Puerto Rico Proposal to adopt plan of dissolution and liquidation

Description

How to fill out Proposal To Adopt Plan Of Dissolution And Liquidation?

US Legal Forms - one of the biggest libraries of legal forms in America - provides a wide array of legal document templates you can obtain or printing. Using the website, you may get a large number of forms for organization and personal uses, sorted by types, states, or keywords and phrases.You can find the latest versions of forms just like the Puerto Rico Proposal to adopt plan of dissolution and liquidation within minutes.

If you already possess a monthly subscription, log in and obtain Puerto Rico Proposal to adopt plan of dissolution and liquidation through the US Legal Forms library. The Acquire switch will show up on each and every kind you see. You have access to all in the past acquired forms from the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, allow me to share simple instructions to help you get started off:

- Be sure you have picked the best kind for your city/state. Click on the Preview switch to analyze the form`s articles. Read the kind explanation to actually have selected the correct kind.

- If the kind does not satisfy your requirements, take advantage of the Lookup area towards the top of the screen to discover the one who does.

- When you are content with the form, verify your decision by clicking the Buy now switch. Then, select the rates strategy you favor and supply your accreditations to register to have an accounts.

- Method the financial transaction. Make use of your Visa or Mastercard or PayPal accounts to perform the financial transaction.

- Select the structure and obtain the form on your gadget.

- Make alterations. Complete, revise and printing and sign the acquired Puerto Rico Proposal to adopt plan of dissolution and liquidation.

Each and every format you included with your bank account lacks an expiration date which is yours permanently. So, in order to obtain or printing yet another copy, just proceed to the My Forms portion and then click on the kind you need.

Gain access to the Puerto Rico Proposal to adopt plan of dissolution and liquidation with US Legal Forms, the most substantial library of legal document templates. Use a large number of skilled and status-distinct templates that fulfill your business or personal needs and requirements.

Form popularity

FAQ

Steps to dissolving a corporation or obtaining a corporate dissolution Call a board meeting. ... File a certificate of dissolution with the Secretary of State. ... Notify the Internal Revenue Service (IRS) ... Close accounts and credit lines, cancel licenses, etc.

The first is voluntary dissolution, which is an elective decision to dissolve the entity. A second is involuntary dissolution, which occurs upon the happening of statute-specific events such as a failure to pay taxes. Last, a corporation may be dissolved judicially, either by shareholder or creditor lawsuit.

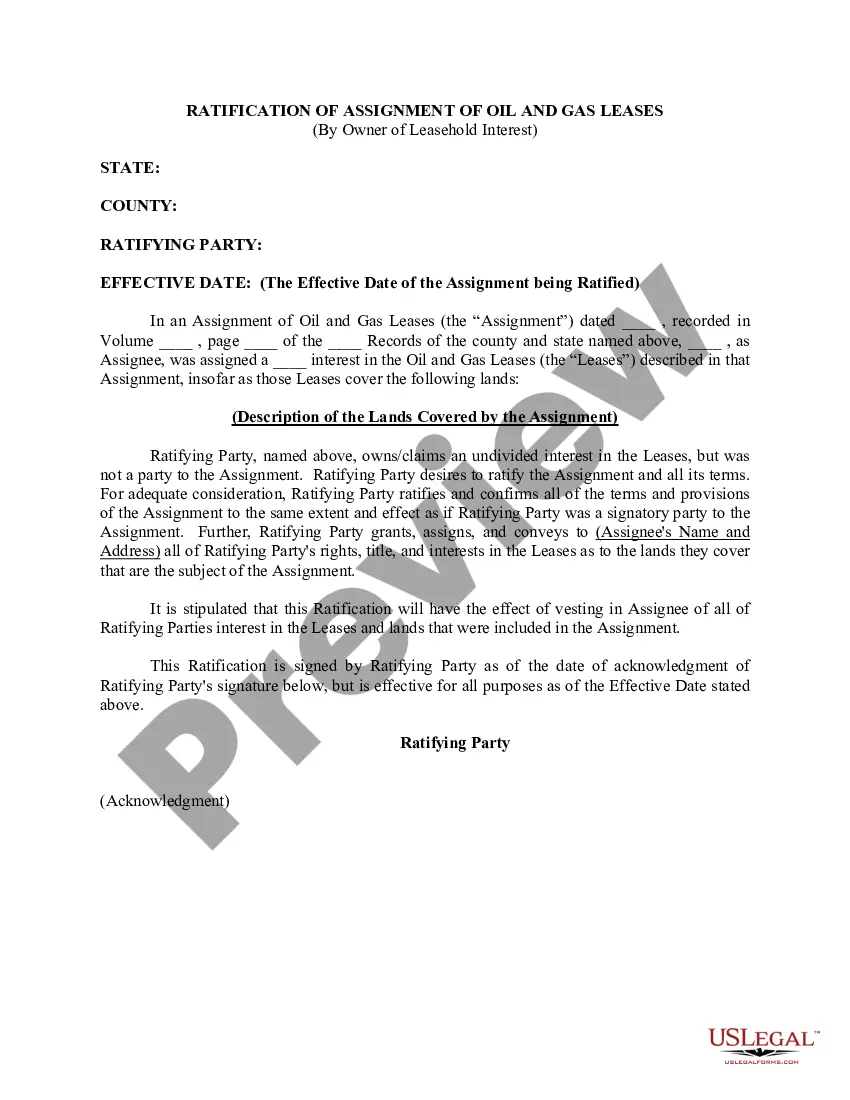

A plan of dissolution is a written description of how an entity intends to dissolve, or officially and formally close the business. A plan of dissolution will include a description of how any remaining assets and liabilities will be distributed.

A plan of liquidation and dissolution that can be used for the dissolution of a Delaware corporation wholly owned by a US parent corporation when the parties intend to qualify the dissolution as a tax-free liquidation under Sections 332 and 337 of the Internal Revenue Code.

Business entities doing or transacting business in California or registered with the California Secretary of State (SOS ) can dissolve, surrender, or cancel when they cease operations in California and need to terminate their legal existence here.

IRC §331 provides rules for the tax treatment of shareholders receiving distributions in a complete liquidation of a corporation. In a complete liquidation, a corporation usually distributes all of its assets to the shareholders in exchange for all of its stock pursuant to a plan of a complete liquidation.

After dissolution, a corporation is generally expected to pay all its existing debts and then liquidate its remaining assets to its shareholders. This sometimes becomes difficult, however, where there are unknown claims that may exist against the corporation.

The process of dissolving a company is done by the company's directors by submitting a DS01 form and paying the relevant fee. A notice is then placed in the Gazette stating the company's intention to strike itself from the register. If no objections are received, the company will be dissolved.