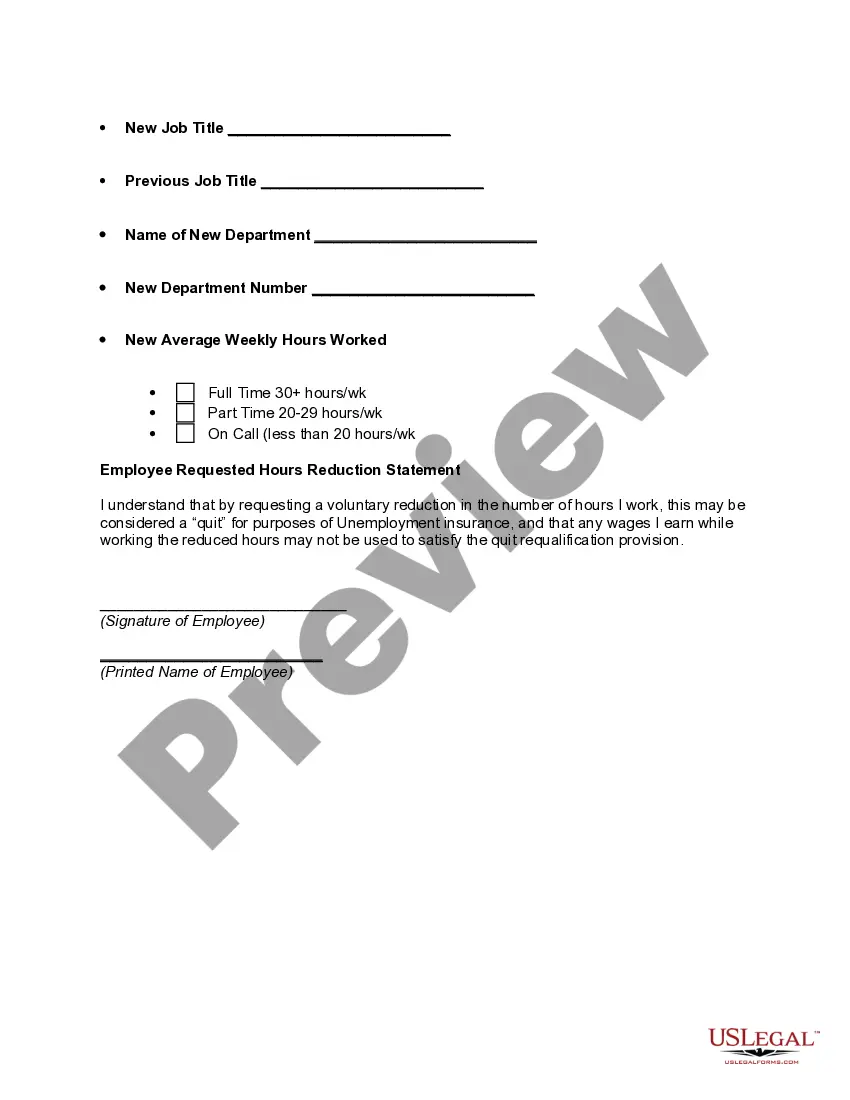

Puerto Rico Personnel Change Form is a crucial document used in the human resources department to record and manage employee-related information within organizations operating in Puerto Rico. This form serves as a formal record of any modifications or updates made to an employee's personal information, position, job title, compensation, and other relevant details. The form typically includes a variety of important fields, including the employee's name, employee ID, contact information, department, job title, supervisor's name, and employment status. It also allows for changes in the employee's marital status, address, phone number, emergency contact details, and any other pertinent personal information. In addition to personal information, the Puerto Rico Personnel Change Form includes the effective date of the change and reasons for the modification. This could involve promotions, demotions, transfers, terminations, salary adjustments, leaves of absence, benefits updates, or any other alteration related to an employee's terms of employment. Different types of Puerto Rico Personnel Change Forms may be used based on specific circumstances or changes in an employee's status. Some common variations may include: 1. Promotion or Job Title Change Form: This type of form is used when an employee is being promoted to a higher position or when their job title is updated to reflect new responsibilities or roles within the organization. 2. Transfer Form: When an employee is transferred from one department or location to another within the same organization, a transfer form is utilized. This form captures the relevant details of the transfer, such as the new department, supervisor, or location. 3. Salary Adjustment Form: In cases where an employee's salary is modified due to a raise, bonus, pay grade change, or any other salary adjustment reason, a salary adjustment form is completed. This form captures the new salary details and the effective date of the change. 4. Termination Form: When an employee is being terminated from their position, a specific termination form is used. This form captures the reason for termination, last working day, and any other pertinent information regarding the termination process. 5. Leave of Absence Form: If an employee requires a leave of absence, a leave form is completed. This form captures the type of leave (e.g., medical, maternity/paternity, personal), duration, and any applicable documentation required. These various types of Puerto Rico Personnel Change Forms aid in effectively documenting and properly communicating modifications or updates related to an employee's personal information, job title, compensation, and employment status. The accurate and thorough completion of these forms ensures compliance with Puerto Rico employment regulations and facilitates efficient HR management within organizations.

Puerto Rico Personnel Change Form

Description

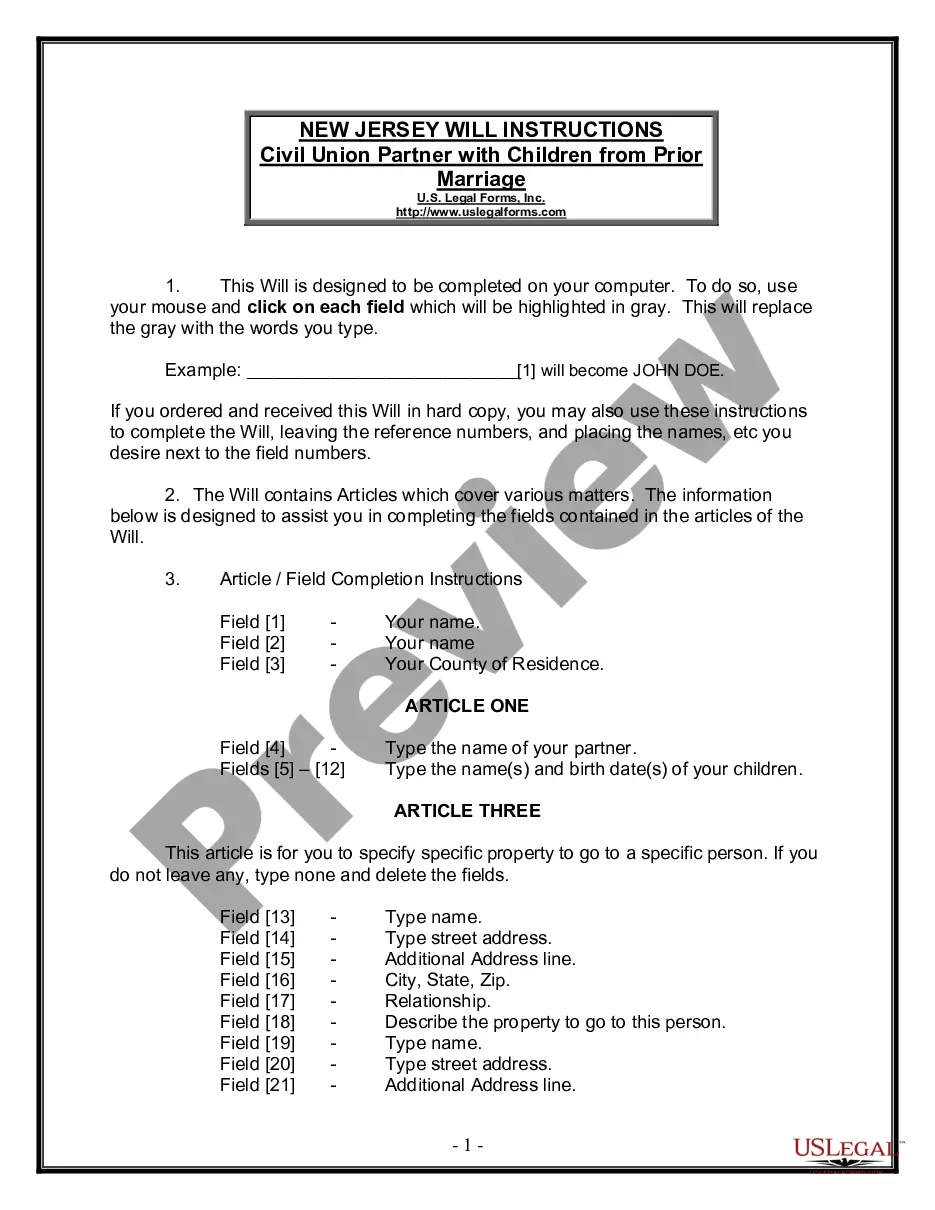

How to fill out Puerto Rico Personnel Change Form?

If you need to full, download, or printing legitimate papers layouts, use US Legal Forms, the greatest selection of legitimate forms, which can be found on-line. Utilize the site`s simple and handy lookup to find the documents you require. Different layouts for company and individual purposes are sorted by groups and states, or key phrases. Use US Legal Forms to find the Puerto Rico Personnel Change Form with a number of clicks.

If you are already a US Legal Forms customer, log in to the accounts and click on the Download button to have the Puerto Rico Personnel Change Form. Also you can gain access to forms you formerly saved within the My Forms tab of your respective accounts.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form to the appropriate town/country.

- Step 2. Utilize the Review solution to look over the form`s content. Never forget to see the description.

- Step 3. If you are not happy using the form, utilize the Search discipline near the top of the display screen to discover other versions from the legitimate form format.

- Step 4. Upon having discovered the form you require, click on the Get now button. Select the pricing program you like and put your credentials to register on an accounts.

- Step 5. Procedure the purchase. You should use your charge card or PayPal accounts to perform the purchase.

- Step 6. Pick the structure from the legitimate form and download it on the device.

- Step 7. Total, edit and printing or sign the Puerto Rico Personnel Change Form.

Each and every legitimate papers format you acquire is yours permanently. You have acces to every single form you saved inside your acccount. Click on the My Forms section and choose a form to printing or download once again.

Be competitive and download, and printing the Puerto Rico Personnel Change Form with US Legal Forms. There are thousands of skilled and condition-specific forms you can use for your company or individual requires.

Form popularity

FAQ

ContributionsEmployer. 6.2% FICA Social Security (Federal) 1.45% FICA Medicare (Federal) 0.90%6.20% FICA Social Security (Federal) (Maximum 142,800 USD) 1.45% FICA Medicare (Federal) 0.90%Employee. Employee Income Tax. 0.00% Not over 9,000 USD. 7.00%

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

If you are a U.S. citizen who is also a bona fide resident of Puerto Rico during the fiscal year but receive income as a U.S. government employee in Puerto Rico, you must file a federal tax return.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

Form 499-R-1C (Adjustments to Income Tax Withheld Worksheet) Form 499R2/W2PR (Withholding Statement) - This withholding statement is the Puerto Rico equivalent of the U.S. Form W2 and should be prepared for every employee.