The Puerto Rico Agreement and Plan of Reorganization and Liquidation executed by Niagara Share Corp. and Scudder Investment Trust is a comprehensive legal document outlining the terms and conditions for the reorganization and liquidation process in Puerto Rico. This agreement aims to provide a structured framework for the orderly disposition and distribution of assets and liabilities. Keywords: Puerto Rico Agreement and Plan of Reorganization and Liquidation, Niagara Share Corp., Scudder Investment Trust, reorganization, liquidation, assets, liabilities, legal document Under this agreement, there may be different types or variations, depending on the specific circumstances and objectives of Niagara Share Corp. and Scudder Investment Trust. Some possible types include the following: 1. Voluntary Reorganization: This type of agreement may be initiated by the companies themselves, with the aim of restructuring their assets and liabilities to enhance their financial stability and efficiency. It often involves a comprehensive analysis of the organization's operations, debt obligations, and potential for growth. 2. Court-Ordered Reorganization: In certain cases, a court may intervene and order a reorganization and liquidation process. This type of agreement is typically designed to protect the interests of creditors, shareholders, and other stakeholders, ensuring a fair and equitable distribution of assets. 3. Debt Restructuring: This type of agreement focuses primarily on the management and repayment of outstanding debts. It may involve renegotiating loan terms, interest rates, and repayment schedules to alleviate financial strain and allow for the orderly liquidation of assets to repay creditors. 4. Asset Liquidation: This type of agreement centers on the orderly disposition and sale of assets to generate cash and repay creditors. It may involve selling assets through auctions, private sales, or other means, aiming to maximize the value of assets while meeting legal requirements and obligations. Regardless of the specific type, the Puerto Rico Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust is a crucial legal instrument that outlines the rights, responsibilities, and procedures involved in the reorganization and liquidation process. It provides the necessary structure and guidelines for all parties involved to navigate the complex legal and financial landscape effectively.

Puerto Rico Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust

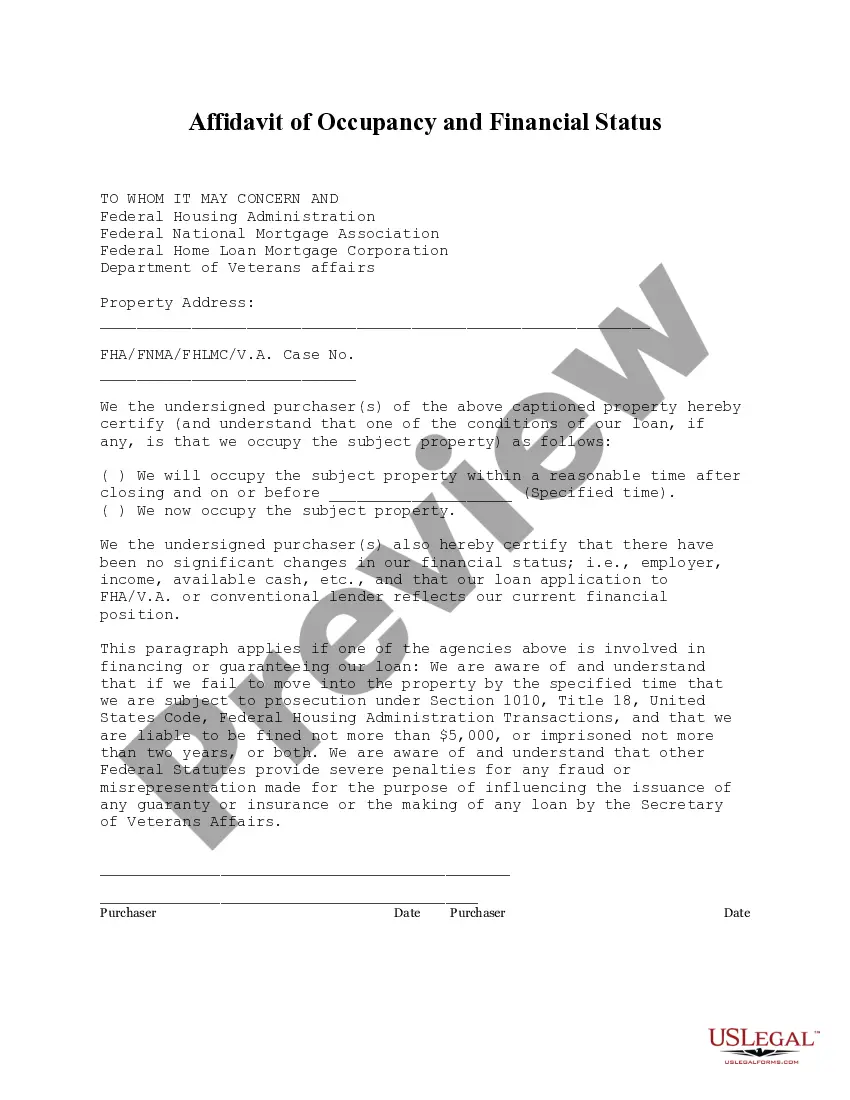

Description

How to fill out Puerto Rico Agreement And Plan Of Reorganization And Liquidation By Niagara Share Corp. And Scudder Investment Trust?

US Legal Forms - one of the greatest libraries of legitimate forms in the USA - offers a wide array of legitimate document web templates you may down load or print. Making use of the web site, you can get a large number of forms for enterprise and specific functions, sorted by classes, suggests, or key phrases.You will discover the latest models of forms like the Puerto Rico Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust within minutes.

If you already possess a registration, log in and down load Puerto Rico Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust through the US Legal Forms local library. The Down load button can look on every single kind you view. You have accessibility to all previously saved forms from the My Forms tab of your accounts.

In order to use US Legal Forms initially, allow me to share straightforward guidelines to get you started out:

- Make sure you have selected the correct kind for your personal area/region. Select the Review button to review the form`s content. Look at the kind information to ensure that you have chosen the appropriate kind.

- In the event the kind doesn`t suit your demands, utilize the Lookup field towards the top of the display to discover the one which does.

- If you are satisfied with the shape, validate your option by clicking on the Buy now button. Then, opt for the costs program you like and give your credentials to register on an accounts.

- Procedure the purchase. Use your charge card or PayPal accounts to accomplish the purchase.

- Find the file format and down load the shape in your gadget.

- Make modifications. Fill up, modify and print and signal the saved Puerto Rico Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust.

Each web template you included with your account does not have an expiry day and is also yours for a long time. So, if you want to down load or print yet another backup, just go to the My Forms segment and click in the kind you want.

Obtain access to the Puerto Rico Agreement and Plan of Reorganization and Liquidation by Niagara Share Corp. and Scudder Investment Trust with US Legal Forms, one of the most considerable local library of legitimate document web templates. Use a large number of skilled and express-distinct web templates that fulfill your business or specific requires and demands.