Puerto Rico Nonqualified and Incentive Stock Option Plan of Intercargo Corp.

Description

How to fill out Nonqualified And Incentive Stock Option Plan Of Intercargo Corp.?

Have you been in a place the place you will need papers for sometimes organization or personal reasons virtually every day? There are plenty of legal document web templates available on the net, but locating types you can rely on is not effortless. US Legal Forms gives a huge number of type web templates, like the Puerto Rico Nonqualified and Incentive Stock Option Plan of Intercargo Corp., that are created to meet state and federal needs.

If you are previously acquainted with US Legal Forms website and also have a free account, basically log in. Following that, it is possible to download the Puerto Rico Nonqualified and Incentive Stock Option Plan of Intercargo Corp. format.

If you do not have an profile and would like to begin using US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for the right area/region.

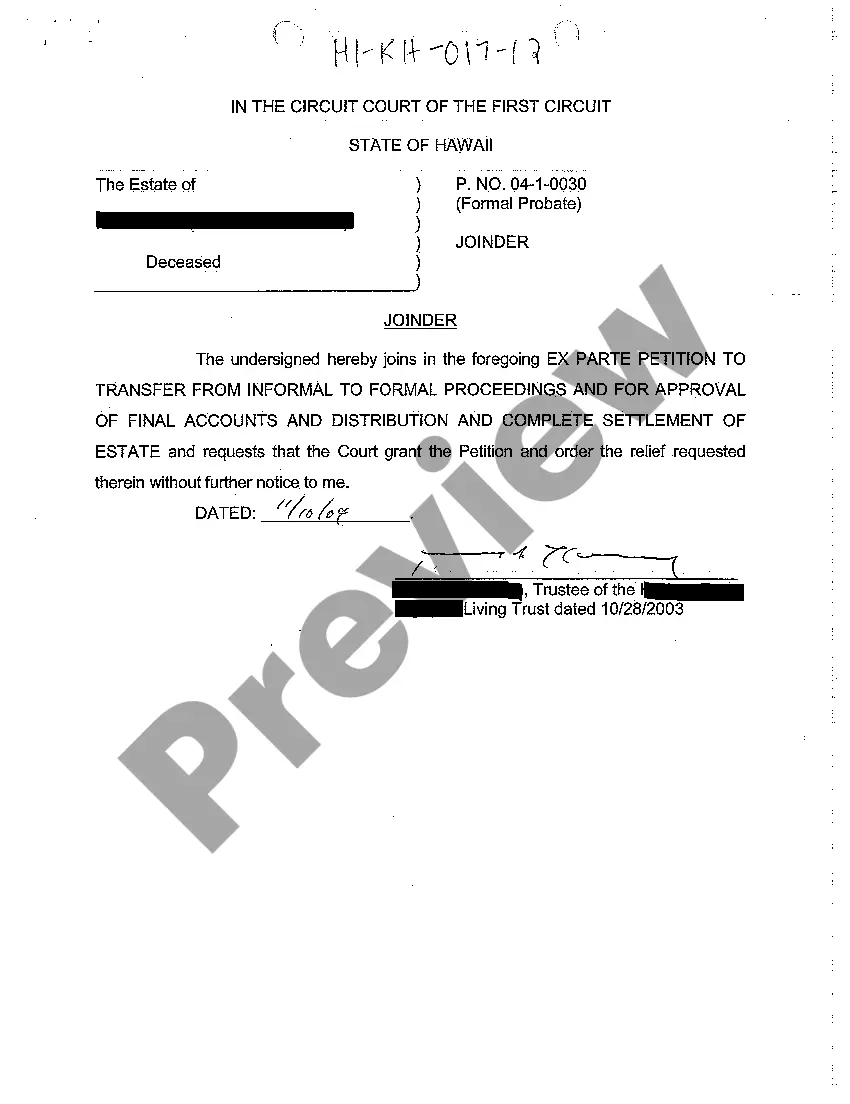

- Use the Review switch to analyze the form.

- See the information to ensure that you have selected the appropriate type.

- If the type is not what you`re trying to find, take advantage of the Research area to obtain the type that suits you and needs.

- When you obtain the right type, just click Purchase now.

- Opt for the pricing prepare you would like, submit the required info to produce your bank account, and purchase the order making use of your PayPal or bank card.

- Decide on a practical document structure and download your copy.

Find every one of the document web templates you possess bought in the My Forms food list. You may get a more copy of Puerto Rico Nonqualified and Incentive Stock Option Plan of Intercargo Corp. any time, if required. Just click on the needed type to download or produce the document format.

Use US Legal Forms, the most substantial assortment of legal types, to save lots of some time and avoid faults. The service gives professionally created legal document web templates which can be used for a range of reasons. Make a free account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

When compared to ISOs, RSUs are less risky and not dependant on the stock price at any given time. They offer a more predictable revenue stream and guarantee at least some money as long as the company's stock has value by the vesting date.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.

You can keep track of your options and shares from previously exercised options on your equity management platform. Difference between the fair market value (FMV) at exercise and the grant price is taxed as ordinary income and subject to federal, state and local income taxes in addition to payroll taxes.

NQOs are unrestricted. As such, they can be offered to anyone. That means that you can extend them to not just standard employees, but also directors, contractors, vendors, and even other third parties. ISOs, on the other hand, can only be issued to standard employees.

If this amount is not included in Box 1 of Form W-2, add it as "Other Income" on your Form 1040. Report the sale on your 2023 Schedule D, Part I as a short-term sale. The sale is short-term because not more than one year passed between the date you acquired the actual stock and the date you sold it.

If a stock option isn't an ISO, it's typically referred to as a nonqualified stock option. NQOs don't qualify for special tax treatment. The favorable tax treatment is the main advantage of ISOs for employees, and this includes long-term capital gains and no recognition of income when they exercise their options.

A stock option is a right to buy a set number of shares of the company's stock at a set price (the ?exercise price?) within a fixed period of time. The Lifecycle of a Non-Qualified Stock Option (NQSO) *When private, a company's FMV is based on the company's valuation; when public, it is based on the stock price.