Puerto Rico Company Property Agreement

Description

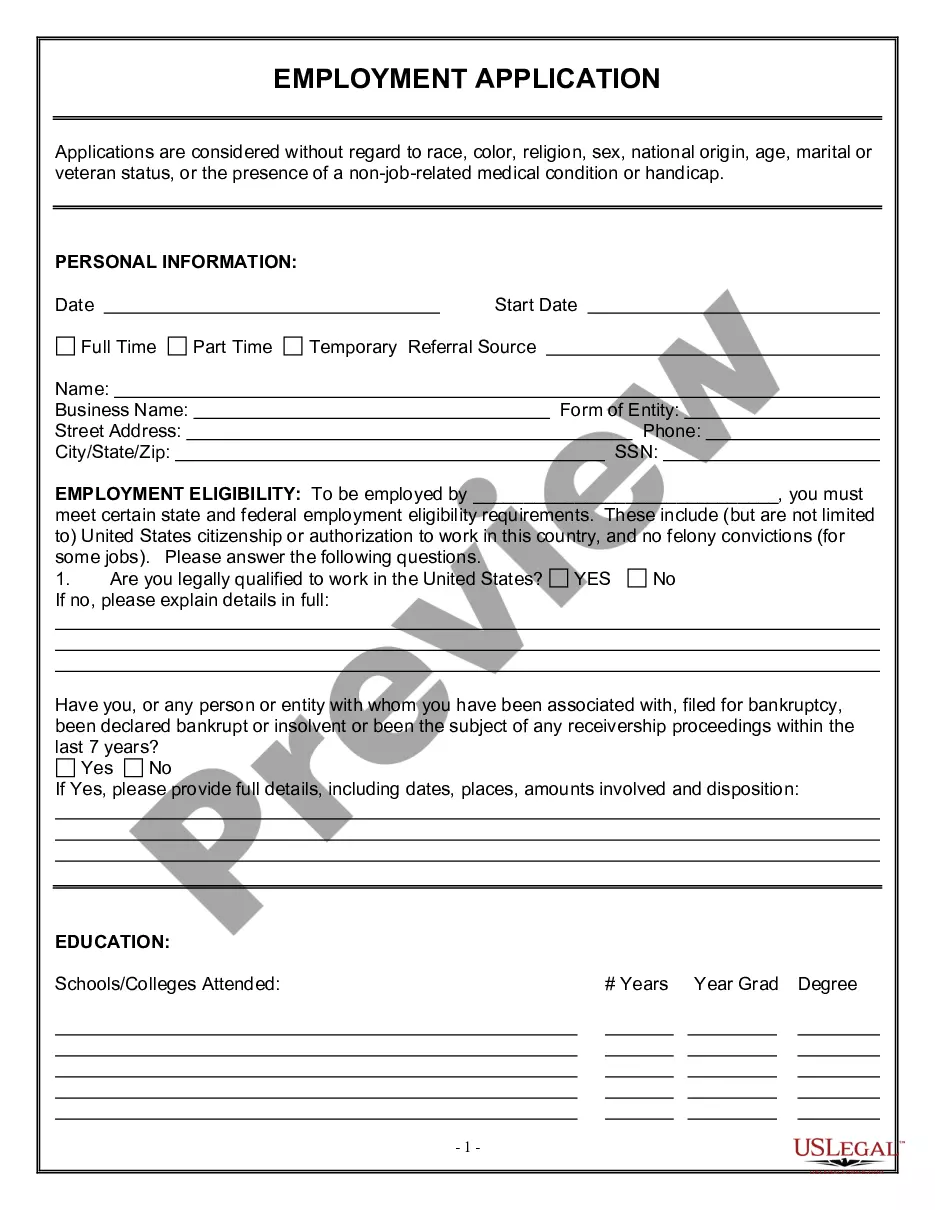

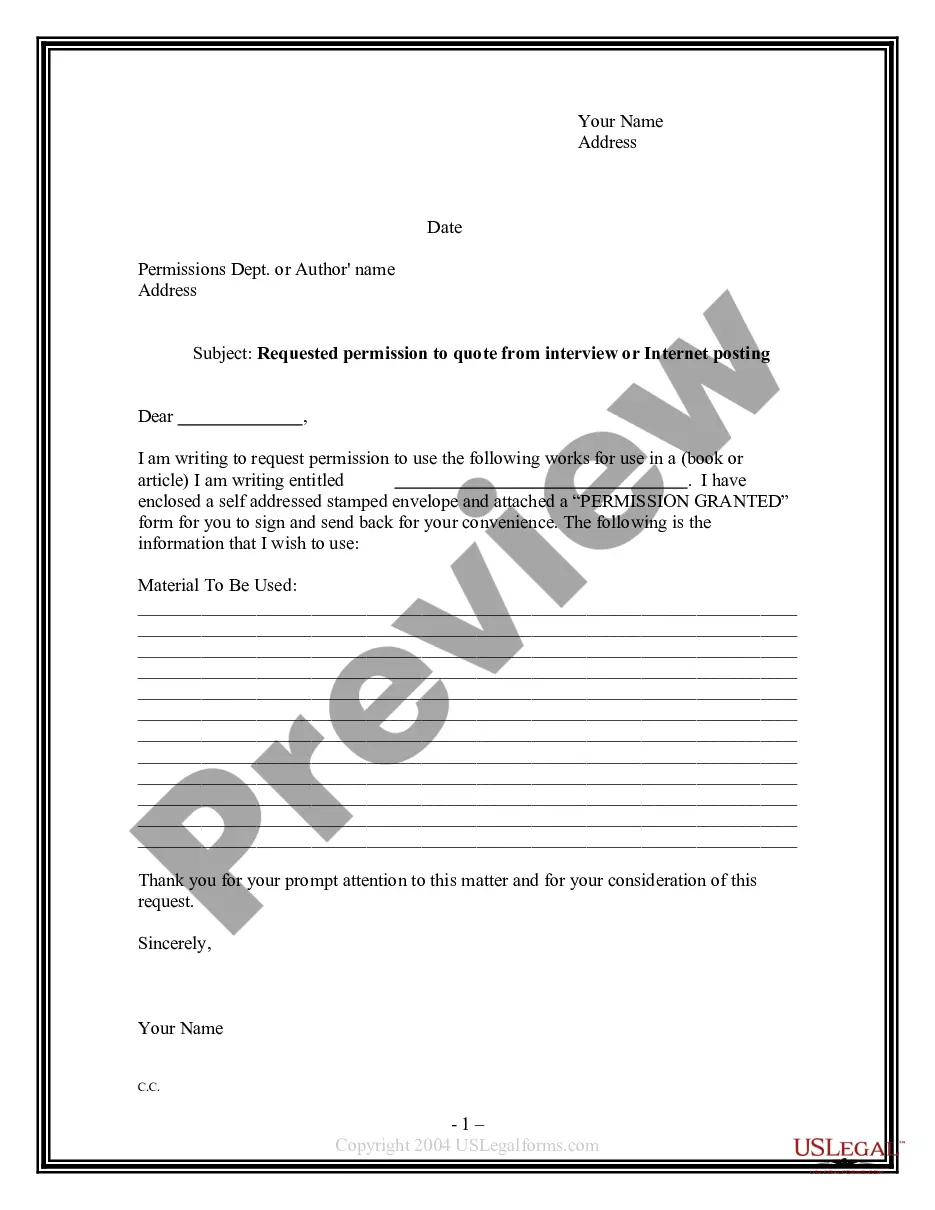

How to fill out Company Property Agreement?

Selecting the appropriate legitimate document template can be challenging.

Obviously, there are numerous templates accessible online, but how can you find the authentic form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Puerto Rico Company Property Agreement, suitable for both business and personal use.

You can examine the document using the Review option and view the document description to verify it is the correct one for you.

- All the documents are verified by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and click on the Download button to access the Puerto Rico Company Property Agreement.

- Use your account to review the legal documents you have previously acquired.

- Go to the My documents section of your account to retrieve an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Puerto Rico corporations are treated as foreign corporations for U.S. income tax purposes.

Under General Corporation Law, a foreign corporation or a limited liability company must register with the State Department of Puerto Rico before conducting business locally.

Puerto Rican trade is facilitated by the island's inclusion in the U.S. Customs system, and Puerto Rico's most important trading partner, by far, is the United States. The island also carries on significant trade with Singapore, Japan, Brazil, and Ireland and other European countries.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico. For stateside employers, that is the easy part.

Puerto Rico offers businesses the security and stability to operate in a US jurisdiction, while providing an unmatched variety of tax incentives that make it an attractive destination for businesses, large and small.

Commonwealth taxesAll federal employees, those who do business with the federal government, Puerto Rico-based corporations that intend to send funds to the US, and some others also pay federal income taxes (for example, Puerto Rico residents who earned income from sources outside Puerto Rico.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

This means that if someone dies owning property in Puerto Rico, in order to transfer that property to another person, you must go to court to get the permission to transfer and register the property to the new person. This is what is commonly known in the U.S. as probating an estate.

A U.S. company that wishes to do business in Puerto Rico may choose to either form a new subsidiary entity or register an existing company. In order to determine the best option, the company should consult an attorney familiar with tax laws and the company's business activities and structure.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.