Puerto Rico Exempt Survey

Description

How to fill out Exempt Survey?

You may spend several hours online searching for the proper legal format that satisfies the state and federal standards you need.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

It is straightforward to obtain or print the Puerto Rico Exempt Survey from the service.

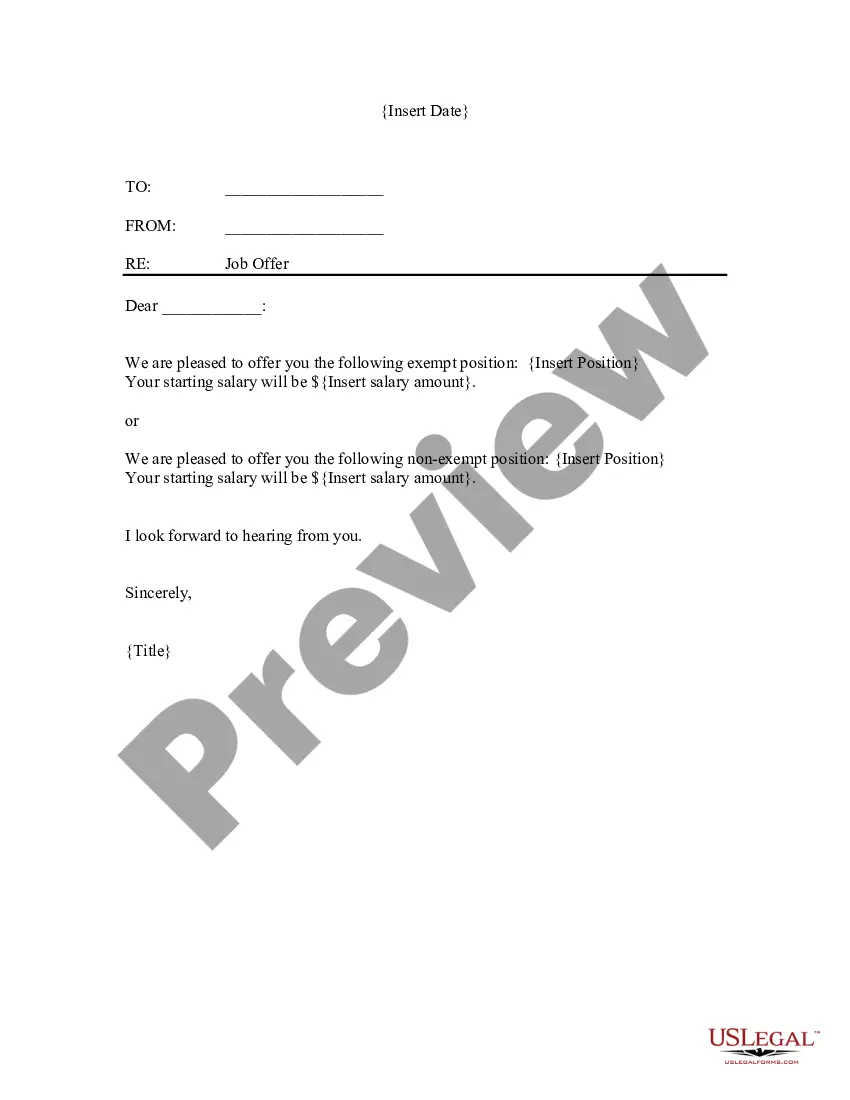

If available, use the Preview button to view the format as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Puerto Rico Exempt Survey.

- Every legal format you acquire is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate format for the state/region of your choice.

- Review the form details to confirm you have picked the correct one.

Form popularity

FAQ

Puerto Rico is an unincorporated territory of the United States and Puerto Ricans are U.S. citizens; however, Puerto Rico is not a U.S. state, but a U.S. insular area. Consequently, while all Puerto Rico residents pay federal taxes, many residents are not required to pay federal income taxes.

There's a special exception that will allow you to use the Puerto Rico tax benefits immediately upon moving there in certain circumstances, but this exception requires you to live in Puerto Rico for at least 3 years. Then, the capital gain must be Puerto Rican source capital gain.

More In File An individual who has income from American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), Guam, Puerto Rico or the U.S. Virgin Islands will usually have to file a tax return with the tax department of one of these territories.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

Puerto Rico is a US territory and not a state, so its residents don't pay federal income tax unless they work for the US government. Even so, workers there pay the majority of federal taxes that Americans on the mainland pay payroll taxes, social security taxes, business taxes, gift taxes, estate taxes and so on.

Well, here is where you must pay close attention. U.S. citizens who have lived all year on the island are exempt from filing taxes to the federal government of the United States as long as all of your income was from Puerto Rican sources only.

Travelers are required to complete the online Request for Room Tax Exemption through Puerto Rico's Tourism Bureau. Once the form is approved, the traveler will be provided a tax exemption letter that must be provided to the hotel.

Puerto Rico Income SourceAn active Act 20 Company with a 100% Puerto Rico resident shareholders ownership is are NOT subject to GILTI, an estimated effective tax of 4%.

Puerto Rico holds a unique position as an unincorporated U.S. territory. Under Internal Revenue Code (IRC) §933, Puerto Rico source income is excluded from U.S. federal tax.

Further, Resident Individuals must apply for and obtain a tax exemption decree under Act 60. To obtain access to the approved and signed tax exemption decree, a one-time fee of $5,000 must be satisfied and deposited into a special fund to promote the relocation of Resident Individuals to Puerto Rico.