Puerto Rico Executive Stock Incentive Plan of Octo Limited

Description

How to fill out Executive Stock Incentive Plan Of Octo Limited?

You may invest hrs on-line trying to find the lawful document design that meets the state and federal specifications you will need. US Legal Forms provides 1000s of lawful types which can be examined by specialists. You can actually obtain or print out the Puerto Rico Executive Stock Incentive Plan of Octo Limited from the service.

If you already possess a US Legal Forms bank account, it is possible to log in and click on the Obtain option. Afterward, it is possible to complete, change, print out, or sign the Puerto Rico Executive Stock Incentive Plan of Octo Limited. Every single lawful document design you acquire is the one you have for a long time. To get one more copy associated with a purchased kind, go to the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms site the first time, follow the easy directions below:

- Initial, be sure that you have selected the correct document design for that area/town of your choosing. See the kind information to ensure you have picked the right kind. If available, utilize the Preview option to look with the document design too.

- In order to locate one more version of your kind, utilize the Search field to obtain the design that fits your needs and specifications.

- After you have identified the design you desire, simply click Acquire now to move forward.

- Find the pricing program you desire, type your references, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your charge card or PayPal bank account to purchase the lawful kind.

- Find the format of your document and obtain it to your system.

- Make modifications to your document if possible. You may complete, change and sign and print out Puerto Rico Executive Stock Incentive Plan of Octo Limited.

Obtain and print out 1000s of document templates utilizing the US Legal Forms web site, that provides the biggest variety of lawful types. Use specialist and express-certain templates to deal with your business or specific requires.

Form popularity

FAQ

While the Commonwealth government has its own tax laws, Puerto Rico residents are also required to pay US federal taxes, but most residents do not have to pay the federal personal income tax.

Long-term capital gains are subject to a special tax rate of 15%. Short-term capital gains are subject to the regular gradual rates. In the case of long-term capital gains, Puerto Rican non-resident foreign nationals are subject to a flat withholding rate of 25%.

Qualifying businesses, foreign or local, with an office in Puerto Rico get a 4% fixed income tax rate under Act 20 for exporting services. Under Act 22, the most controversial of the two, individual investors looking to benefit from the tax breaks must not have lived in Puerto Rico between 2006 and 2012.

One of the greatest of many Puerto Rico tax benefits is the Act 60 Investor Resident Individual Tax Incentive (formerly Act 22), which allows you to pay 0% federal or Puerto Rico capital gains tax on all capital gains incurred during the time that you qualify as a bona fide Puerto Rico resident living in Puerto Rico.

Estates of residents of Puerto Rico who are considered citizens of the United States, under Subtitle B, Chapter II of the United States Internal Revenue Code, are allowed an exemption which is the greater of (i) $30,000.00 or (ii) that proportion of $60,000 which the value of that part of the decedent's gross estate ...

Dividends If the regular tax rate that would apply is 39.6%. Qualified dividends if the regular tax rate that would apply is 25% through 35%. Qualified dividends if the regular tax rate that would apply is 39.6%.

For the 2023 tax year, individual filers won't pay any capital gains tax if their total taxable income is $44,625 or less. The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Above that income level the rate climbs to 20 percent.

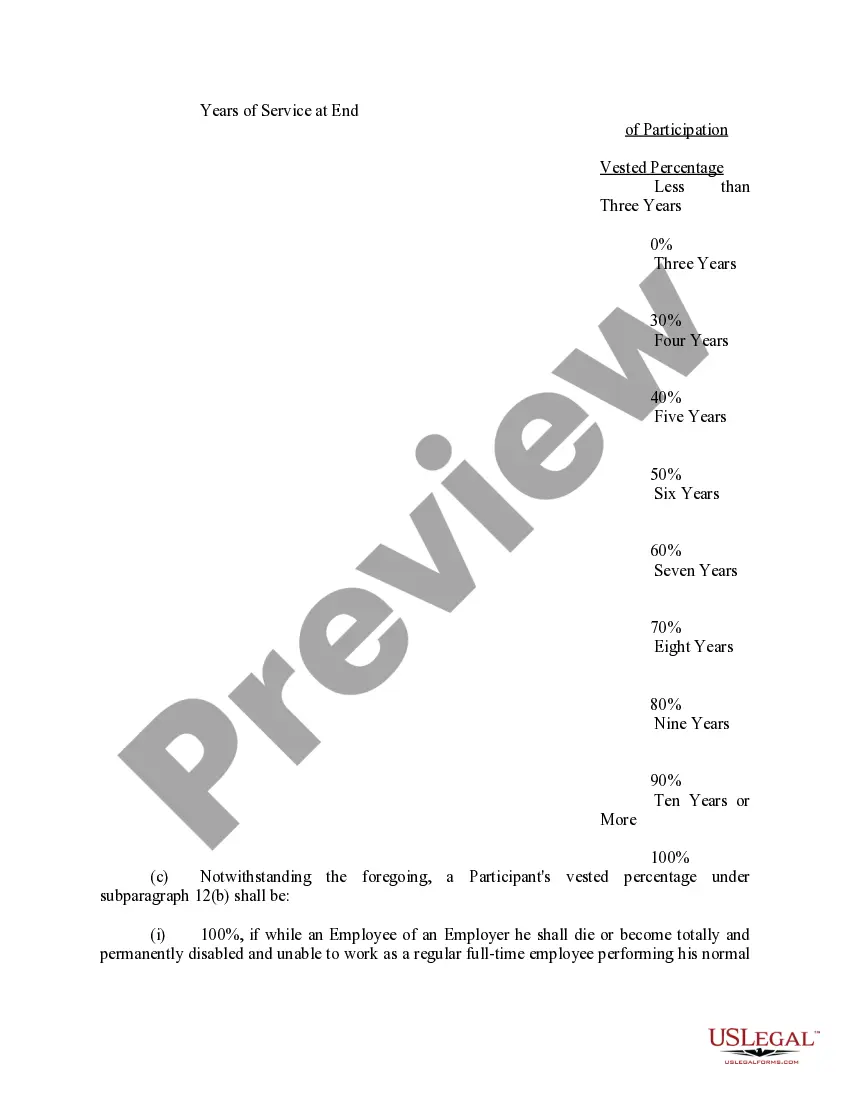

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.