Puerto Rico Startup Package

Description

How to fill out Startup Package?

US Legal Forms - one of the greatest libraries of lawful types in the United States - gives a wide array of lawful record templates it is possible to obtain or print. Using the internet site, you can find thousands of types for enterprise and individual functions, categorized by types, claims, or key phrases.You can find the most recent types of types just like the Puerto Rico Startup Package in seconds.

If you already possess a registration, log in and obtain Puerto Rico Startup Package from the US Legal Forms local library. The Download key can look on every single kind you perspective. You gain access to all formerly saved types from the My Forms tab of your account.

In order to use US Legal Forms initially, here are straightforward guidelines to obtain started:

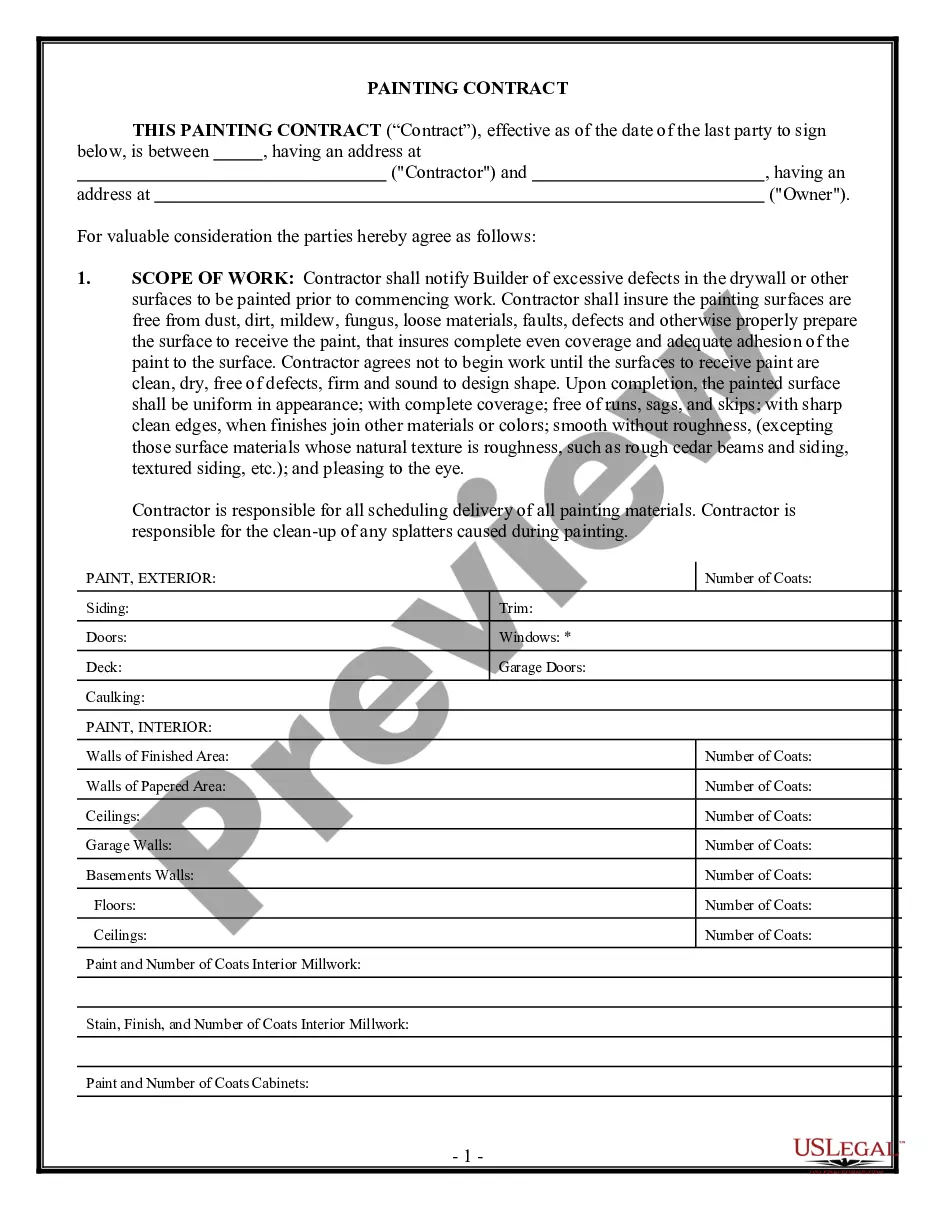

- Be sure you have picked out the proper kind for the metropolis/area. Select the Review key to examine the form`s content. See the kind description to ensure that you have chosen the appropriate kind.

- In the event the kind doesn`t fit your requirements, take advantage of the Research field at the top of the display screen to discover the one that does.

- When you are happy with the shape, affirm your choice by simply clicking the Purchase now key. Then, pick the costs plan you prefer and offer your qualifications to sign up to have an account.

- Approach the transaction. Use your charge card or PayPal account to finish the transaction.

- Find the formatting and obtain the shape in your gadget.

- Make adjustments. Load, modify and print and indicator the saved Puerto Rico Startup Package.

Each web template you added to your account does not have an expiry day and it is your own property eternally. So, in order to obtain or print yet another duplicate, just go to the My Forms segment and click on on the kind you require.

Obtain access to the Puerto Rico Startup Package with US Legal Forms, one of the most comprehensive local library of lawful record templates. Use thousands of professional and condition-particular templates that fulfill your small business or individual demands and requirements.

Form popularity

FAQ

Business name and registration Register your business name with the local government where your business is located. If you are a corporation, you will also need to register with the Department of State in Puerto Rico, or with the Department of Corporations and Trademarks in the U.S. Virgin Islands.

Puerto Rico offers many benefits, especially for citizens and businesses of the United States. Between the cost of living, tax rates, and other incentives, there are many good reasons for doing business in Puerto Rico. Doing Business in Puerto Rico - bMedia bmediagroup.com ? news ? doing-business-i... bmediagroup.com ? news ? doing-business-i...

Ready to Start a Business in Puerto Rico? Pick a Business Structure. Name Your Business. File Formation Paperwork. Draft Internal Records. Get Puerto Rico Business Licenses. Get Business Insurance. File a Puerto Rico Annual Report. Build Your Business Website. How to Start a Business in Puerto Rico - Northwest Registered Agent northwestregisteredagent.com ? puerto-rico northwestregisteredagent.com ? puerto-rico

If your LLC is taxed as a Puerto Rico corporation, you'll need to pay corporate income tax. Puerto Rico's corporate tax rate is 37.5%. However, under the Puerto Rico Incentives Code (Act 60), businesses based in Puerto Rico only need to pay a 4% corporate income tax on goods and services exported from the commonwealth.

A domestic corporation is taxable in Puerto Rico on its worldwide income. A foreign corporation engaged in trade or business in Puerto Rico is taxed at the regular corporate tax rates on income from Puerto Rico sources that is effectively connected income.

Talk to the people you know and the people they know. ask about pains, listen, validate your idea. you're not selling, you're learning. get ahold of the pains. expand your network with other business owners and investors. ask for introductions. 6 foolproof ways to get your startup its first 100 customers - Salesflare Blog salesflare.com ? startup-first-100-customers salesflare.com ? startup-first-100-customers

Puerto Rico residents generally do not pay federal income taxes, but they do pay taxes to the Puerto Rico government. And Puerto Rico keeps those taxes low for certain businesses and individuals. Under the Act 60 Export Services Tax Incentive, a qualified business enjoys a corporate tax rate of only 4%.

A foreign corporation may be engaged in trade or business in Puerto Rico as a division or branch of that foreign corporation, or as a separate corporation or subsidiary. Doing business in Puerto Rico - Kevane Grant Thornton grantthornton.pr ? puerto-rico ? publications grantthornton.pr ? puerto-rico ? publications