Puerto Rico Employee Evaluation Form for Nurse

Description

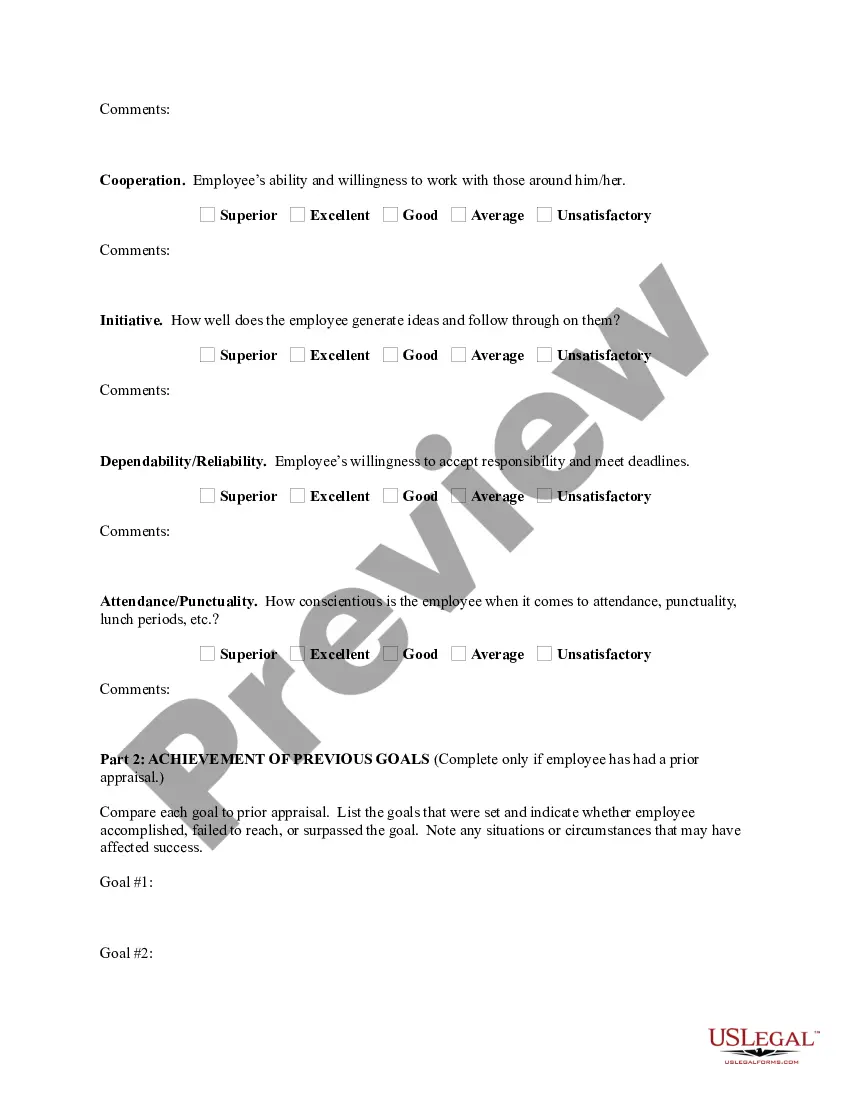

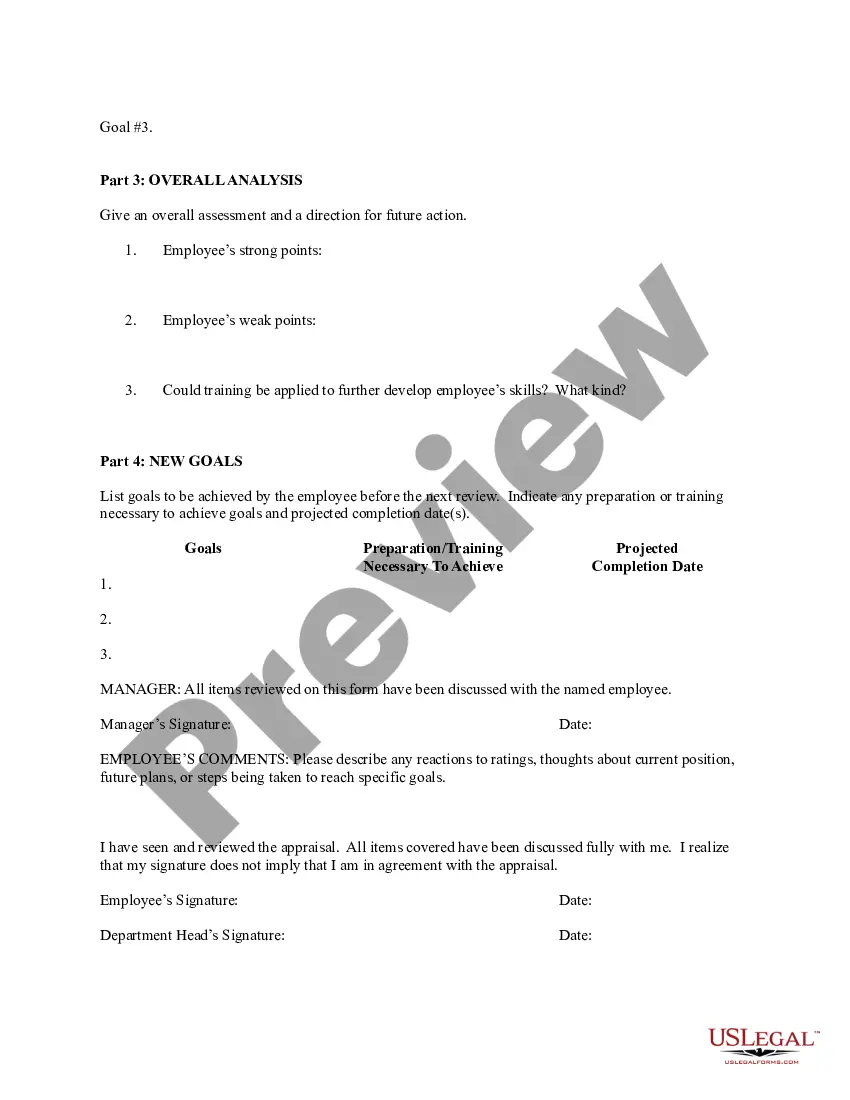

How to fill out Puerto Rico Employee Evaluation Form For Nurse?

Choosing the best legitimate record web template can be quite a have difficulties. Of course, there are plenty of themes available online, but how will you get the legitimate form you need? Utilize the US Legal Forms website. The service offers 1000s of themes, including the Puerto Rico Employee Evaluation Form for Nurse, which can be used for company and private requirements. Each of the forms are checked by experts and meet federal and state requirements.

Should you be previously registered, log in to the accounts and then click the Download switch to find the Puerto Rico Employee Evaluation Form for Nurse. Make use of your accounts to appear through the legitimate forms you may have ordered previously. Proceed to the My Forms tab of your respective accounts and get one more copy of the record you need.

Should you be a brand new consumer of US Legal Forms, listed here are basic guidelines that you can adhere to:

- Initially, be sure you have selected the proper form for the town/area. You can look through the shape while using Review switch and study the shape information to make certain this is basically the best for you.

- In case the form will not meet your requirements, utilize the Seach industry to find the appropriate form.

- When you are certain the shape would work, go through the Purchase now switch to find the form.

- Opt for the prices plan you desire and type in the necessary information. Design your accounts and pay money for the order utilizing your PayPal accounts or charge card.

- Select the document format and acquire the legitimate record web template to the gadget.

- Complete, modify and print and sign the attained Puerto Rico Employee Evaluation Form for Nurse.

US Legal Forms may be the most significant library of legitimate forms in which you can see numerous record themes. Utilize the company to acquire appropriately-manufactured paperwork that adhere to state requirements.

Form popularity

FAQ

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

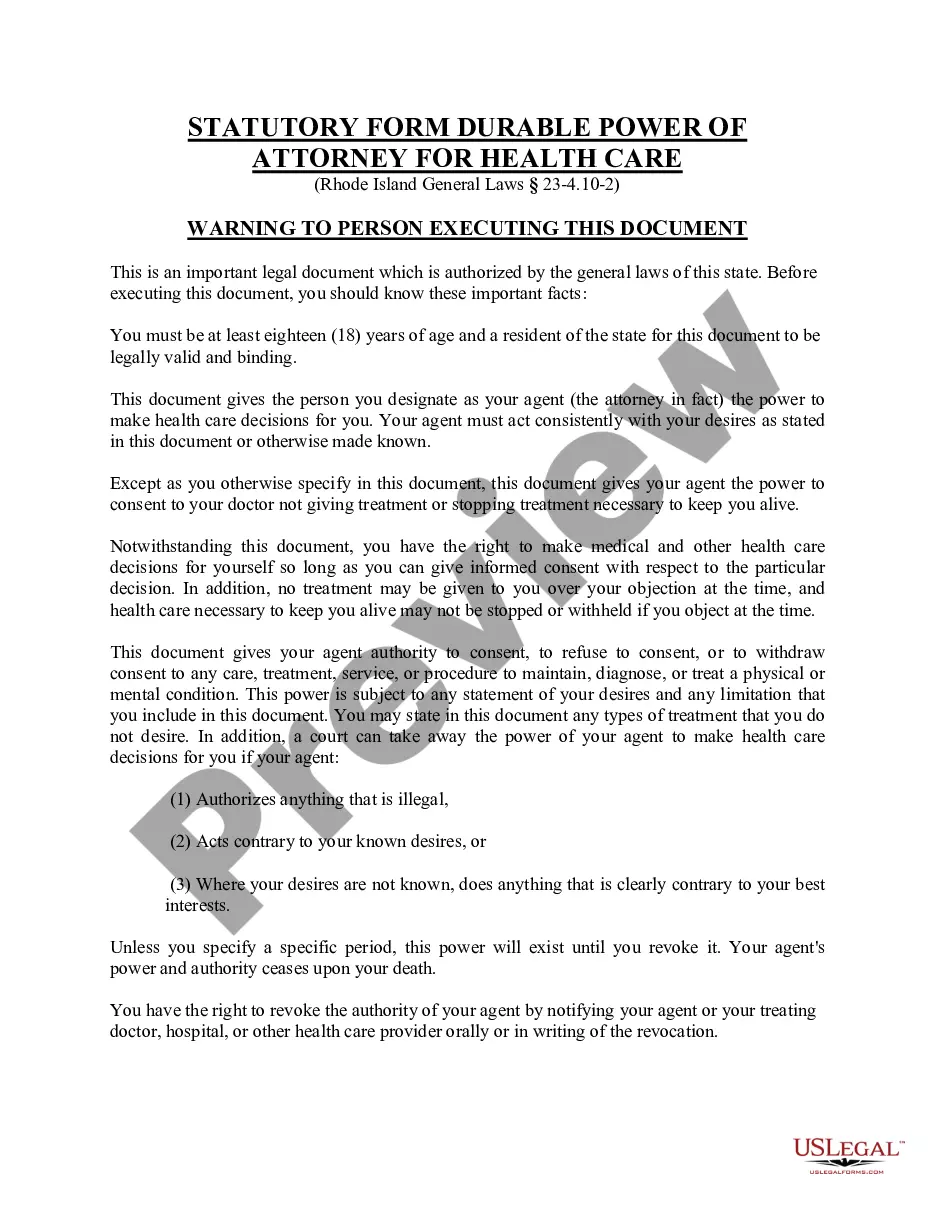

The Puerto Rico Board of Nursing licenses registered nurses and practical nurses. Nurses planning to work in Puerto Rico must apply to the Board of Nursing for licensure. Puerto Rico is not a Nurse Licensure Compact jurisdiction.

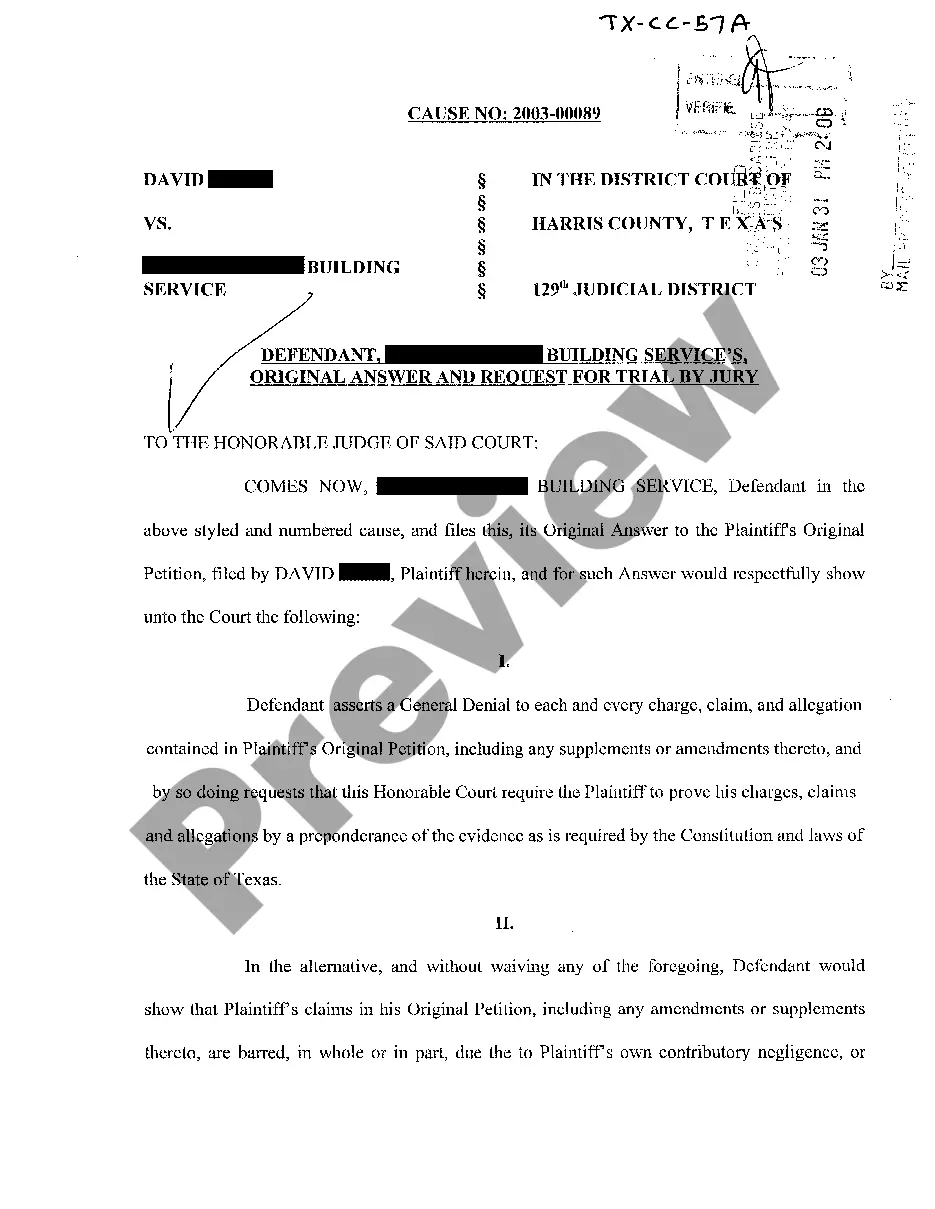

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

As an unincorporated territory of the United States, US federal laws apply in Puerto Rico, including federal labour and employment laws. The Puerto Rico Constitution, multiple labour and employment statutory and regulatory provisions and court decisions also govern the employment relationship.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

For U.S. citizens, traveling to and working in Puerto Rico is like traveling to or working in another state. U.S. citizens only need a valid driver's license to travel to and work from Puerto Rico.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

In Puerto Rico, the payroll frequency is bi-weekly, monthly or semi-monthly. An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory.