Puerto Rico Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates that you can download or print.

While using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Puerto Rico Liquidation of Partnership with Authority, Rights and Obligations during Liquidation in seconds.

If you have a monthly subscription, Log In and download the Puerto Rico Liquidation of Partnership with Authority, Rights and Obligations during Liquidation from the US Legal Forms library. The Download button will be visible on each form you view. You have access to all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form onto your device. Edit. Fill out, modify and print, and sign the downloaded Puerto Rico Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

Each template you add to your account does not have an expiration date and is yours permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your city/state.

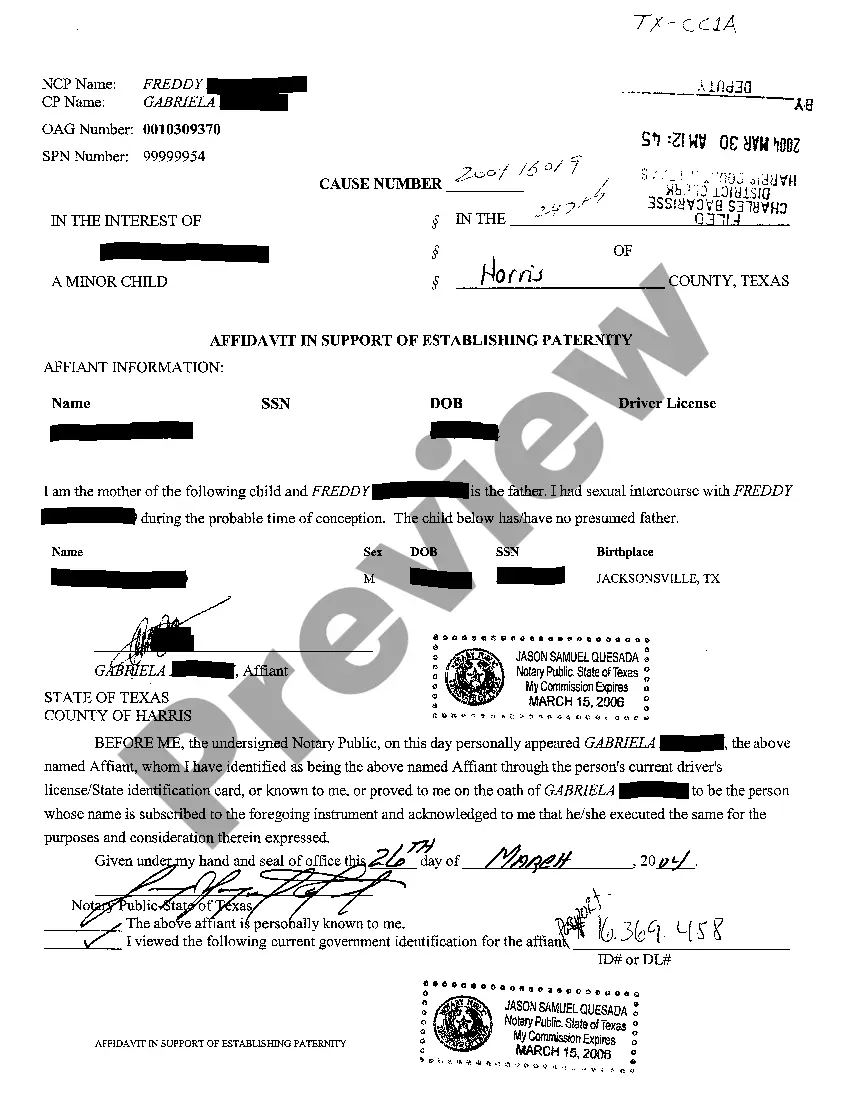

- Click the Preview button to view the content of the form.

- Review the form summary to confirm you have chosen the right document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find another one that does.

- If you're happy with the form, confirm your choice by clicking the Download now button.

- Then, select the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

The first preference is given to the company's secured creditors. The remaining money is then used to discharge preferential creditors, i.e., taxes due to the government, salaries of employees, etc.

Once the liquidator is appointed, one of the first duties of his is collecting, consolidating and verifying the claims of stakeholders of the CD. Within a period of 30 days from the liquidation commencement date, the liquidator must collect or receive the claims27 of creditors.

In any case, the first step in the liquidation process is for the company directors to seek impartial advice from an insolvency expert, before convening a meeting with shareholders to announce the intended liquidation.

The below procedure would provide winding up of a company thorough the voluntary method:Passing of Resolution and Special Resolution. First and foremost, the company must have a general meeting to pass the resolution.Declaration of Solvency.Preparation of Winding Up Report.Application to Tribunal.

When a company goes into liquidation its assets are sold to repay creditors and the business closes down. The company name remains live on Companies House but its status switches to 'Liquidation'.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

Selling or closing the business. identifying and selling the company's assets. contacting and receiving claims from creditors. sending progress reports to creditors.

The liquidator shall liquidate the corporate debtor within a period of one year from the liquidation commencement date. Provided that where the sale is attempted under sub- Regulation (1) of regulation 32A, the liquidation process may take an additional period up to ninety days.

Procedure for Summary LiquidationEvery sale has to be made with the confirmation of the central government. The gross sale proceeds shall be paid to the liquidator. Any expenses incurred in connection with the sale shall be paid by the liquidator out of the gross proceeds of the sale.