Title: Puerto Rico Credit Approval Form: A Comprehensive Overview of Types and Key Details Introduction: The Puerto Rico Credit Approval Form is an essential document used in financial transactions and lending processes across Puerto Rico. This detailed description aims to provide an insight into the purpose, importance, and different types of credit approval forms commonly encountered in Puerto Rico. 1. Definition and Purpose: The Puerto Rico Credit Approval Form is a legal document that allows financial institutions, such as banks and credit unions, to assess and approve individuals or businesses for credit-based services, such as loans, mortgages, credit cards, or other forms of credit. It serves as a tool to evaluate an applicant's creditworthiness, ensuring that lending decisions are made based on accurate and relevant information. 2. Key Information and Fields: The Puerto Rico Credit Approval Form typically includes various sections and fields that collect crucial information. These may include but are not limited to: a. Personal Information: Funnymanam— - Contact details (address, phone number, email) — Social Security Number (SSN) or Tax Identification Number (TIN) Catbirdsrt— - Employment details (current employer, occupation, income) b. Financial Information: — Expense breakdown (mortgages, rent, utilities, etc.) — Current debt obligations (loan balances, credit card balances, etc.) — Assets (real estate, vehicles, investments, etc.) — Bank account details (balances, account numbers) c. Credit History and References: — Credit score and credit history (FICO score, credit reports) — Previous lenders and reference— - Payment history (late payments, defaults) d. Consent and Authorization: — Applicant's consent for credit checks, verification, and reference contact — Authorization for accessing credit bureaus and financial institutions' data — Declarations of accuracy and understanding of the provided information 3. Types of Puerto Rico Credit Approval Forms: Different financial institutions or specific credit-based services may have distinct credit approval forms tailored to their requirements. Some commonly encountered types of Puerto Rico Credit Approval Forms include: a. Personal Loan Credit Approval Form: Used for evaluating individuals' creditworthiness and approving personal loans. b. Mortgage Loan Credit Approval Form: A specialized form used for assessing and approving mortgage loan applications. c. Credit Card Application Credit Approval Form: Used by credit card issuers to evaluate an individual's eligibility for a credit card. d. Business Credit Approval Form: Designed for businesses or commercial borrowers seeking credit-based services. e. Auto Loan Credit Approval Form: Used in assessing creditworthiness specifically for vehicle financing. f. Retail Credit Approval Form: Commonly utilized by retailers offering in-store credit or financing options to customers. g. Student Loan Credit Approval Form: Tailored for educational purposing, evaluating student loan applications. Conclusion: Understanding the Puerto Rico Credit Approval Form is vital when engaging in financial transactions within Puerto Rico. It serves as a standard tool to evaluate creditworthiness and guide lending decisions for a range of credit-based services. Whether its personal loans, mortgages, credit cards, or other forms of credit, filling out and submitting the appropriate type of credit approval form accurately and comprehensively is essential for financial institutions to make responsible lending decisions.

Puerto Rico Credit Approval Form

Description

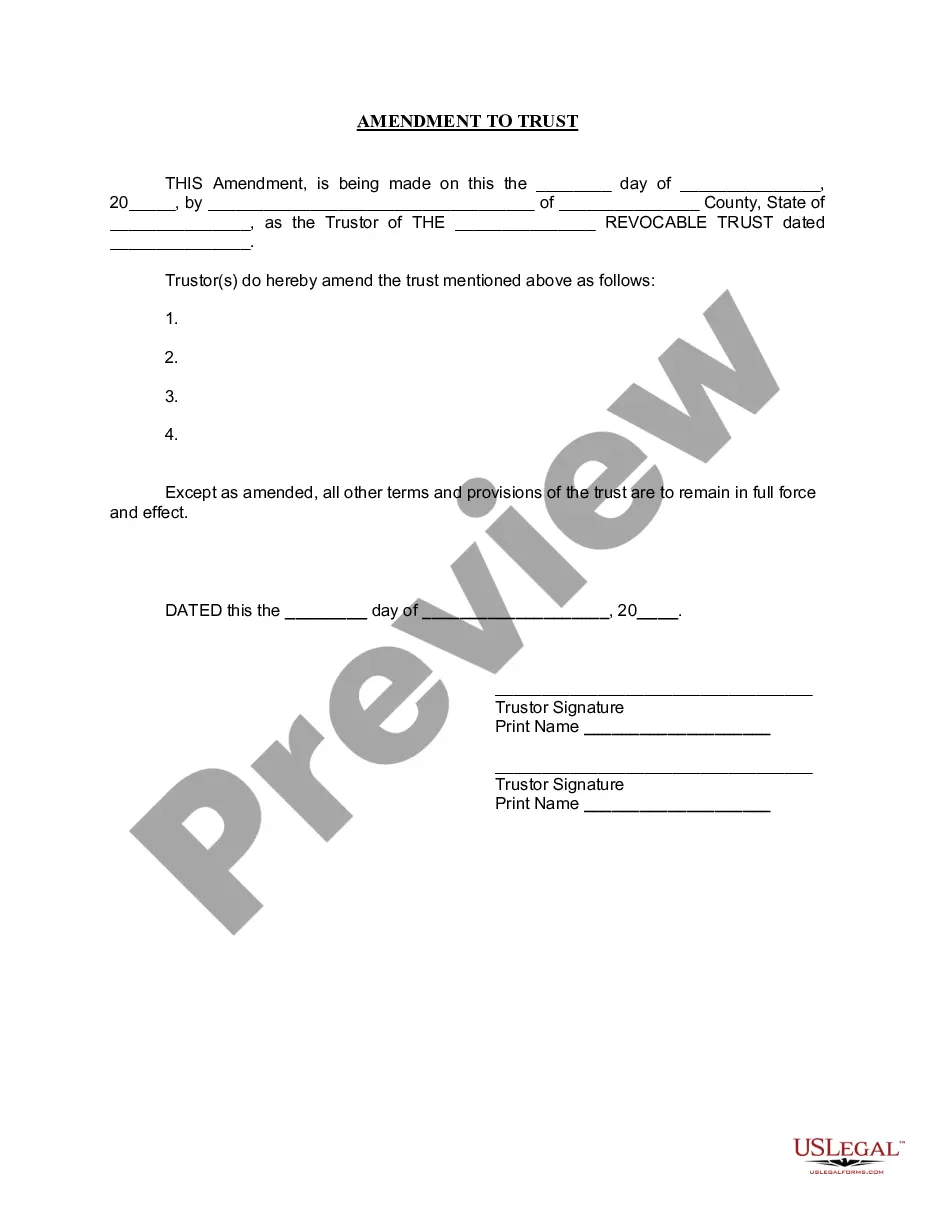

How to fill out Puerto Rico Credit Approval Form?

Choosing the best lawful papers web template can be a have a problem. Obviously, there are a lot of templates available on the Internet, but how can you get the lawful form you need? Use the US Legal Forms site. The support delivers thousands of templates, like the Puerto Rico Credit Approval Form, that you can use for business and private demands. All the varieties are examined by specialists and meet state and federal needs.

When you are currently authorized, log in to your accounts and then click the Obtain key to have the Puerto Rico Credit Approval Form. Utilize your accounts to search with the lawful varieties you have ordered earlier. Visit the My Forms tab of your accounts and obtain an additional duplicate of your papers you need.

When you are a new user of US Legal Forms, listed below are simple directions for you to follow:

- Initial, be sure you have selected the appropriate form to your city/area. You are able to look through the shape while using Review key and look at the shape explanation to make certain it will be the best for you.

- In case the form will not meet your requirements, make use of the Seach industry to discover the correct form.

- When you are sure that the shape is acceptable, click the Purchase now key to have the form.

- Opt for the rates plan you need and enter the required details. Design your accounts and buy the order making use of your PayPal accounts or charge card.

- Select the document structure and acquire the lawful papers web template to your gadget.

- Comprehensive, revise and print and sign the received Puerto Rico Credit Approval Form.

US Legal Forms is the most significant catalogue of lawful varieties for which you can see different papers templates. Use the company to acquire appropriately-produced documents that follow condition needs.

Form popularity

FAQ

All seven states allow filers to claim both the state and federal child tax credit.

The difference between these federal income tax forms is the relative simplicity of short forms 1040EZ and 1040A compared to the longer, more complex Form 1040. Using the shorter tax forms can simplify your tax preparation. Each of these tax forms has the same set of purposes, including: Reporting your income.

Thanks to the American Rescue Plan, bona fide residents of Puerto Rico now are eligible to receive the same Child Tax Credit benefit as residents of the 50 States and the District of Columbia.

For the first time ever, this year, all families in Puerto Rico regardless of the number of children in their family are eligible for the Child Tax Credit on the same basis as families in the 50 states and the District of Columbia.

About Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

The W-2 is the form your employer sends to you each January reporting your wages & withholding. The form 1040 is your tax return you file.

Citizens of the United States traveling to Puerto Rico need only a government-issued form of photo identification because they are not going to another country. Acceptable forms of ID include a driver's license or a photo ID card issued by a U.S. Department of motor vehicles.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Most U.S. citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the year. You may want to file even if you make less than that amount, because you may get money back if you file.

You must file Form 1040-SS if you meet all three requirements below. 1. You, or your spouse if filing a joint return, had net earnings from self-employment (from other than church employee income) of $400 or more (or you had church employee income of $108.28 or moresee Church Employees, later).