Puerto Rico Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits

Description

How to fill out Letter To Stockholders Regarding Authorization And Sale Of Preferred Stock And Stock Transfer Restriction To Protect Tax Benefits?

Have you been in a position in which you require files for both organization or individual functions just about every time? There are plenty of legitimate file templates accessible on the Internet, but getting ones you can trust is not effortless. US Legal Forms gives a large number of kind templates, just like the Puerto Rico Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits, which can be published in order to meet state and federal requirements.

When you are previously informed about US Legal Forms website and have a free account, basically log in. After that, you may acquire the Puerto Rico Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits design.

If you do not have an account and wish to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you need and ensure it is for your proper area/region.

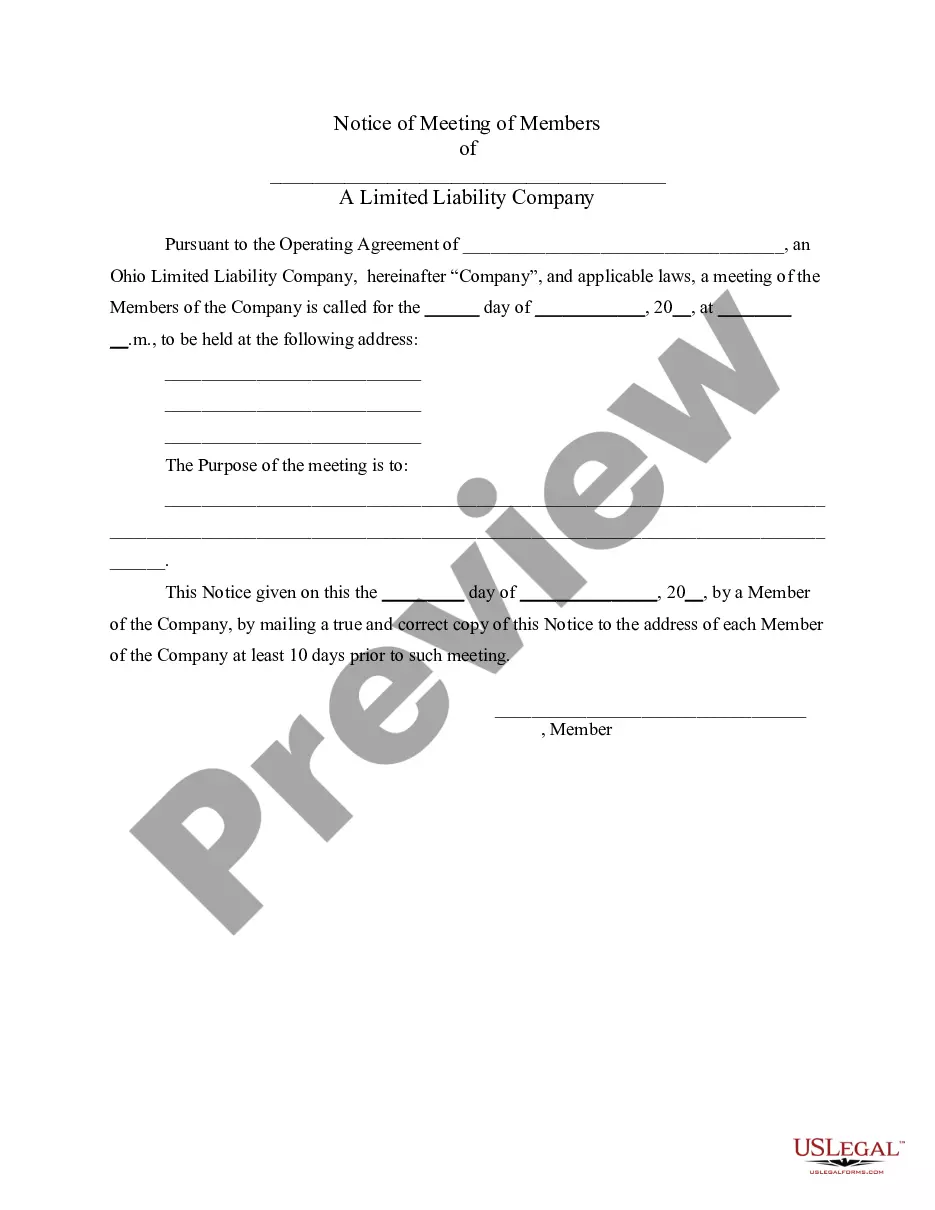

- Use the Preview switch to analyze the shape.

- Read the explanation to actually have selected the appropriate kind.

- If the kind is not what you are trying to find, make use of the Look for industry to get the kind that suits you and requirements.

- Whenever you obtain the proper kind, click Get now.

- Select the rates program you need, complete the necessary info to produce your account, and pay for the order with your PayPal or bank card.

- Decide on a practical document file format and acquire your copy.

Locate all of the file templates you may have purchased in the My Forms food list. You can aquire a extra copy of Puerto Rico Letter to Stockholders regarding authorization and sale of preferred stock and stock transfer restriction to protect tax benefits at any time, if needed. Just select the necessary kind to acquire or produce the file design.

Use US Legal Forms, the most considerable variety of legitimate kinds, in order to save efforts and prevent mistakes. The assistance gives expertly produced legitimate file templates that you can use for a selection of functions. Produce a free account on US Legal Forms and start creating your way of life easier.

Form popularity

FAQ

Form F-10 is a registration statement used to register any kind of security, except derivative securities (other than certain warrants, options, rights and convertible securities), under the Securities Act of 1933 (Securities Act).

The SEC POS AM filing is submitted by companies that have filed a prospectus for registration with the U.S. Securities and Exchange Commission (SEC). It is a post-effective amendment to that registration statement that is not immediately effective upon filing.

SEC Form F-10 is a form the Securities and Exchange Commission (SEC) requires certain publicly traded Canadian foreign private issuers to complete to register and sell securities in the United States.

A Form 10 registration statement is automatically effective 60 days after filing, regardless of whether the issuer has responded to all Securities and Exchange Commission (the ?SEC?) comments. Registration statements on Form S-1 register specific securities of a company.

A spinoff occurs when a parent company creates a new independent company through the distribution or sale of new shares of its existing business. The purpose of SEC Form 10-12B is for the parent company to disclose to shareholders and the trading markets relevant information regarding the proposed spinoff.

Form 10 is intended to provide disclosure of all relevant material information for an investor to make an investment decision. The form is a necessary requirement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934, but is not sufficient on its own to register.

In this regard, General Instruction I.B. 4. of Form S-3 requires that the registrant provide an annual report which meets the requirements of Rule 14a-3(b). That rule requires an annual report with three years of audited financial statements.

Any registrant which meets the requirements of I.A. below (?Registrant Requirements?) may use this Form for the registration of securities under the Securities Act of 1933 (?Securities Act?) which are offered in any transaction specified in I.B.