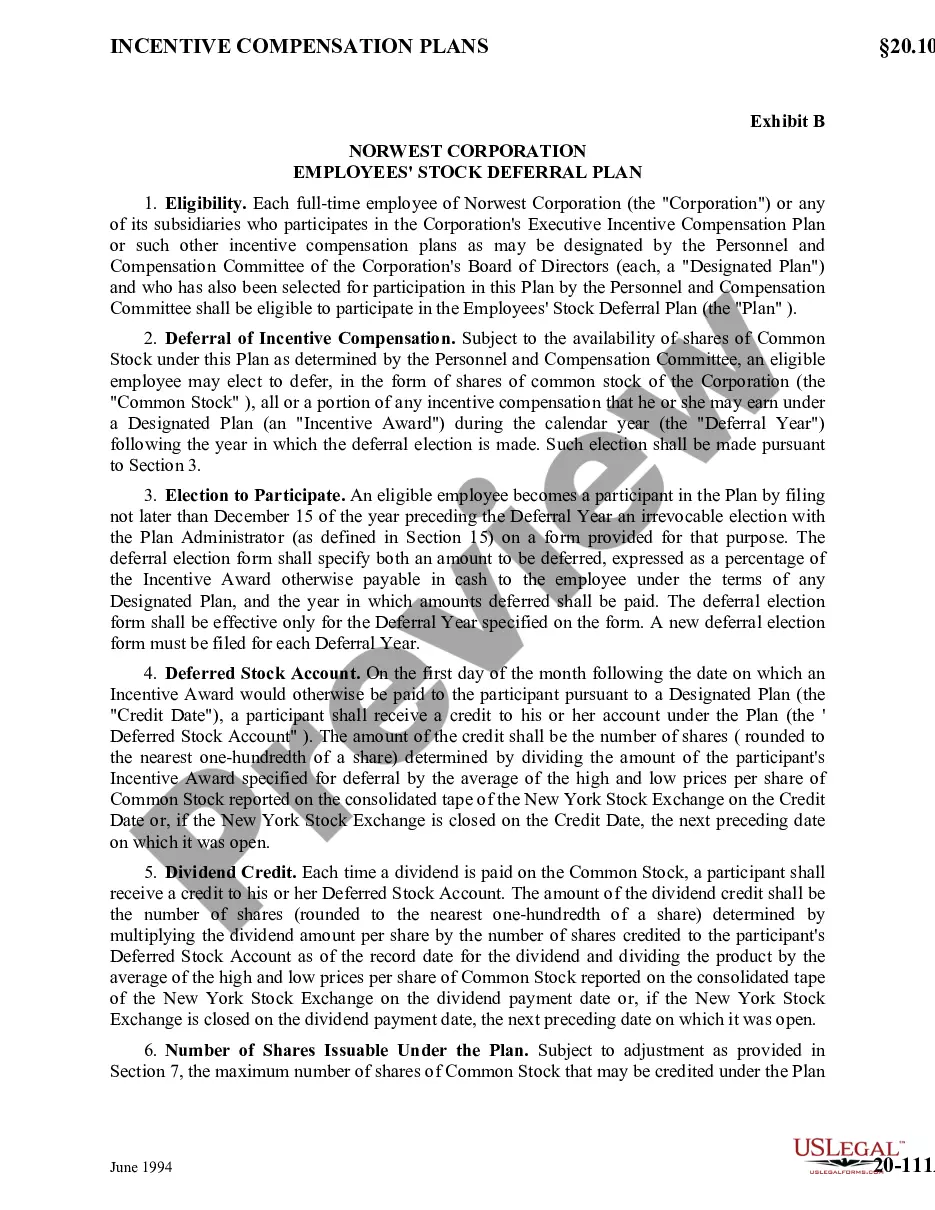

Puerto Rico Directors' Stock Deferral Plan for Norwest Corp.

Description

How to fill out Directors' Stock Deferral Plan For Norwest Corp.?

You may devote hrs on-line searching for the legal papers template which fits the federal and state needs you need. US Legal Forms offers thousands of legal forms which are examined by professionals. It is possible to down load or print the Puerto Rico Directors' Stock Deferral Plan for Norwest Corp. from my assistance.

If you currently have a US Legal Forms profile, you can log in and then click the Down load button. After that, you can complete, edit, print, or indication the Puerto Rico Directors' Stock Deferral Plan for Norwest Corp.. Every single legal papers template you get is yours for a long time. To have another version associated with a obtained type, check out the My Forms tab and then click the corresponding button.

If you use the US Legal Forms website for the first time, adhere to the basic guidelines under:

- Very first, make certain you have selected the right papers template for your state/metropolis that you pick. Read the type outline to ensure you have selected the appropriate type. If available, take advantage of the Review button to look through the papers template as well.

- If you want to find another model of your type, take advantage of the Lookup industry to find the template that suits you and needs.

- After you have identified the template you want, simply click Buy now to proceed.

- Select the costs strategy you want, type in your qualifications, and sign up for an account on US Legal Forms.

- Total the deal. You should use your bank card or PayPal profile to pay for the legal type.

- Select the structure of your papers and down load it to your device.

- Make alterations to your papers if necessary. You may complete, edit and indication and print Puerto Rico Directors' Stock Deferral Plan for Norwest Corp..

Down load and print thousands of papers layouts utilizing the US Legal Forms site, which offers the greatest variety of legal forms. Use expert and express-specific layouts to handle your business or individual demands.