Puerto Rico Company Property Checklist

Description

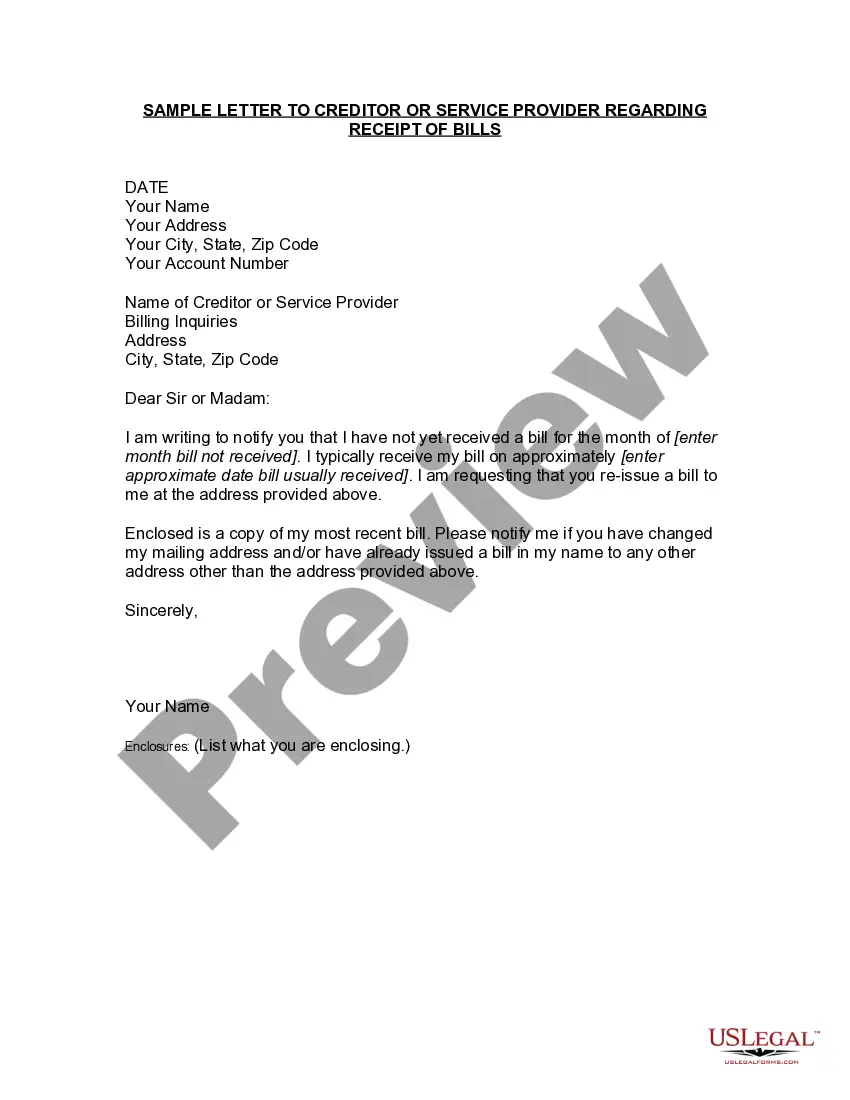

How to fill out Company Property Checklist?

You might spend time online attempting to locate the legal document template that satisfies the state and federal standards you require.

US Legal Forms offers a vast array of legal documents that can be assessed by experts.

You can easily download or print the Puerto Rico Company Property Checklist from the service.

To obtain an additional version of the form, use the Search field to find the template that meets your needs and specifications.

- If you already have a US Legal Forms account, you can Log In and hit the Download button.

- Then, you can fill out, modify, print, or sign the Puerto Rico Company Property Checklist.

- Every legal document template you download is yours permanently.

- To acquire another copy of any purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/town of your choice.

- Review the form details to ensure you have chosen the right form.

Form popularity

FAQ

Annual reports must be filed electronically by accessing the Department of State website at . A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

Filing and forming an LLC in Puerto Rico requires a $250 filing fee. Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

Foreign corporations (including US corporations) desiring to operate in PR must request a certificate of authorization to do business in PR by filing an application at the PR State Department.

Limited liability companies (LLCs) are generally taxed as corporations. Accordingly if an LLC is organized under the laws of Puerto Rico it is taxed as a domestic corporation and if organized under the laws of any other country, including the United States, it is taxed as a foreign corporation.

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

Under General Corporation Law, a foreign corporation or a limited liability company must register with the State Department of Puerto Rico before conducting business locally.

To register a foreign LLC in Puerto Rico, you must file a Puerto Rico Certificate of Authorization for Doing Business in Puerto Rico with the Puerto Rico Department of State. You can submit this document by mail or online. The Certificate of Authorization costs $150 to file by mail and $250 to file online.

Under General Corporation Law, a foreign corporation or a limited liability company must register with the State Department of Puerto Rico before conducting business locally.