The Puerto Rico Amendment of Restated Certificate of Incorporation refers to the process carried out by a company incorporated in Puerto Rico to modify the terms and conditions associated with its dividend rate on the $10.50 cumulative second preferred convertible stock. This amendment is crucial for companies seeking to adjust the rate at which dividends are paid out to shareholders who hold this particular class of stock. The amendment effectively enables the company's management to revise the dividend rate, thereby determining the amount of dividends distributed to the holders of $10.50 cumulative second preferred convertible stock. By making changes to the rate, the company can align its dividend payments with its financial goals and meet the expectations of its preferred stockholders. In Puerto Rico, amendments to the Restated Certificate of Incorporation must comply with the laws and regulations put forth by the Puerto Rico Department of State — Corporation Bureau. This ensures that the amendment process is carried out legitimately and transparently. Different types or variations of the Puerto Rico Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock may include: 1. Standard Dividend Rate Amendment: This type of amendment serves to modify the existing dividend rate associated with the $10.50 cumulative second preferred convertible stock. The company may choose to increase or decrease the dividend rate based on current financial circumstances and business objectives. 2. Fixed Dividend Rate Conversion Amendment: This variation of the amendment aims to convert the variable dividend rate on the $10.50 cumulative second preferred convertible stock into a fixed rate. By doing so, the company provides stability to preferred stockholders by guaranteeing a consistent dividend amount. 3. Adjustable Dividend Rate Amendment: This type of amendment allows for a flexible dividend rate, meaning that the company can adjust the dividend payments on the $10.50 cumulative second preferred convertible stock periodically. This gives the company the flexibility to match dividend payments with its financial performance. 4. Special Dividend Rate Amendment: In certain situations, a company may decide to introduce a special dividend rate on its $10.50 cumulative second preferred convertible stock. This type of amendment is usually applied when there is a specific event, such as a windfall profit or exceptional financial results, warranting a higher dividend payment. Overall, the Puerto Rico Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock allows companies to adapt their dividend policies to align with their financial goals and meet the expectations of preferred stockholders.

Puerto Rico Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

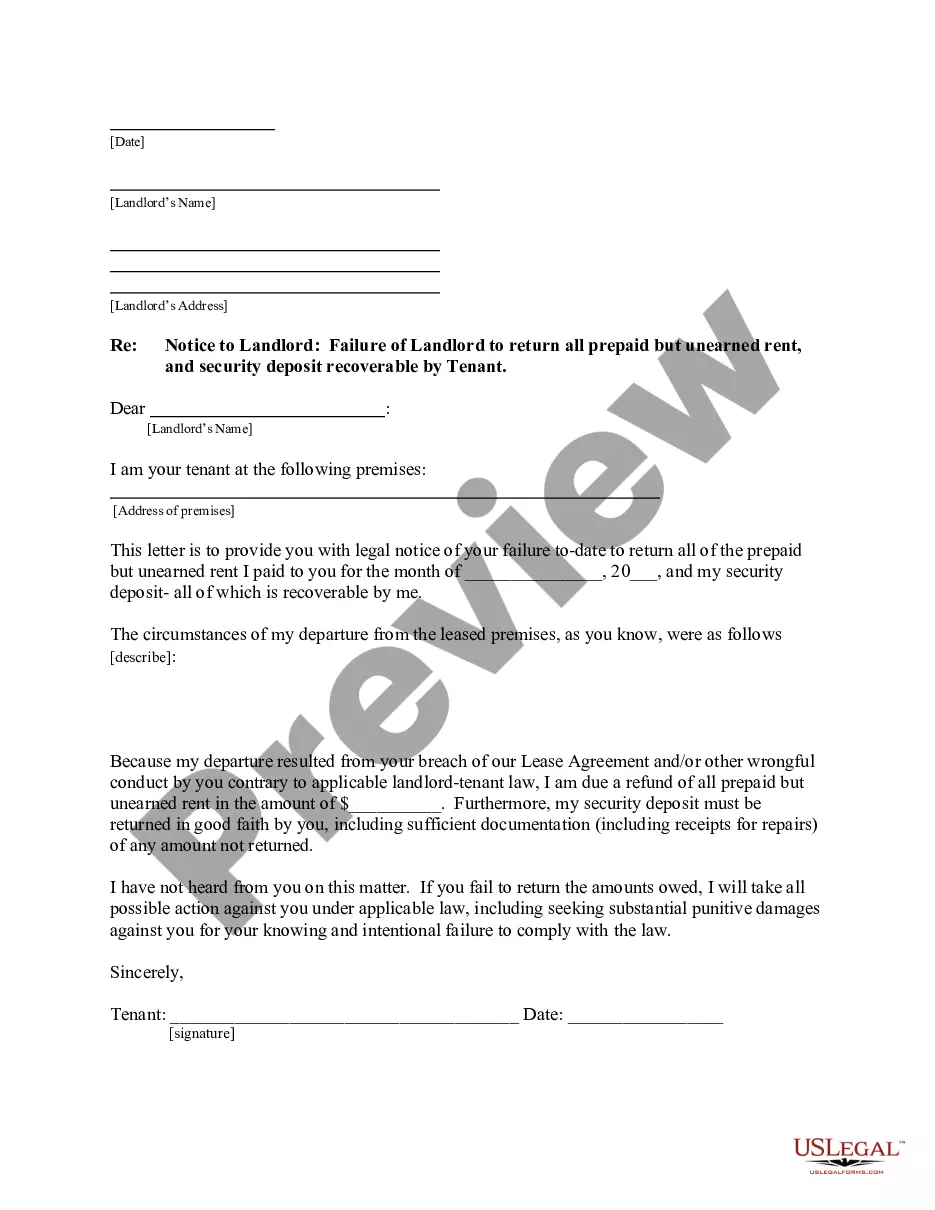

How to fill out Puerto Rico Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

US Legal Forms - one of many largest libraries of authorized types in the States - provides a wide range of authorized file web templates you can down load or produce. Using the site, you can get thousands of types for business and person reasons, categorized by groups, suggests, or keywords and phrases.You can find the latest types of types such as the Puerto Rico Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock in seconds.

If you currently have a subscription, log in and down load Puerto Rico Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock from your US Legal Forms catalogue. The Down load key will appear on every single form you see. You gain access to all formerly delivered electronically types inside the My Forms tab of your profile.

If you wish to use US Legal Forms initially, here are basic guidelines to get you started out:

- Be sure to have selected the best form for the city/area. Go through the Review key to check the form`s content material. See the form description to actually have selected the correct form.

- In case the form does not satisfy your demands, use the Search field at the top of the display screen to discover the one who does.

- If you are happy with the shape, confirm your option by clicking the Buy now key. Then, choose the pricing strategy you want and give your references to register for the profile.

- Method the transaction. Make use of your charge card or PayPal profile to perform the transaction.

- Choose the formatting and down load the shape on your own product.

- Make adjustments. Load, edit and produce and indicator the delivered electronically Puerto Rico Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock.

Each and every design you included in your money does not have an expiry particular date and is the one you have eternally. So, if you want to down load or produce yet another duplicate, just visit the My Forms segment and click on in the form you will need.

Get access to the Puerto Rico Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock with US Legal Forms, the most extensive catalogue of authorized file web templates. Use thousands of skilled and condition-specific web templates that meet up with your organization or person requires and demands.