Puerto Rico Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co

Description

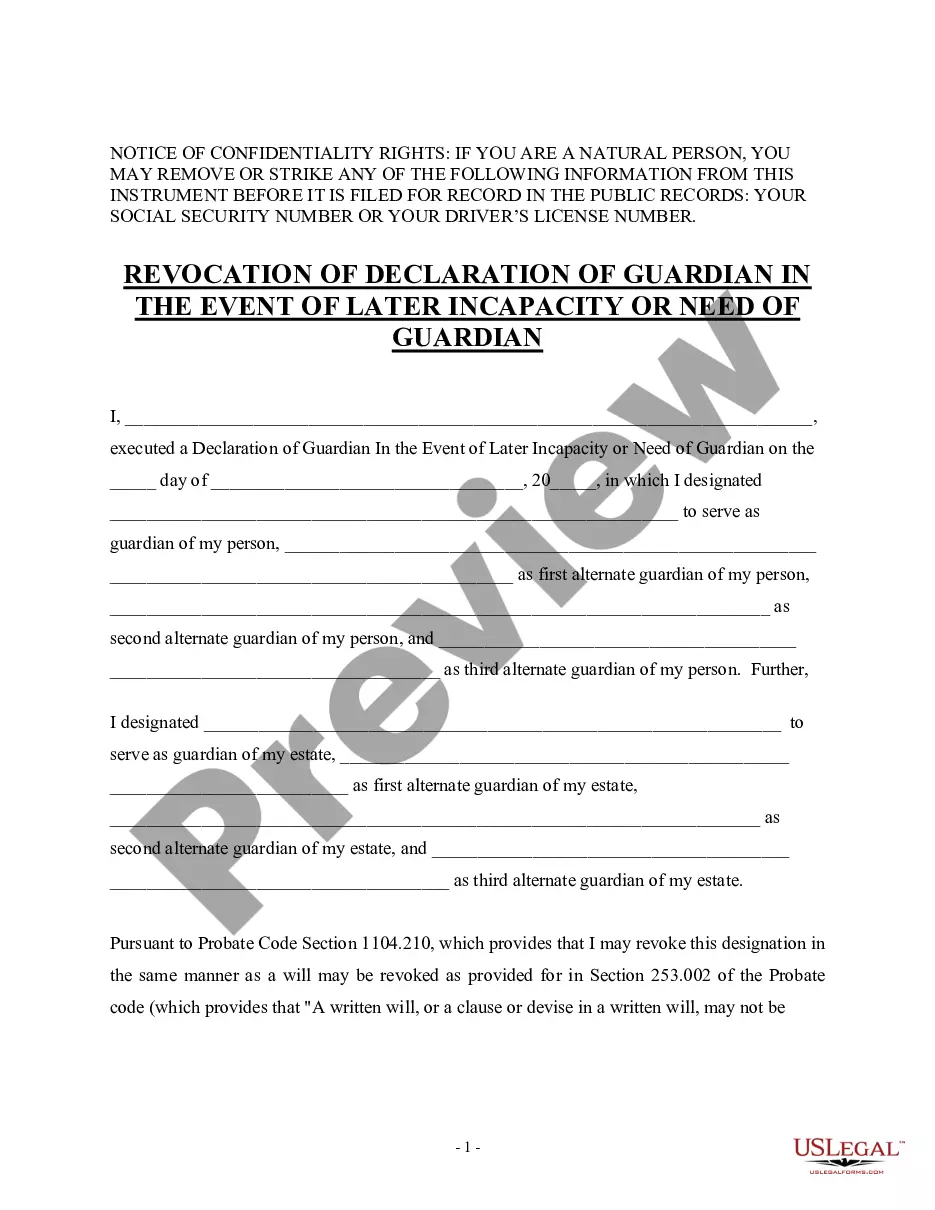

How to fill out Amended And Restated Agreement And Plan Of Merger Between CNL Financial Corp And Newco Merger Co?

If you wish to comprehensive, down load, or printing legal record themes, use US Legal Forms, the greatest variety of legal varieties, that can be found on the Internet. Make use of the site`s simple and convenient research to obtain the paperwork you need. A variety of themes for business and person reasons are categorized by categories and states, or search phrases. Use US Legal Forms to obtain the Puerto Rico Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co in just a few mouse clicks.

If you are already a US Legal Forms customer, log in to your accounts and click on the Obtain button to obtain the Puerto Rico Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co. You may also gain access to varieties you earlier delivered electronically inside the My Forms tab of your own accounts.

If you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form to the correct city/region.

- Step 2. Use the Review solution to look through the form`s content. Don`t neglect to read the description.

- Step 3. If you are unsatisfied with all the type, use the Look for area on top of the screen to get other models from the legal type design.

- Step 4. Once you have identified the form you need, select the Purchase now button. Opt for the costs strategy you favor and include your credentials to register for an accounts.

- Step 5. Procedure the financial transaction. You may use your bank card or PayPal accounts to complete the financial transaction.

- Step 6. Select the structure from the legal type and down load it on your gadget.

- Step 7. Complete, revise and printing or indicator the Puerto Rico Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co.

Every legal record design you get is yours eternally. You have acces to every type you delivered electronically in your acccount. Click the My Forms section and select a type to printing or down load again.

Contend and down load, and printing the Puerto Rico Amended and Restated Agreement and Plan of Merger between CNL Financial Corp and Newco Merger Co with US Legal Forms. There are many expert and state-certain varieties you can use for your personal business or person requires.

Form popularity

FAQ

There are many different ways to acquire financing for an acquisition. The acquiring company can pay the target company through methods such as cash, stock swaps, debt, mezzanine financing, equity, leveraged buyout, or seller's financing.

Acquisitions are mostly funded from a combination of debt and equity. If the company doesn't have its own funds available for an acquisition, it can avail of the required capital through third party debt (bank loan, SBA loan, private debt, etc.), owners' equity, or even a line of credit.

A "Merger Sub" is the term given in M&A documents of a new shell company formed by the Acquirer solely to complete its acquisition of a target company.

These provisions may include (1) the presence, or absence, of a financing condition to the buyer's obligation to close (and alternative provisions, such as a reverse breakup fee), (2) the buyer's representation to the seller concerning the terms of its committed debt financing, (3) the covenant of the buyer to obtain ...

Merger and acquisition funding is different from normal corporate finance such as venture capital, and the investor pool also varies. Acquisition funders can include private equity companies and traditional banks, for example. The two most common types of acquisition finance are debt finance and equity finance.

M&A financing is the process of raising money to fund mergers and acquisitions. The primary sources of M&A financing are equity financing and debt financing. Companies may also use their existing cash reserves.