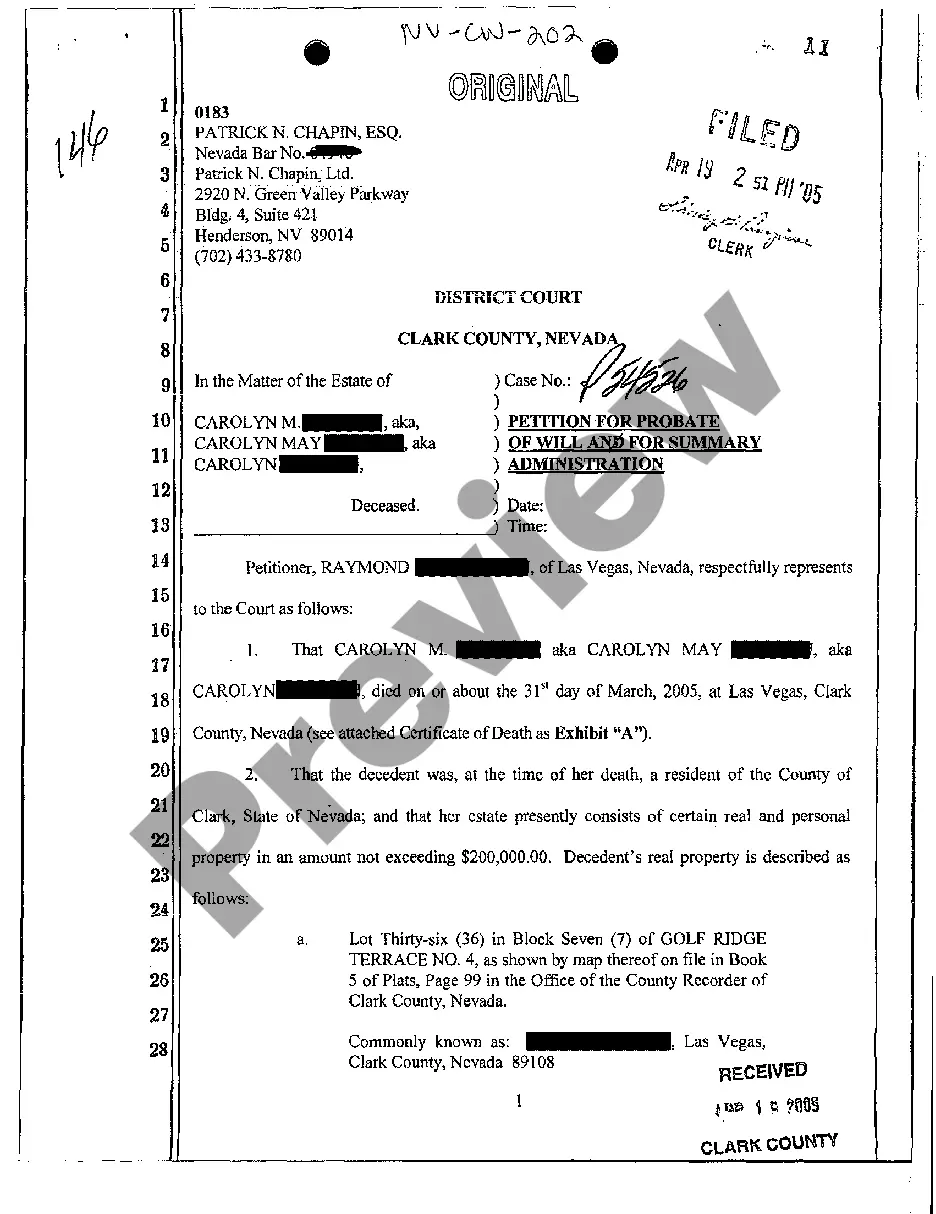

The Puerto Rico Agreement and Plan of Merger is a legally binding document that outlines the terms and conditions for the merger between Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank. This comprehensive agreement sets forth the details of the merger, including the steps to be taken, the timeline, and the financial considerations involved. The merger between these financial institutions aims to combine their resources, expertise, and customer bases to create a stronger and more competitive entity in the Puerto Rican banking industry. The Puerto Rico Agreement and Plan of Merger aims to ensure a smooth transition and integration of the involved entities, while maximizing benefits for shareholders, customers, and employees alike. This merger agreement includes provisions that detail the exchange ratio of shares, the treatment of outstanding stock options, and the composition of the board of directors for the merged entity. It also outlines the process for gaining the necessary regulatory approvals from local and national authorities. Key terms and clauses within the Puerto Rico Agreement and Plan of Merger may cover areas such as governance, management structure, operational integration, branding, technology consolidation, and target financial synergies. Furthermore, the agreement may address legal matters, such as the handling of any pending litigation, intellectual property rights, and compliance with applicable laws and regulations. Named variations of the Puerto Rico Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank may include the "Amended and Restated Agreement and Plan of Merger" or the "Supplemental Agreement to the Puerto Rico Agreement and Plan of Merger." Each named variation reflects specific updates, amendments, or additions made to the original agreement as circumstances require or to clarify certain provisions. Overall, the Puerto Rico Agreement and Plan of Merger serves as a comprehensive blueprint for the successful combination and integration of Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank, ensuring a seamless transition and solidifying their position in the Puerto Rican banking industry.

Puerto Rico Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank

Description

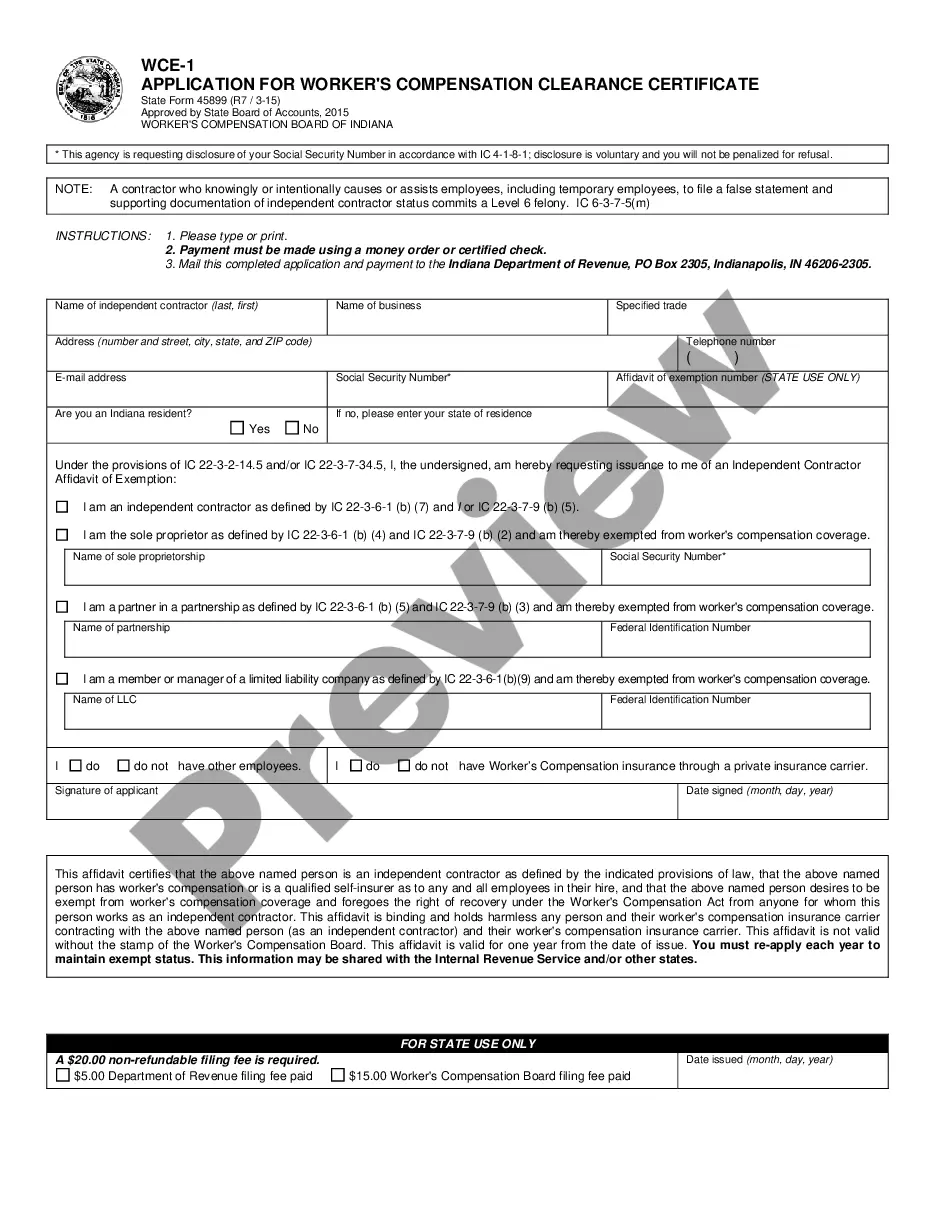

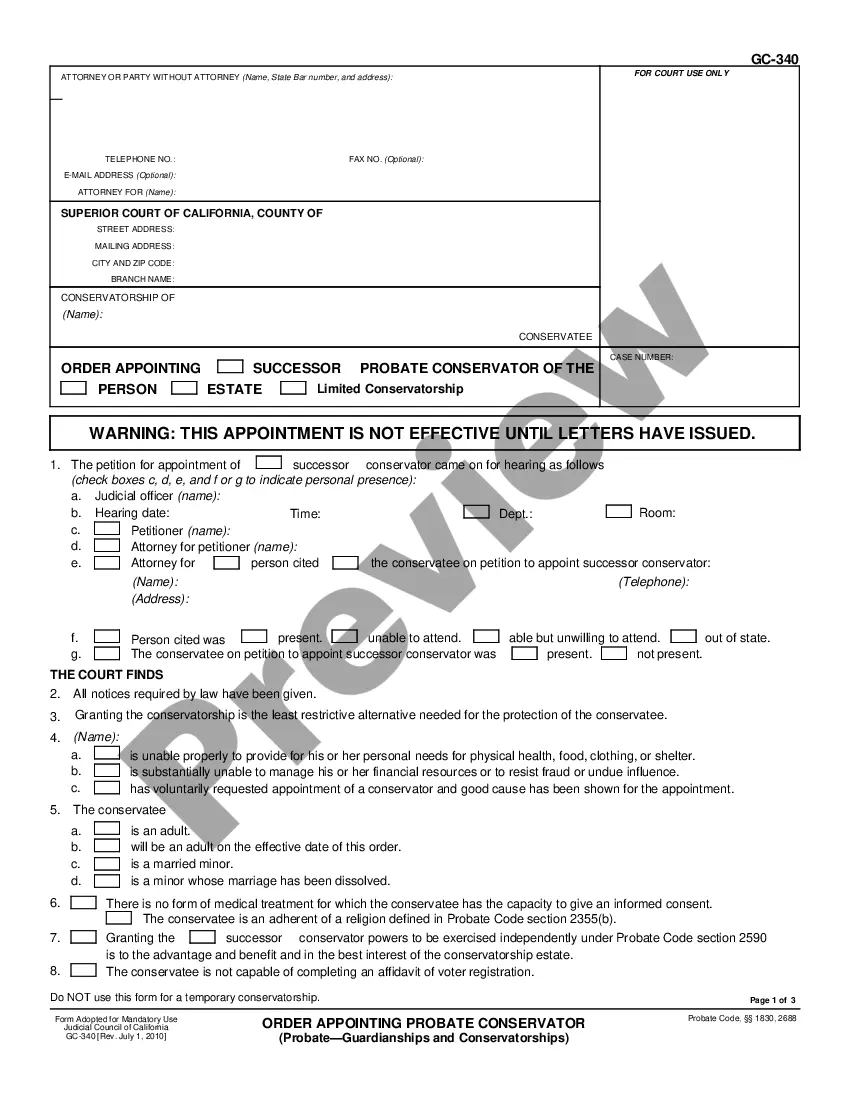

How to fill out Puerto Rico Agreement And Plan Of Merger By Cascade Financial, Cascade Bank, Amfirst Bancorporation, And American First National Bank?

If you wish to total, download, or print lawful document web templates, use US Legal Forms, the most important selection of lawful kinds, that can be found on the web. Use the site`s simple and practical research to find the paperwork you will need. Various web templates for enterprise and individual purposes are sorted by types and says, or keywords. Use US Legal Forms to find the Puerto Rico Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank in a number of clicks.

Should you be presently a US Legal Forms buyer, log in for your bank account and then click the Down load button to get the Puerto Rico Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank. Also you can gain access to kinds you in the past delivered electronically within the My Forms tab of your own bank account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the form to the correct metropolis/country.

- Step 2. Take advantage of the Review choice to check out the form`s information. Never forget about to see the information.

- Step 3. Should you be unsatisfied using the form, use the Research discipline on top of the monitor to locate other types of your lawful form web template.

- Step 4. When you have found the form you will need, click on the Purchase now button. Choose the prices strategy you choose and put your credentials to register for an bank account.

- Step 5. Process the purchase. You may use your Мisa or Ьastercard or PayPal bank account to perform the purchase.

- Step 6. Pick the structure of your lawful form and download it in your gadget.

- Step 7. Complete, change and print or sign the Puerto Rico Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank.

Each and every lawful document web template you buy is yours forever. You may have acces to each form you delivered electronically inside your acccount. Click on the My Forms section and select a form to print or download once more.

Compete and download, and print the Puerto Rico Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank with US Legal Forms. There are many professional and condition-certain kinds you can use for your personal enterprise or individual requires.