Title: Puerto Rico Letter Requesting Transfer of Property to Trust — Comprehensive Guide Introduction: In the realm of estate planning and property management, transferring property to a trust is a widely utilized strategy, offering several benefits such as asset protection, tax advantages, and efficient distribution of assets upon death. For residents of Puerto Rico, a specific "Letter Requesting Transfer of Property to Trust" plays a key role in initiating this process effectively. This detailed description aims to shed light on the purpose, importance, and various types of Puerto Rico Letters Requesting Transfer of Property to Trust. Keywords: Puerto Rico, letter requesting transfer of property to trust, estate planning, property management, asset protection, tax advantages, distribution of assets, death, process, purpose, types. 1. Purpose of a Puerto Rico Letter Requesting Transfer of Property to Trust: A Puerto Rico Letter Requesting Transfer of Property to Trust serves as a formal request to legally transfer ownership of a property or assets from an individual to a trust established by that individual. The purpose is to ensure that the assets are correctly titled and aligned with the individual's estate planning objectives. 2. Importance of a Puerto Rico Letter Requesting Transfer of Property to Trust: i. Asset Protection: By transferring assets to a trust, individuals can protect their property from potential creditors, lawsuits, and other claims while maintaining control over the assets. ii. Tax Advantages: Depending on the trust type, transferring property to a trust may offer potential tax benefits, such as reducing estate taxes, capital gains taxes, or income taxes. iii. Efficient Distribution: Transferring property to a trust allows for the smooth and efficient distribution of assets to beneficiaries upon the individual's death, avoiding probate and potentially minimizing conflicts. 3. Types of Puerto Rico Letters Requesting Transfer of Property to Trust: i. Revocable Living Trust: This type of trust can be altered or revoked during the individual's lifetime, providing flexibility and control over the assets. A letter requesting the transfer of property to a revocable living trust outlines the intentions to transfer the property while retaining control over it. ii. Irrevocable Trust: An irrevocable trust cannot be easily altered or revoked once established. A letter requesting the transfer of property to an irrevocable trust officially initiates the process, conveying the intentions and providing necessary details. iii. Testamentary Trust: Unlike a revocable or irrevocable trust, a testamentary trust is established through instructions laid out in a will and becomes active upon the individual's death. A letter requesting the transfer of property to a testamentary trust is typically submitted alongside the will, specifying the property to be transferred. Conclusion: A Puerto Rico Letter Requesting Transfer of Property to Trust is a crucial document for individuals seeking to transfer their property or assets into a trust structure. Whether it's to ensure asset protection, tax advantages, or seamless distribution of assets, understanding the purpose and importance of such letters is paramount. By considering the different types of letters depending on the trust structure (revocable living, irrevocable, or testamentary), individuals can make informed decisions and effectively implement their estate planning strategies in Puerto Rico.

Puerto Rico Letter Requesting Transfer of Property to Trust

Description

How to fill out Puerto Rico Letter Requesting Transfer Of Property To Trust?

Are you currently inside a place the place you need to have paperwork for sometimes organization or person functions almost every day time? There are a lot of legal papers web templates available online, but getting versions you can rely is not easy. US Legal Forms offers a huge number of type web templates, much like the Puerto Rico Letter Requesting Transfer of Property to Trust, that happen to be created to fulfill federal and state requirements.

When you are currently informed about US Legal Forms site and get an account, merely log in. After that, you are able to acquire the Puerto Rico Letter Requesting Transfer of Property to Trust format.

If you do not come with an account and wish to start using US Legal Forms, adopt these measures:

- Get the type you will need and ensure it is for your right metropolis/region.

- Use the Preview switch to review the form.

- Browse the description to ensure that you have selected the proper type.

- In the event the type is not what you are seeking, take advantage of the Research discipline to find the type that meets your needs and requirements.

- Once you discover the right type, click on Get now.

- Opt for the pricing plan you would like, complete the necessary information and facts to produce your account, and buy the order with your PayPal or credit card.

- Choose a practical paper formatting and acquire your duplicate.

Find all of the papers web templates you have purchased in the My Forms menus. You may get a more duplicate of Puerto Rico Letter Requesting Transfer of Property to Trust whenever, if possible. Just go through the necessary type to acquire or print out the papers format.

Use US Legal Forms, by far the most substantial collection of legal types, in order to save some time and avoid blunders. The support offers skillfully produced legal papers web templates which can be used for an array of functions. Make an account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

This means that if someone dies owning property in Puerto Rico, in order to transfer that property to another person, you must go to court to get the permission to transfer and register the property to the new person. This is what is commonly known in the U.S. as probating an estate.

Under Puerto Rico inheritance law, one-third of the inheritance is equally split between the forced heirs. Another third is doled out according to the wishes of the testator (the person leaving the inheritance), but this too goes to the heirs.

All expenses for the cancellation of any existing liens or mortgages, are to the seller, unless negotiated otherwise. Typically the notary fee will be . 50% to 1.0% of the sales price, or .

Currently, there is a 10% tax on property transferred by gift or inheritance that is not subject to exemption. Recipients of property that is subject to gift or inheritance taxation may increase their tax basis by the fair market value of the property at the time of the transfer.

Puerto Rico Uses Forced Heirs Forced heirship means that children, grandchildren or direct descendants are guaranteed some part of the inheritance. If there are no children or grandchildren, then parents are also included as forced heirs.

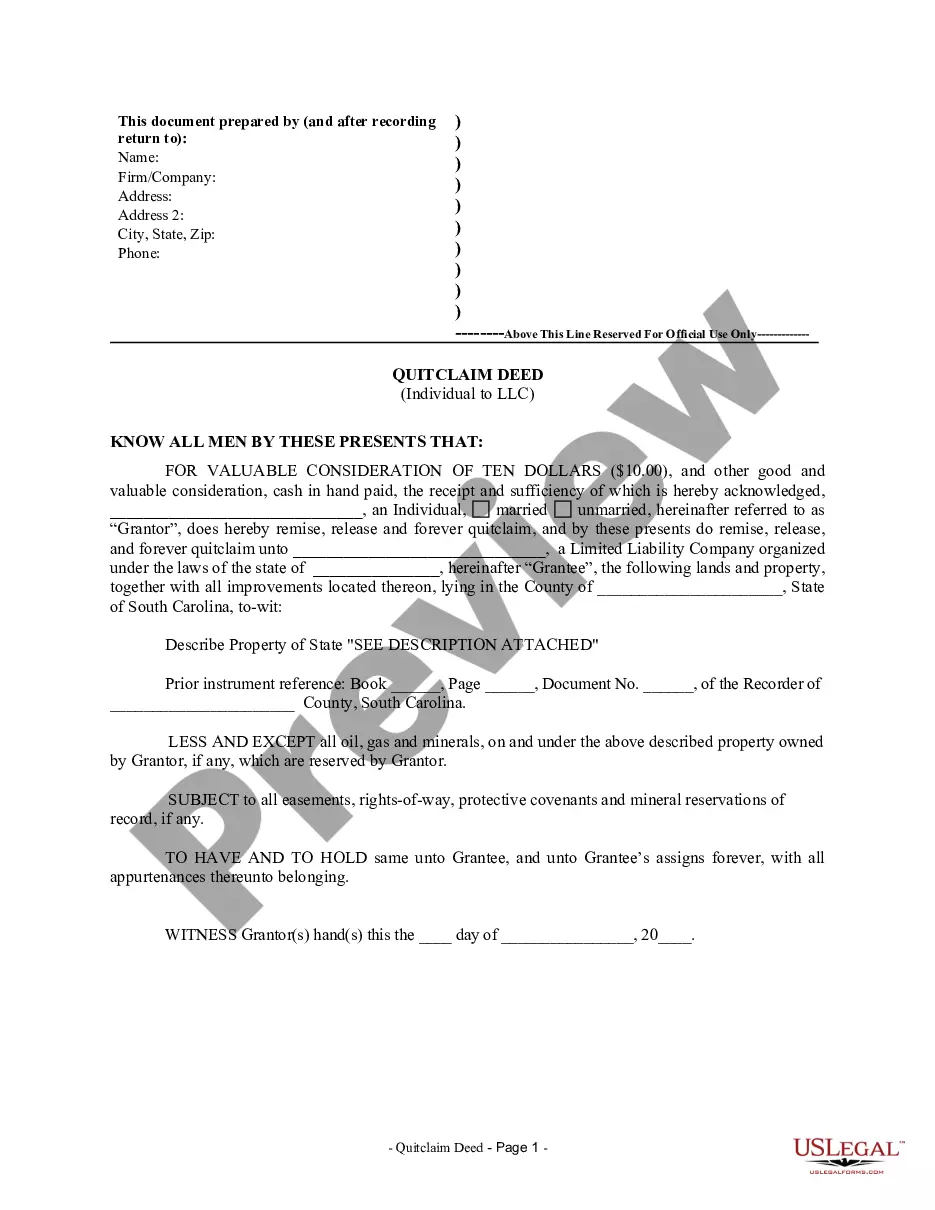

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Three Ways to Restrict Forced Heirship There are three ways that a forced heir's rights may be legally restricted: usufruct, legitime trust, and survivorship requirements.

Successions in General However, the New Code adds the surviving spouse to the first order of succession as a forced heir (Art. 1720). For example, if a testator has three offspring and a surviving spouse, each will inherit 25% of the estate.

Any abandoned property that has a mortgage will be subject to a judicial foreclosure process. Until then, the ownership will be retained by its lawful owners, he said. Then if they are finally foreclosed, it will become a real estate owned (REO) property of the particular bank.