The Puerto Rico Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal process carried out when a partnership comes to an end and its assets need to be distributed among its partners. This type of liquidation involves selling off the partnership's assets and dividing the proceeds between the partners in proportion to their ownership interests. In Puerto Rico, there are two main types of liquidation methods used: voluntary liquidation and judicial liquidation. 1. Voluntary Liquidation: This occurs when partners agree to dissolve the partnership voluntarily. It involves the unanimous consent of all partners, who then proceed to sell the partnership's assets and distribute the proceeds accordingly. Voluntary liquidation can be a smooth and amicable process if all partners are in agreement. 2. Judicial Liquidation: This type of liquidation is initiated when there is a disagreement or dispute among the partners, or when a partner petitions the court for the liquidation of the partnership. Judicial liquidation involves court intervention, where a judge will oversee the sale of the partnership's assets and the distribution of the proceeds. During the liquidation process, it is crucial to follow specific legal requirements and steps to ensure a fair and orderly distribution of assets. Here are the key steps involved: 1. Partnership Agreement Review: Partners need to consult the partnership agreement to determine the terms and conditions for liquidation. The agreement may provide guidelines on the sale of assets, division of proceeds, and priority of payments. 2. Valuation of Assets: An appraisal of the partnership's assets is conducted to determine their fair market value. This assessment ensures an accurate distribution of the assets' sale proceeds. 3. Asset Sale: The partnership's assets are then sold, either individually or as a whole, depending on the nature of the assets and market conditions. The sale can be conducted through private negotiations or public auctions to maximize the value of the assets. 4. Payment of Debts and Liabilities: Prior to distributing the sale proceeds, the partnership's outstanding debts, liabilities, and obligations must be settled. This includes paying off creditors, taxes, and any other obligations the partnership may have. 5. Proportional Asset Distribution: After settling all debts, the remaining sale proceeds are distributed among the partners based on their ownership interests. The proportional distribution ensures that each partner receives their fair share of the partnership's assets. 6. Dissolution and Termination: Once all assets are sold and the proceeds are distributed, the partnership is officially dissolved and terminated. Appropriate legal documentation is filed to reflect the end of the partnership. It is essential to consult with a qualified attorney experienced in Puerto Rico partnership law during the liquidation process to ensure compliance with local regulations and to protect the rights and interests of all partners involved.

Puerto Rico Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

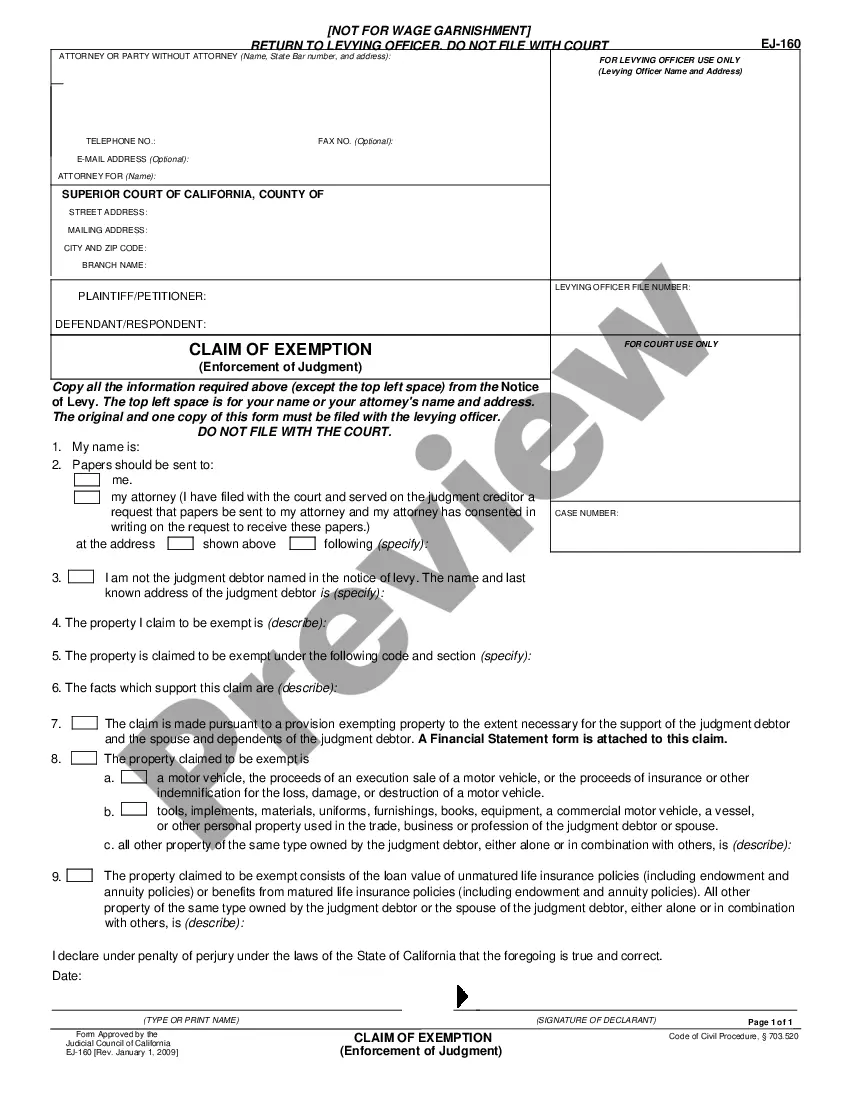

How to fill out Puerto Rico Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

You may devote time on the web looking for the lawful file design that meets the state and federal demands you want. US Legal Forms offers 1000s of lawful types which are analyzed by experts. You can actually down load or print out the Puerto Rico Liquidation of Partnership with Sale and Proportional Distribution of Assets from the support.

If you already have a US Legal Forms bank account, it is possible to log in and click the Down load button. Next, it is possible to full, modify, print out, or indicator the Puerto Rico Liquidation of Partnership with Sale and Proportional Distribution of Assets. Each and every lawful file design you acquire is yours eternally. To acquire one more backup associated with a acquired form, go to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms web site the first time, keep to the basic directions under:

- Initially, be sure that you have selected the right file design to the region/city of your choice. Browse the form description to make sure you have selected the right form. If readily available, use the Preview button to appear from the file design also.

- If you wish to discover one more variation of your form, use the Research discipline to discover the design that meets your requirements and demands.

- Upon having found the design you want, click Buy now to carry on.

- Select the rates strategy you want, key in your references, and sign up for your account on US Legal Forms.

- Total the financial transaction. You can use your charge card or PayPal bank account to pay for the lawful form.

- Select the formatting of your file and down load it to the gadget.

- Make modifications to the file if required. You may full, modify and indicator and print out Puerto Rico Liquidation of Partnership with Sale and Proportional Distribution of Assets.

Down load and print out 1000s of file themes using the US Legal Forms site, that provides the biggest variety of lawful types. Use specialist and express-particular themes to tackle your business or personal demands.

Form popularity

FAQ

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

A liquidation marks the official ending of a partnership agreement. To end the partnership, the parties involved sell the property the business owns, and each partner receives a share of the remaining money.

Liquidation of a Partnership As with winding up a company, there are two ways that the partnership can be wound up; the creditor's petition or the partner's petition.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

If the partnership decides to liquidate, the assets of the partnership are sold, liabilities are paid off, and any remaining cash is distributed to the partners according to their capital account balances.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

Upon liquidation of a partnership, the Internal Revenue Service views the distributions as a sale of a partnership interest; as a result, gains are generally taxed as long-term capital gains to partners.

Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain on Schedule D.