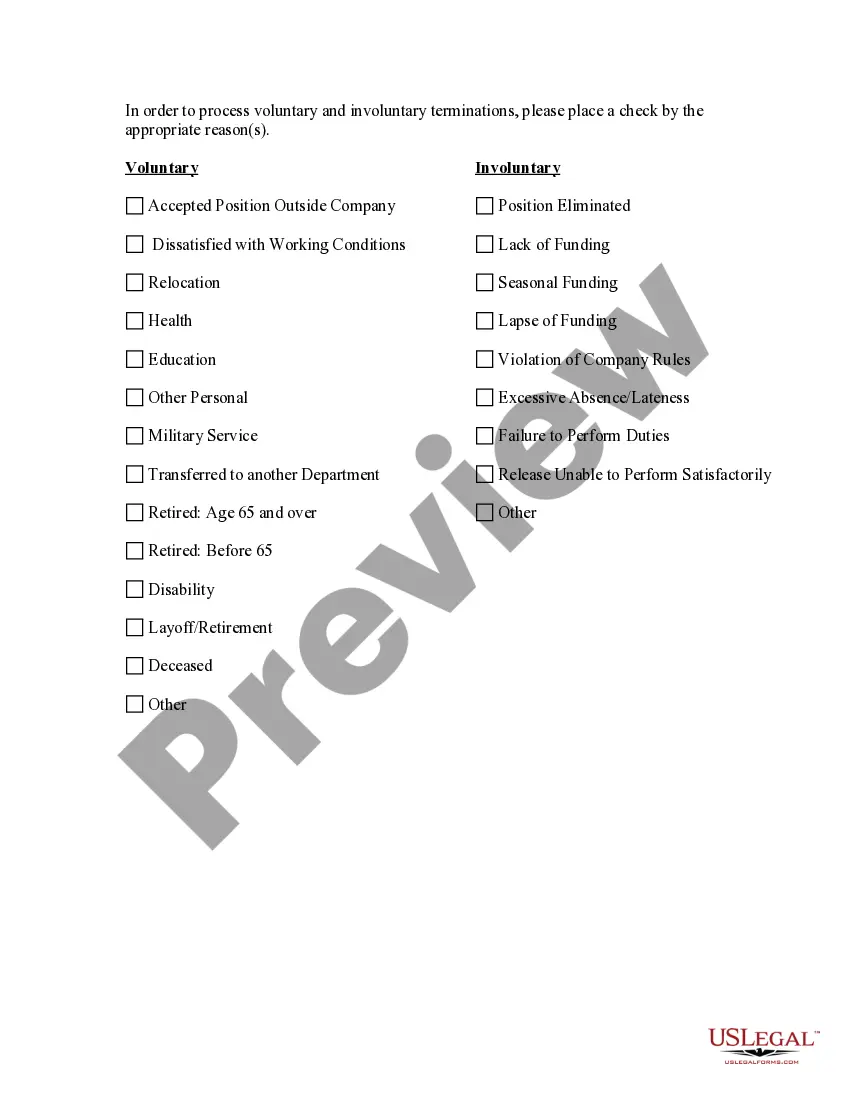

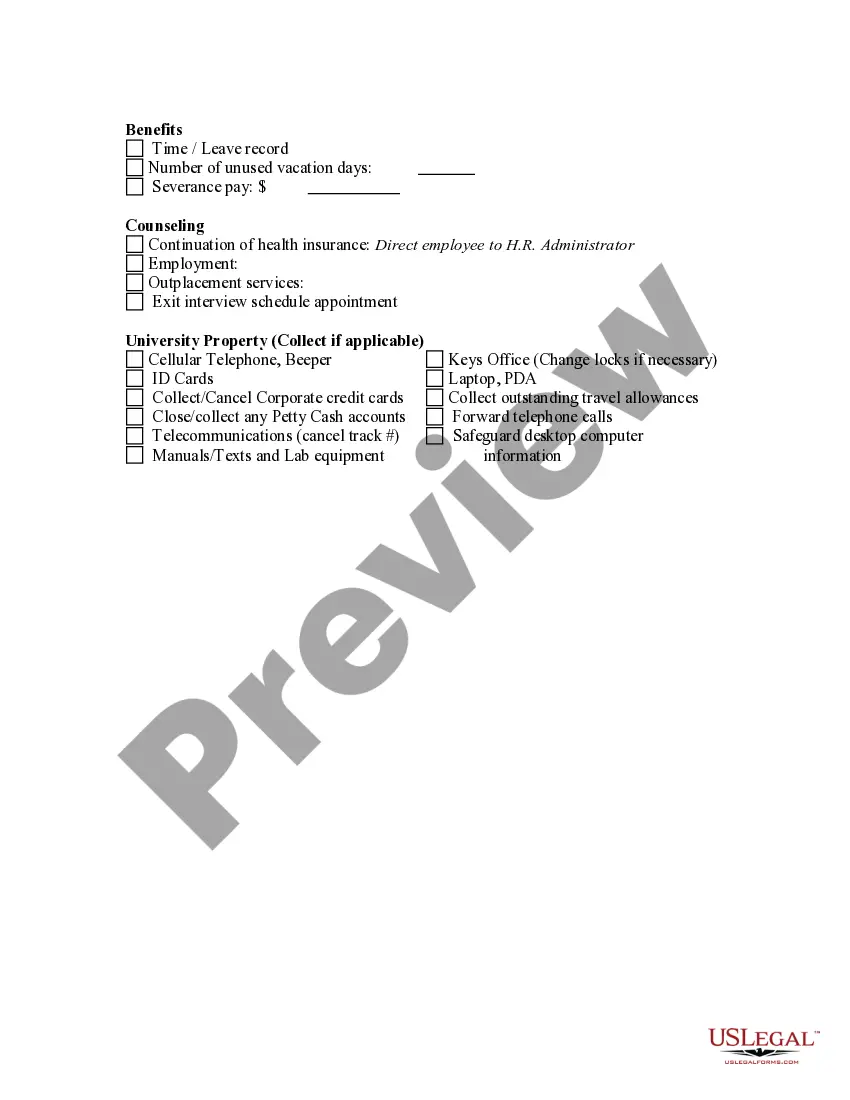

Puerto Rico Exit — Termination Checklist is a comprehensive guide that outlines the necessary procedures and steps for individuals or businesses planning to terminate their operations or exit from Puerto Rico. This checklist serves as an invaluable resource for ensuring a smooth and orderly termination process, while also addressing a range of legal, financial, and operational considerations. The Puerto Rico Exit — Termination Checklist can vary depending on the specific circumstances and reasons for termination. Here are a few different types of termination checklists in Puerto Rico: 1. Business Termination Checklist: This checklist addresses the process of winding down and terminating a business in Puerto Rico. It covers areas such as canceling licenses and permits, settling outstanding debts, notifying employees and customers, and complying with tax and regulatory requirements. 2. Employment Termination Checklist: Designed for employers terminating their workforce in Puerto Rico, this checklist includes steps such as finalizing payroll and employee benefits, conducting exit interviews, providing required notices, and ensuring compliance with labor laws. 3. Real Estate Termination Checklist: For individuals or businesses terminating their real estate leases, this checklist covers tasks such as notifying landlords, organizing property inspections, settling outstanding rent payments, and terminating utility and service contracts. 4. Tax Termination Checklist: This checklist is specifically tailored for individuals or businesses looking to terminate their tax obligations in Puerto Rico. It includes actions like filing final tax returns, settling tax liabilities, canceling tax registrations, and obtaining tax clearance or termination certifications. 5. Expat Termination Checklist: Geared towards expatriates or individuals moving out of Puerto Rico, this checklist encompasses tasks such as terminating residency status, closing local bank accounts, canceling local services, and ensuring compliance with immigration laws and regulations. In conclusion, the Puerto Rico Exit — Termination Checklist provides a comprehensive framework for individuals or businesses exiting Puerto Rico. By following this checklist, users can ensure a smooth and efficient termination process while complying with legal, financial, and operational requirements relevant to their specific circumstances.

Puerto Rico Exit - Termination Checklist

Description

How to fill out Puerto Rico Exit - Termination Checklist?

You can devote time on the Internet looking for the lawful file web template that suits the state and federal specifications you will need. US Legal Forms supplies a huge number of lawful kinds that happen to be analyzed by pros. It is simple to down load or printing the Puerto Rico Exit - Termination Checklist from the assistance.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Down load option. Next, it is possible to comprehensive, change, printing, or indication the Puerto Rico Exit - Termination Checklist. Each lawful file web template you buy is your own property permanently. To obtain an additional backup of the bought kind, check out the My Forms tab and then click the related option.

If you work with the US Legal Forms internet site for the first time, follow the basic instructions under:

- First, make certain you have selected the proper file web template for your state/city of your choosing. Read the kind description to ensure you have chosen the correct kind. If offered, utilize the Preview option to look through the file web template too.

- In order to discover an additional variation of the kind, utilize the Lookup field to find the web template that meets your needs and specifications.

- Once you have located the web template you would like, simply click Get now to proceed.

- Find the pricing plan you would like, type in your qualifications, and register for a merchant account on US Legal Forms.

- Total the transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the lawful kind.

- Find the formatting of the file and down load it in your system.

- Make alterations in your file if needed. You can comprehensive, change and indication and printing Puerto Rico Exit - Termination Checklist.

Down load and printing a huge number of file layouts making use of the US Legal Forms website, which provides the most important collection of lawful kinds. Use specialist and state-certain layouts to deal with your business or personal requires.