Puerto Rico Employee Evaluation Form for Labourer

Description

How to fill out Puerto Rico Employee Evaluation Form For Labourer?

You are able to devote time on the web attempting to find the legitimate document format that meets the state and federal specifications you want. US Legal Forms supplies 1000s of legitimate forms which are reviewed by specialists. You can easily acquire or produce the Puerto Rico Employee Evaluation Form for Labourer from our assistance.

If you already possess a US Legal Forms bank account, you may log in and click on the Download option. After that, you may complete, modify, produce, or sign the Puerto Rico Employee Evaluation Form for Labourer. Every single legitimate document format you get is yours for a long time. To obtain one more version associated with a bought develop, proceed to the My Forms tab and click on the related option.

If you work with the US Legal Forms internet site for the first time, follow the easy guidelines beneath:

- Initial, make certain you have selected the correct document format for your county/metropolis that you pick. See the develop description to make sure you have chosen the appropriate develop. If readily available, use the Review option to search through the document format also.

- If you would like discover one more variation in the develop, use the Look for area to find the format that fits your needs and specifications.

- After you have found the format you want, click Purchase now to proceed.

- Find the pricing prepare you want, key in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your Visa or Mastercard or PayPal bank account to fund the legitimate develop.

- Find the file format in the document and acquire it in your product.

- Make changes in your document if required. You are able to complete, modify and sign and produce Puerto Rico Employee Evaluation Form for Labourer.

Download and produce 1000s of document themes utilizing the US Legal Forms site, which provides the most important selection of legitimate forms. Use professional and express-particular themes to deal with your company or individual demands.

Form popularity

FAQ

Puerto RicoRegister your business name and file articles of incorporation.File for local bank accounts.Learn and keep track of the local employment laws.Set up local payroll.Hire local accounting, legal, and HR people.

An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory. Employers with a workforce in excess of 21 employees must by law pay a 13th-month salary in December equating to 2% of the employees' wages or not more than 600 USD.

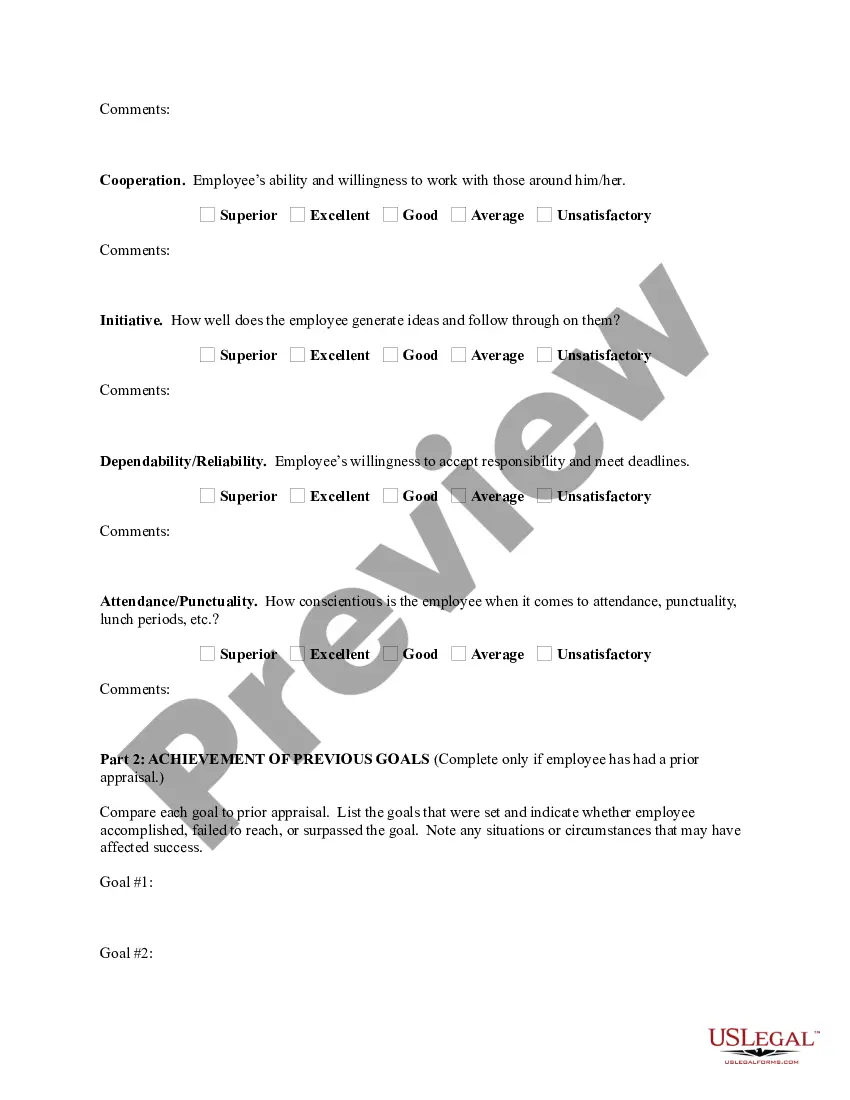

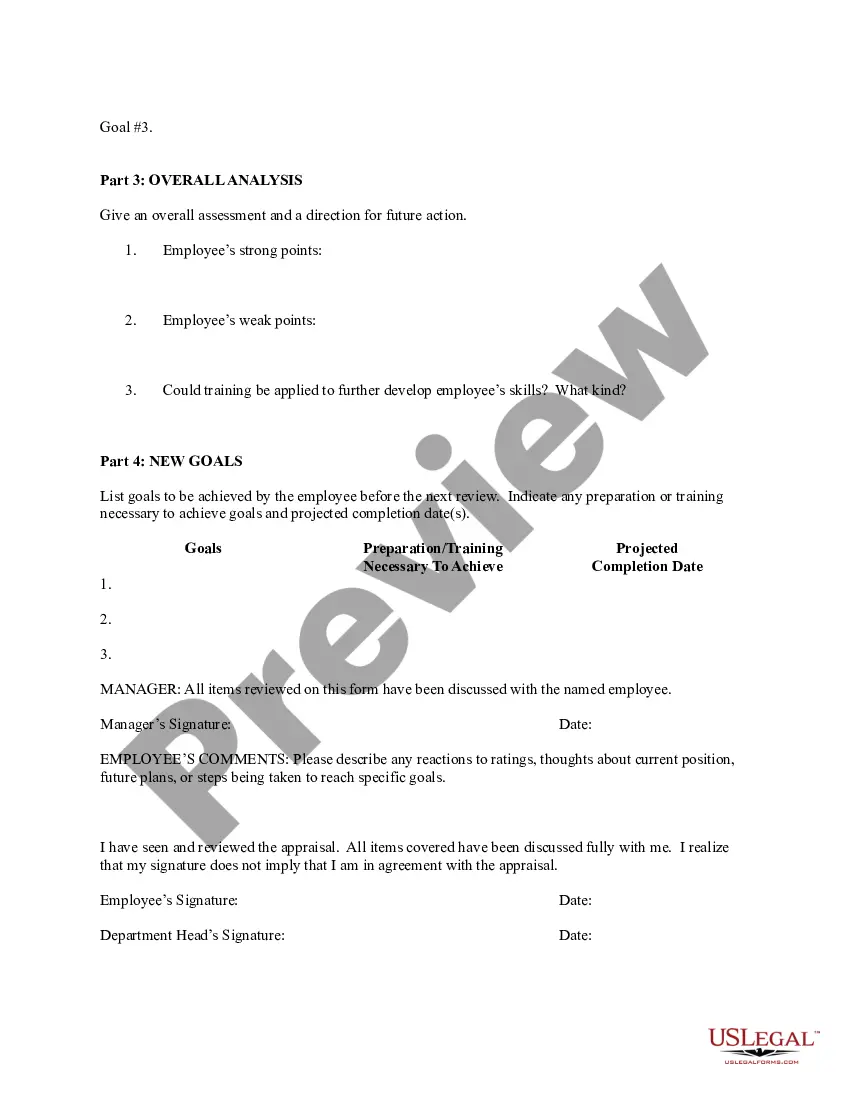

The form should include clear guidelines and instructions to allow managers and employees to know exactly what information to provide, the meaning of the ratings, and how to get the information they need. When designing your evaluation form, consider your primary purpose for conducting performance reviews.

What to Include in an Employee Evaluation Form?Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.More items...?

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

What to Include in an Employee Evaluation Form?Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.More items...?

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Hours & Pay Regulations. The regular work shift for non-exempt employees is 8 hours per day and a regular workweek of 40 hours per week.

According to Puerto Rico Act Number 379 of (Law No 379), which covers non-exempt (hourly) employees, eight hours of work constitutes a regular working day in Puerto Rico and 40 hours of work constitutes a workweek. Working hours exceeding these minimums must be compensated as overtime.

Domestic workers, government employees, and white-collar executive, professional, or administrative workers are all completely exempt from overtime pay under Puerto Rico law.