Puerto Rico Retirement Benefits Plan

Description

How to fill out Retirement Benefits Plan?

Discovering the right legitimate document template could be a struggle. Needless to say, there are a variety of layouts available on the net, but how do you obtain the legitimate develop you need? Take advantage of the US Legal Forms site. The support delivers thousands of layouts, for example the Puerto Rico Retirement Benefits Plan, that you can use for business and personal demands. Each of the forms are checked by specialists and fulfill state and federal specifications.

Should you be already registered, log in to your account and click the Download button to obtain the Puerto Rico Retirement Benefits Plan. Make use of account to search from the legitimate forms you may have bought earlier. Visit the My Forms tab of your own account and have another duplicate in the document you need.

Should you be a brand new consumer of US Legal Forms, listed here are easy instructions for you to comply with:

- Initial, make sure you have chosen the correct develop to your city/area. You can check out the shape making use of the Preview button and read the shape information to guarantee it is the right one for you.

- When the develop fails to fulfill your preferences, use the Seach area to discover the right develop.

- Once you are sure that the shape is suitable, go through the Buy now button to obtain the develop.

- Pick the prices prepare you want and type in the essential information. Make your account and pay money for an order utilizing your PayPal account or Visa or Mastercard.

- Choose the submit formatting and download the legitimate document template to your gadget.

- Comprehensive, revise and print out and indicator the acquired Puerto Rico Retirement Benefits Plan.

US Legal Forms is the most significant library of legitimate forms that you can see various document layouts. Take advantage of the service to download expertly-made files that comply with express specifications.

Form popularity

FAQ

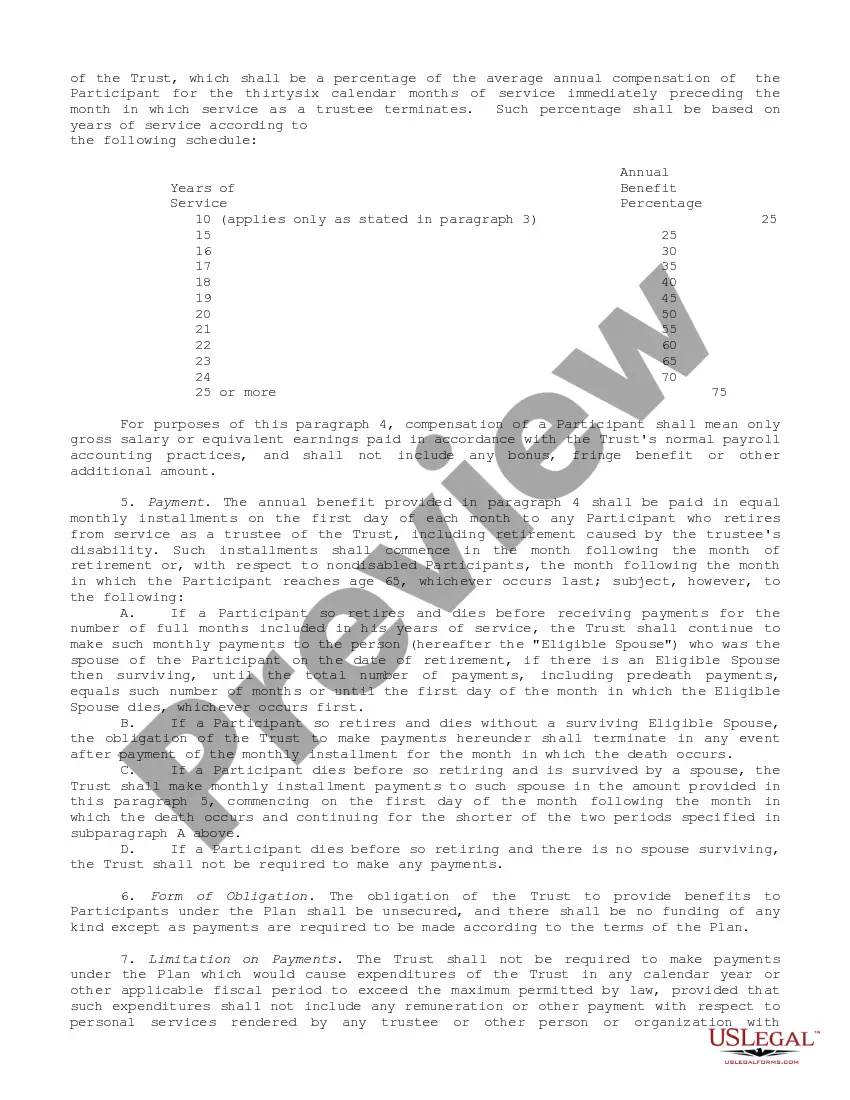

Thus, the following are the applicable 2023 limits for qualified retirement plans in Puerto Rico: Annual Benefit Limit applicable to defined benefit plans ? $265,000 (increased from $245,000 for 2022).

FERS is a retirement plan that provides benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP).

Most federal employees participate in one of two retirement savings programs, the Federal Employees' Retirement System (FERS), or the Civil Service Retirement System (CSRS).

Puerto Rico qualified retirement plan limits, 2022 vs. 2023 Puerto Rico qualified plan limits20222023Maximum recognizable compensation$305,000$330,000Highly compensated employee$135,000$150,000Annual benefit limit (DB)$245,000$265,000Annual contribution limit (DC)$61,000$66,0008 more rows ? 10-Feb-2023

The GRB Platform is the only known customized and distinctive software system capable of providing accurate retirement and benefit estimates for both the Civil Service (CS) and Foreign Service (FS) retirement system, which include the Civil Service Retirement System (CSRS), Federal Employees Retirement System (FERS), ...

ERS was created to provide pension and other benefits to retired employees of the Government of Puerto Rico, most of the public corporations and the municipalities of Puerto Rico.

Puerto Rico offers tax benefits to people who choose to retire to the island due to its own tax laws. In simple terms, Act 60 provides tax exemptions to those who relocate to the island. Income sourced in Puerto Rico is exempt from US federal and state income taxes.