Puerto Rico Payroll Deduction Authorization Form is a legal document used by employers in Puerto Rico to obtain written consent from employees to deduct certain amounts from their wages. It is designed to ensure compliance with specific Puerto Rican labor laws and allows employees to authorize deductions voluntarily for specific purposes. This form serves as a written agreement between the employer and employee, clearly outlining the terms and conditions of the authorized deductions. Keywords: Puerto Rico, Payroll Deduction, Authorization Form, employees, wages, written consent, compliance, labor laws, deductions, voluntary, specific purposes, agreement, terms and conditions. Different types of Puerto Rico Payroll Deduction Authorization Forms can include: 1. Puerto Rico Retirement Savings Deduction Authorization Form: This form enables employees to authorize deductions from their wages for contributions into retirement savings plans such as 401(k) or individual retirement accounts (IRA). 2. Puerto Rico Health Insurance Deduction Authorization Form: Designed to obtain employee consent for deductions to cover health insurance premiums or other healthcare-related expenses. 3. Puerto Rico Charitable Contribution Deduction Authorization Form: This form allows employees to authorize deductions from wages for charitable donations to eligible organizations or causes. 4. Puerto Rico Union Dues Deduction Authorization Form: This form grants employees the option to authorize deductions for union membership dues or fees. 5. Puerto Rico Debt Repayment Deduction Authorization Form: Employees who owe debts to their employer, such as loans or advances, can use this form to authorize wage deductions towards the repayment of the outstanding amounts. These are just a few examples of the various types of Puerto Rico Payroll Deduction Authorization Forms, each catering to specific purposes or deductions that an employee may authorize.

Puerto Rico Payroll Deduction Authorization Form

Description

How to fill out Puerto Rico Payroll Deduction Authorization Form?

If you wish to comprehensive, download, or printing lawful papers templates, use US Legal Forms, the greatest collection of lawful forms, which can be found on the web. Utilize the site`s easy and practical lookup to obtain the documents you require. A variety of templates for organization and personal purposes are sorted by categories and states, or keywords and phrases. Use US Legal Forms to obtain the Puerto Rico Payroll Deduction Authorization Form within a couple of click throughs.

If you are currently a US Legal Forms customer, log in in your account and click on the Down load button to get the Puerto Rico Payroll Deduction Authorization Form. Also you can access forms you in the past acquired in the My Forms tab of your account.

If you work with US Legal Forms the very first time, follow the instructions under:

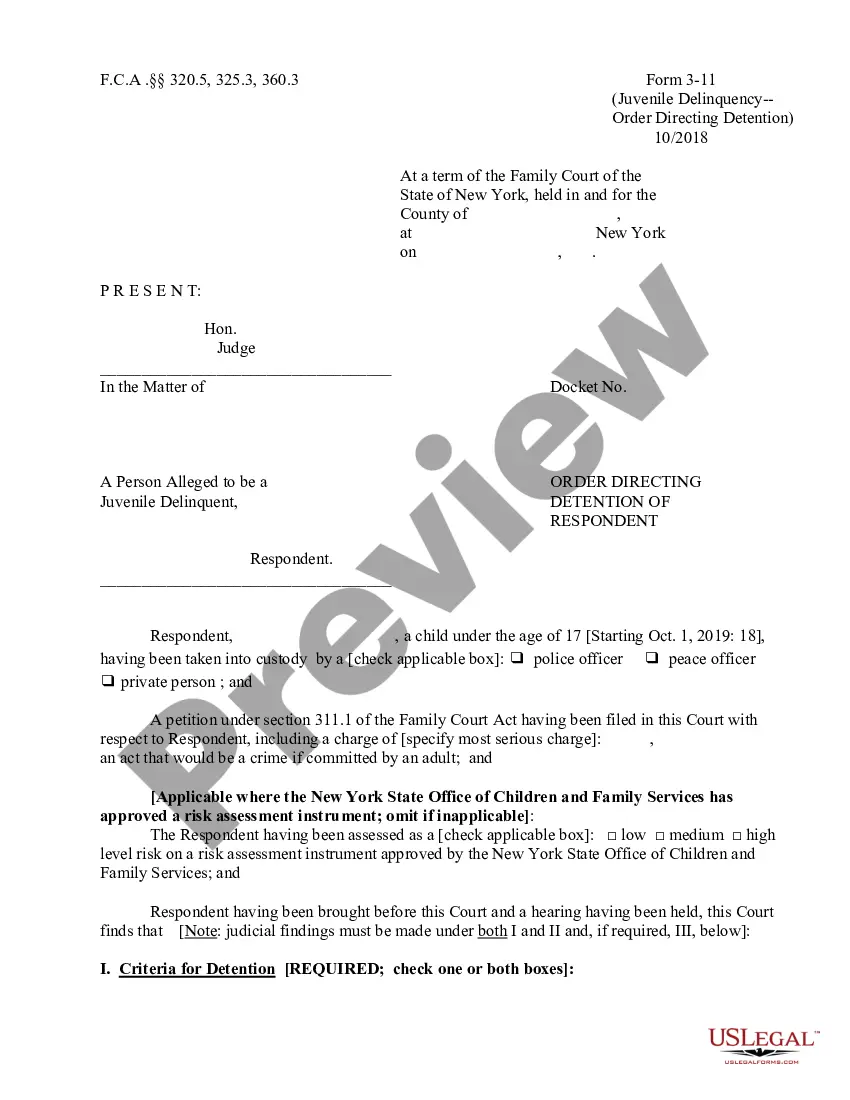

- Step 1. Be sure you have chosen the shape to the correct town/country.

- Step 2. Use the Review choice to look through the form`s articles. Do not forget about to see the description.

- Step 3. If you are not satisfied with all the kind, use the Lookup discipline on top of the display to find other models from the lawful kind web template.

- Step 4. After you have found the shape you require, click the Get now button. Opt for the costs strategy you favor and add your qualifications to sign up for an account.

- Step 5. Process the deal. You can utilize your credit card or PayPal account to complete the deal.

- Step 6. Select the file format from the lawful kind and download it on your device.

- Step 7. Total, modify and printing or indicator the Puerto Rico Payroll Deduction Authorization Form.

Each lawful papers web template you purchase is your own property forever. You might have acces to each kind you acquired within your acccount. Select the My Forms section and choose a kind to printing or download again.

Compete and download, and printing the Puerto Rico Payroll Deduction Authorization Form with US Legal Forms. There are thousands of skilled and status-certain forms you can use to your organization or personal requires.

Form popularity

FAQ

The current tax rate for Social Security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

The amount the employer withholds from an employee's gross pay for taxes, wage garnishment and company benefits are called payroll deductions. Some examples include 401(k) contributions, Medicare and Social Security tax, income tax and health insurance premiums.

Authorized deductions are limited to: deductions which the employer is required to withhold by law or court order; deductions for the reasonable cost of board, lodging, and facilities furnished to the employee; and.

Mandatory Payroll Tax DeductionsFederal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding. Local tax withholdings such as city or county taxes, state disability or unemployment insurance.

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

Every entity engaged in business in Puerto Rico must obtain a federal Employer Identification Number (EIN) from the U.S. Internal Revenue Service (IRS) by filing Form SS-4. Upon obtaining an EIN, the entity must file a copy of the certificate of incorporation, and a copy of Form SS-4 at the P.R. Department of Treasury.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Register for a withholding tax account through the Puerto Rico Department of the Treasury. Employers need to complete the application form SC4809 Information of Identification Number Organizations (Employers) (this form is in both Spanish and English and does contain instructions).

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.