Puerto Rico Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

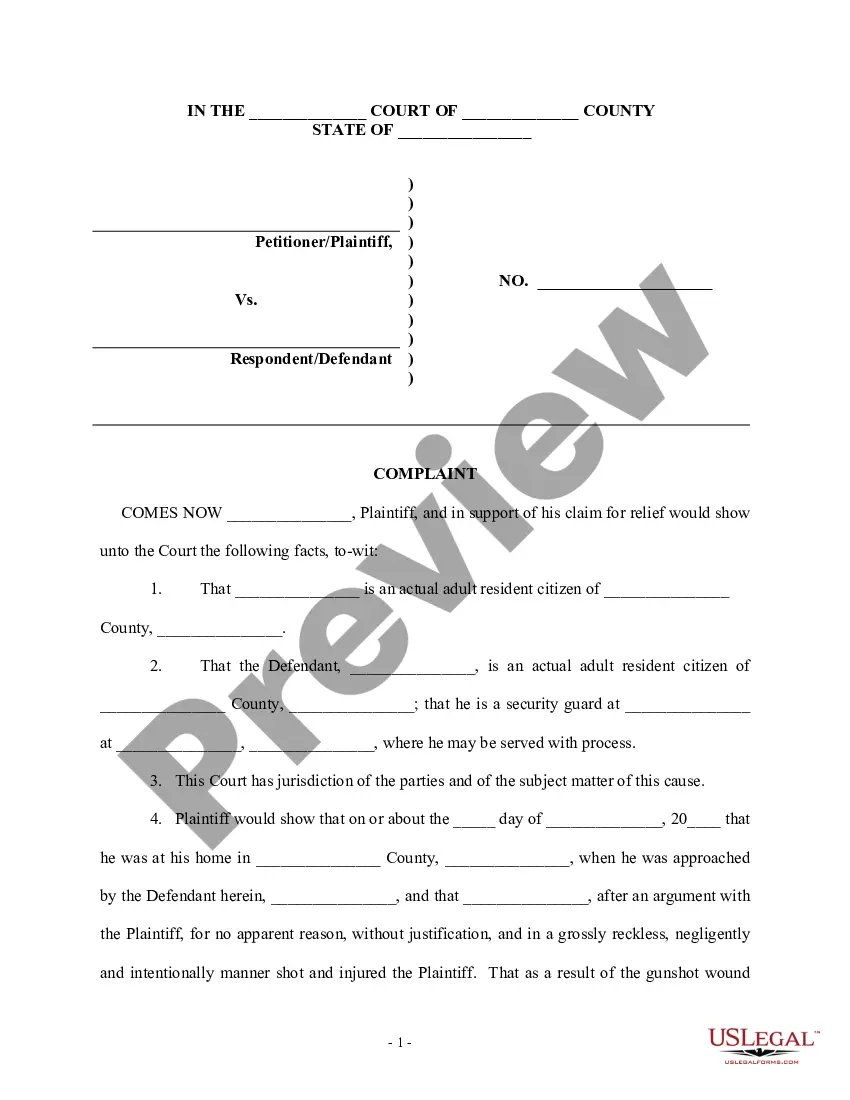

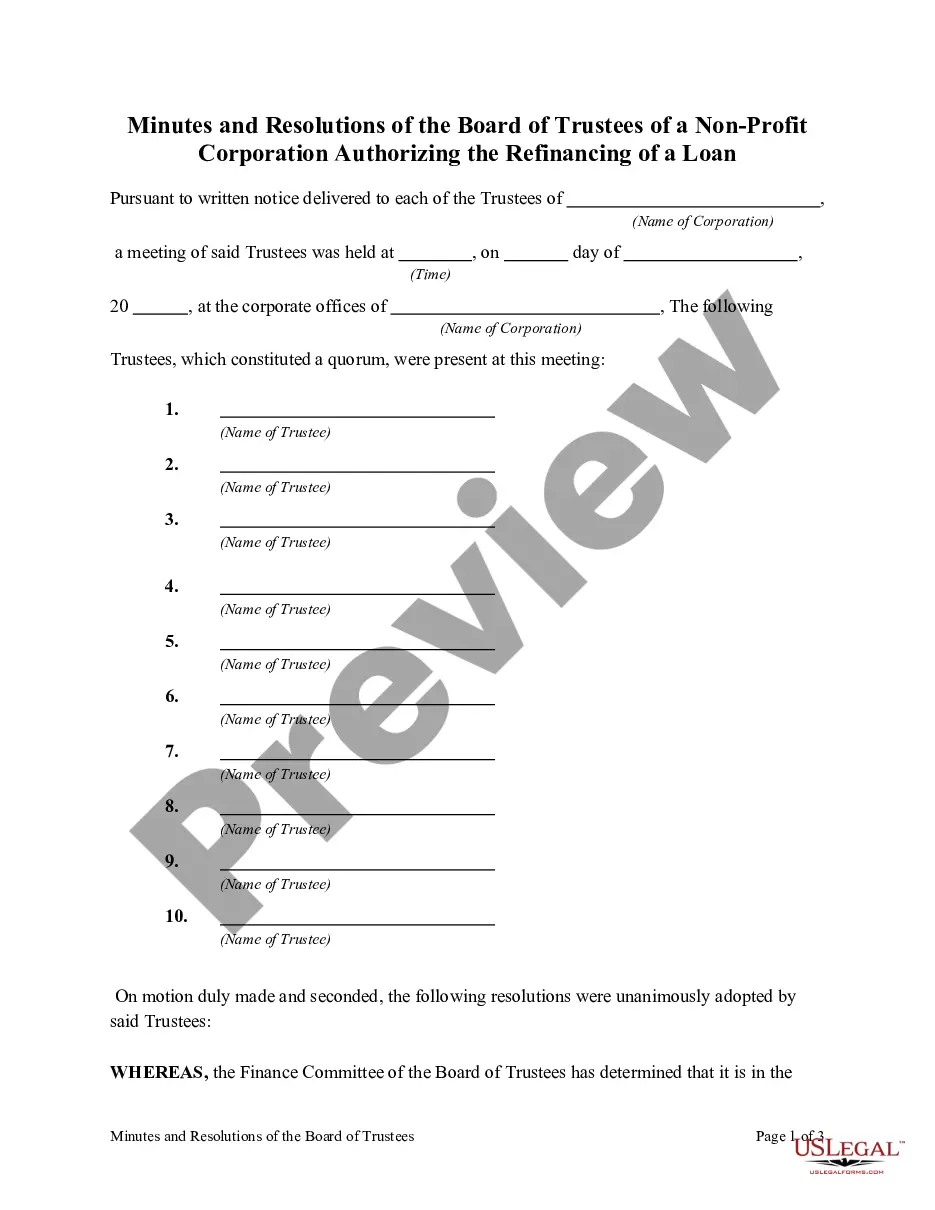

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump Sum Payment?

You can invest hours online attempting to discover the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can download or print the Puerto Rico Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment from their service.

First, ensure you have selected the correct document template for your chosen state/city. Review the form description to make certain you have selected the correct type. If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- Subsequently, you can complete, modify, print out, or sign the Puerto Rico Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment.

- Every legal document template you acquire is yours indefinitely.

- To retrieve another copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

There are 5 main ways to dissolve a partnership legally :Dissolution of Partnership by agreement.Dissolution by notice.Termination of Partnership by expiration.Death or bankruptcy.Dissolution of a Partnership by court order.

Winding up ends all outstanding legal and financial obligations of the partnership so that the business can be terminated. Winding up is a process and will be conducted according to the partnership agreement and according to applicable state laws. Once winding up is complete, the partnership is terminated.

One partner may want to leave the business and dispense with all assets. A partner can die, or the business may dissolve in its entirety. Timing determines whether a partnership has dissolved or officially terminated. Both informal and LLC partnership dissolution occur when one partner leaves.

What is a Partnership Winding Up? This is similar to the liquidation of a company. When the partners have decided that the partnership has no viable future or purpose then a decision may be made to cease trading and wind up the partnership.

The partner must give notice in writing. If the partner does not want to dissolve the partnership immediately, they should specify in the notice the date on which the partnership is to dissolve. If the matter proceeds to court, a court order can also terminate the partnership.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

Definition: Partnership liquidation is the process of closing the partnership and distributing its assets. Many times partners choose to dissolve and liquidate their partnerships to start new ventures. Other times, partnerships go bankrupt and are forced to liquidate in order to pay off their creditors.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

A partnership is considered terminated if no part of its business, financial operations, or activities continues. In any case, the partnership agreement dictates what happens when the partnership is terminated. Without an agreement, the termination terms are left up to the courts in your state.

On the dissolution of a partnership every partner is entitled, as against the other partners in the firm, and all persons claiming through them in respect of their interests as partners, to have the property of the partnership applied in payment of the debts and liabilities of the firm, and to have the surplus assets