Puerto Rico Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

US Legal Forms - one of the largest collections of legal documents in the USA - provides an array of official file templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Puerto Rico Pay in Lieu of Notice Guidelines in a matter of minutes.

If you already possess a subscription, Log In to retrieve the Puerto Rico Pay in Lieu of Notice Guidelines from your US Legal Forms collection. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Make edits. Fill out, adjust, and print and sign the downloaded Puerto Rico Pay in Lieu of Notice Guidelines. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the document you need. Access the Puerto Rico Pay in Lieu of Notice Guidelines with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and specifications.

- Ensure you have selected the appropriate form for your location/county.

- Click the Preview button to examine the content of the form.

- Review the form overview to confirm that you have chosen the correct document.

- If the form does not meet your criteria, utilize the Search feature at the top of the screen to find the one that does.

- If you are satisfied with the form, verify your selection by clicking the Buy now button.

- Then, select your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

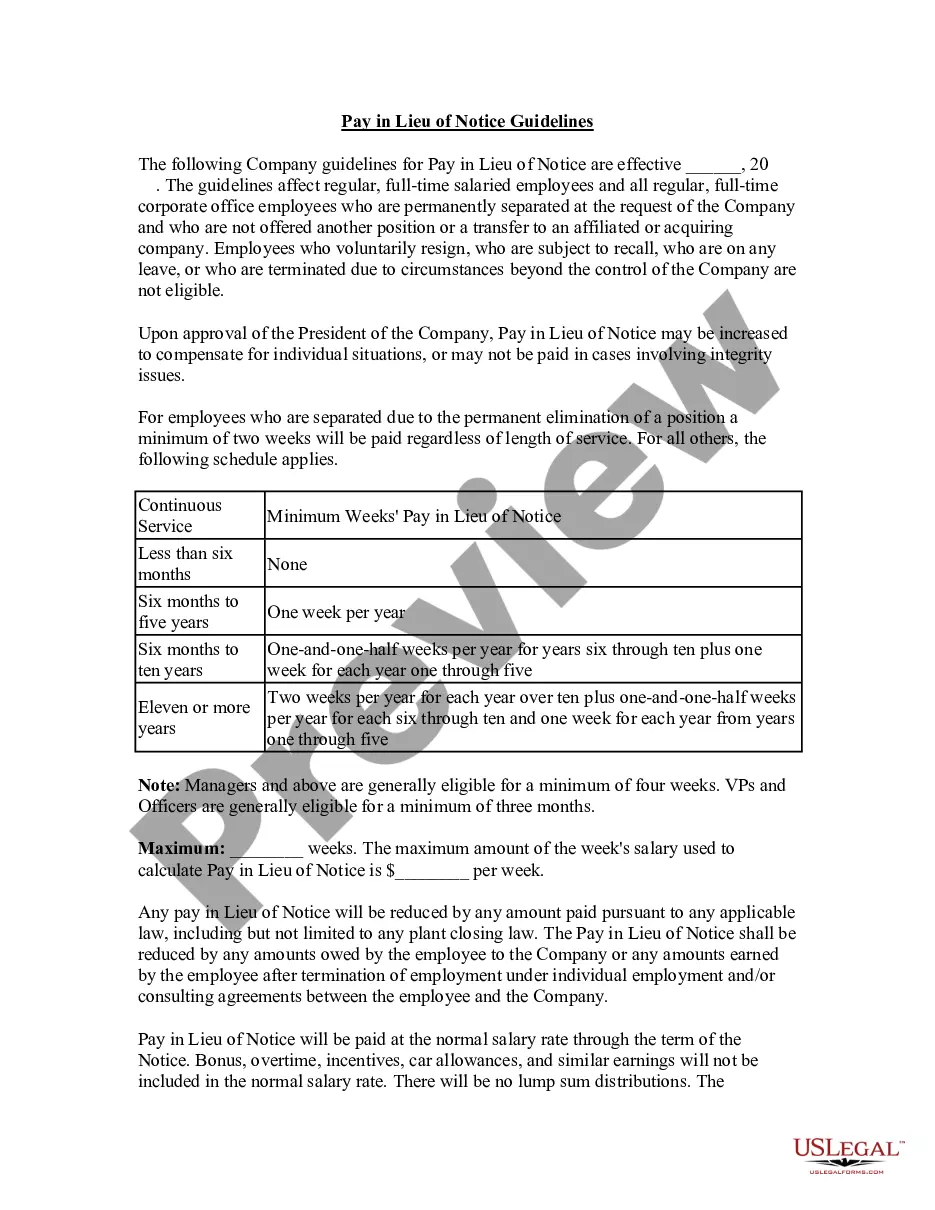

The amount in lieu of notice is the financial compensation given to an employee instead of allowing them to work out their notice period. According to the Puerto Rico Pay in Lieu of Notice Guidelines, this amount is generally calculated based on the employee's wage and any other relevant benefits. It ensures that transitioning employees receive the necessary financial support during their job change.

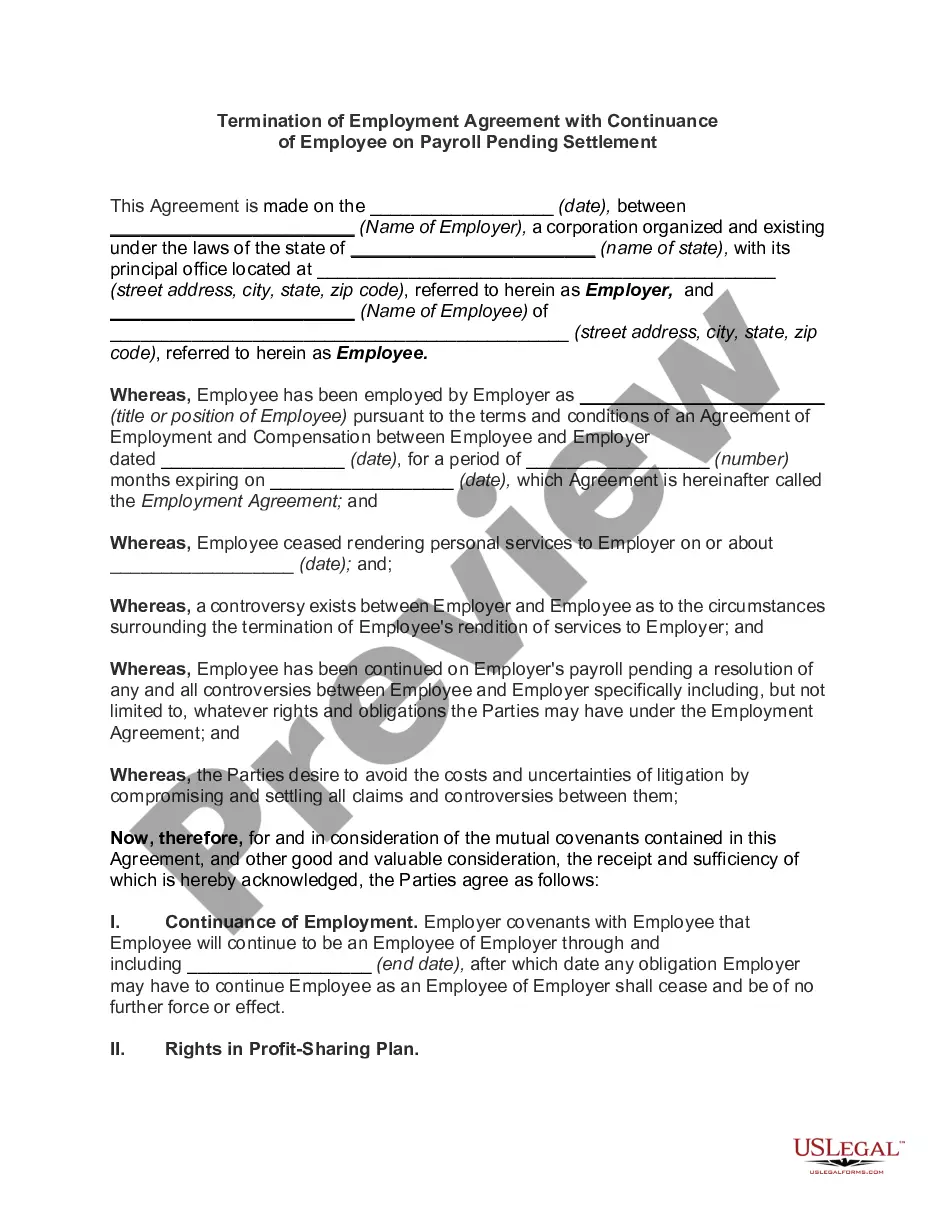

A letter of payment in lieu of notice by the employer formally communicates the decision to terminate employment without providing the standard notice period. This letter includes details about the payment amount and serves as a legal document, ensuring compliance with the Puerto Rico Pay in Lieu of Notice Guidelines. Utilizing platforms like uslegalforms can assist in drafting these important documents accurately.

Processing payment in lieu of notice involves a few straightforward steps. First, calculate the appropriate amount based on the Puerto Rico Pay in Lieu of Notice Guidelines. Then, ensure that this payment is included in the final paycheck to the employee, along with any applicable withholdings and contributions.

Yes, under Puerto Rico Pay in Lieu of Notice Guidelines, payments made in lieu of notice typically attract Superannuation contributions. Employers should consider this when budgeting for termination payments. Ensuring compliance with these guidelines helps avoid penalties and supports fair treatment for employees.

To calculate payment in lieu of notice according to Puerto Rico Pay in Lieu of Notice Guidelines, first determine the employee's regular wage. Multiply this amount by the number of notice days required by law or the employment contract. This calculation ensures that employees receive compensation during the notice period they would have worked.

Law 80 in Puerto Rico governs the termination of employment relationships and outlines the responsibilities of employers in situations of wrongful termination. Under this law, employees have specific rights and may be entitled to compensation if their termination does not adhere to legal guidelines. Understanding Law 80 is essential for employees and employers alike, and following the Puerto Rico Pay in Lieu of Notice Guidelines can help ensure compliance with these regulations.

Payment in lieu of leave is compensation an employee receives instead of taking their allocated leave days. In the context of the Puerto Rico Pay in Lieu of Notice Guidelines, this means that if an employee does not take their leave, they can opt to receive payment for those days instead. This arrangement provides employees with the flexibility to choose financial compensation over taking time off, thereby supporting their personal and financial circumstances.

Payment in lieu of notice refers to a financial compensation given to an employee when they are not provided with the notice period before termination. According to the Puerto Rico Pay in Lieu of Notice Guidelines, this payment allows employees to receive wages equivalent to the notice period they would have worked, ensuring they are compensated fairly. This approach helps protect employees from sudden job loss and offers them financial stability while they search for new employment.

To get payment in lieu, you must first determine your eligibility under the Puerto Rico Pay in Lieu of Notice Guidelines. Typically, you should notify your employer if you wish to receive this payment instead of a notice period. It often requires formal documentation, so consider utilizing services like US Legal Forms for templates and support in drafting your request. This way, you can ensure that the process is smooth and legally sound.

Regulation 13 in Puerto Rico outlines the legal standards for employee notices and terminations. It specifically addresses the requirements for employers when providing payment in lieu of notice. Understanding this regulation is crucial to ensure that your actions align with legal expectations. You can refer to the Puerto Rico Pay in Lieu of Notice Guidelines for detailed insights into complying with Regulation 13.