The Puerto Rico Stock Option Plan for Federal Savings Association is a financial program specifically designed for Federal Savings Associations (FSA's) operating in Puerto Rico. This initiative enables FSA's to grant stock options to their employees, providing them with an opportunity to purchase company stock at a predetermined price within a specified timeframe. The plan serves as a vital tool for FSA's to attract and retain talented professionals by offering them a sense of ownership in the institution. These stock options are typically granted to key employees, such as executives and upper-level management, as a performance-based incentive to drive growth and encourage long-term commitment. The Puerto Rico Stock Option Plan for FSA's offers various types of stock options to cater to the diverse needs and goals of both FSA's and their employees. Some common types include: 1. Incentive Stock Options (SOS): SOS are typically granted to employees as a tax-advantaged form of compensation. These options allow employees to purchase shares at a specific price, known as the strike price, without incurring immediate tax obligations. If certain qualifying conditions are met, employees can benefit from favorable tax treatment upon exercising the options. 2. Non-Qualified Stock Options (Nests): Nests are an alternative to SOS and are often granted to employees who do not meet the criteria for SOS. These options are subject to regular income tax upon exercise, with the difference between the strike price and the market price at the time of exercise being taxed as ordinary income. 3. Restricted Stock Units (RSS): RSS are a popular type of stock option that does not grant employees immediate ownership of company stock. Instead, RSS represent a promise to deliver actual shares of stock in the future, usually after a predetermined vesting period. Once the RSS vest, employees can receive the shares, subject to certain conditions or restrictions. 4. Performance Stock Units (Plus): Similar to RSS, Plus also represent a promise to deliver shares in the future. However, their vesting is typically contingent upon the attainment of specific performance goals set by the FSA. These performance targets may include metrics such as revenue growth, customer satisfaction, or profitability. The Puerto Rico Stock Option Plan for Federal Savings Association provides FSA's with a flexible framework to customize the stock option offerings based on their specific needs, regulatory requirements, and industry best practices. By implementing this plan, FSA scan motivate employees, align their interests with company performance, and create a culture of ownership and responsibility.

Puerto Rico Stock Option Plan For Federal Savings Association

Description

How to fill out Puerto Rico Stock Option Plan For Federal Savings Association?

Discovering the right legitimate document web template could be a have difficulties. Of course, there are a lot of layouts available on the Internet, but how will you find the legitimate form you require? Take advantage of the US Legal Forms website. The services provides 1000s of layouts, like the Puerto Rico Stock Option Plan For Federal Savings Association, that can be used for business and private demands. All the kinds are checked out by pros and fulfill state and federal specifications.

When you are already listed, log in to your bank account and click the Acquire button to obtain the Puerto Rico Stock Option Plan For Federal Savings Association. Make use of your bank account to appear through the legitimate kinds you have bought formerly. Go to the My Forms tab of the bank account and have an additional copy of the document you require.

When you are a whole new customer of US Legal Forms, listed here are straightforward directions for you to comply with:

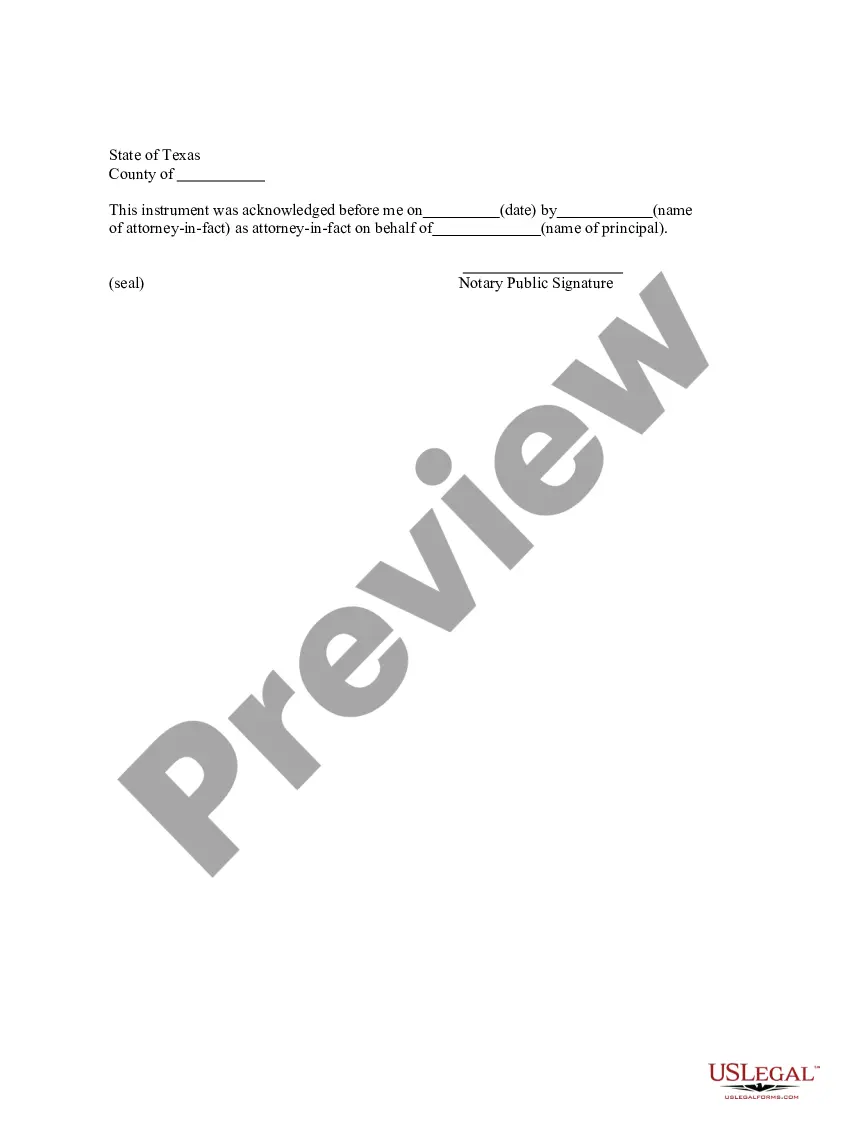

- First, make sure you have chosen the proper form to your city/region. You can examine the shape making use of the Review button and study the shape outline to ensure this is basically the best for you.

- In the event the form is not going to fulfill your expectations, make use of the Seach discipline to discover the proper form.

- Once you are positive that the shape is acceptable, click on the Acquire now button to obtain the form.

- Choose the pricing program you desire and enter in the essential details. Make your bank account and pay for the order using your PayPal bank account or Visa or Mastercard.

- Pick the document format and acquire the legitimate document web template to your product.

- Full, edit and print out and indication the acquired Puerto Rico Stock Option Plan For Federal Savings Association.

US Legal Forms is the most significant collection of legitimate kinds for which you will find a variety of document layouts. Take advantage of the service to acquire appropriately-created files that comply with express specifications.