Puerto Rico Complex Will — Income Trust for Spouse is a specialized legal document that allows individuals in Puerto Rico to protect their assets and provide financial security for their spouses after their passing. This sophisticated estate planning tool is designed to address complex financial situations and ensure the long-term financial well-being of the surviving spouse. The Puerto Rico Complex Will — Income Trust for Spouse provides a detailed framework for the distribution and management of assets after the original owner's death. By setting up a trust, the testator can ensure that the surviving spouse receives a steady stream of income throughout their lifetime while preserving the principal for the beneficiaries' future needs. There are several types of Puerto Rico Complex Will — Income Trust for Spouse, each tailored to suit different financial circumstances and goals: 1. Traditional Puerto Rico Complex Will — Income Trust for Spouse: This is the most common type, where the surviving spouse receives regular income generated by the trust. The principal remains intact and is distributed among the beneficiaries upon the passing of the surviving spouse. 2. Puerto Rico Complex Will — Income Trust for Spouse with Medicaid Planning: This variant of the trust takes into account the potential need for long-term care and helps protect the surviving spouse's eligibility for Medicaid benefits. 3. Puerto Rico Complex Will — Income Trust for Spouse with Tax Planning: This trust is designed to minimize estate taxes and reduce the tax burden on the surviving spouse and beneficiaries. It employs strategies such as gifting, charitable contributions, and generation-skipping transfer tax planning to optimize tax efficiency. 4. Puerto Rico Complex Will — Income Trust for Spouse with Special Needs Planning: This type of trust is crafted specifically for families with disabled beneficiaries. It ensures that the surviving spouse receives income to support their needs while safeguarding the special needs beneficiary's eligibility for government assistance programs. 5. Puerto Rico Complex Will — Income Trust for Spouse with Creditor Protection: This trust safeguards assets from potential creditors, ensuring that the surviving spouse's income and the beneficiaries' inheritance remain secure. In summary, the Puerto Rico Complex Will — Income Trust for Spouse is a legal instrument designed to provide financial stability and protection for surviving spouses in Puerto Rico. By establishing this trust, individuals can customize their estate plans to meet their specific needs and objectives while ensuring the long-term financial well-being of their loved ones.

Puerto Rico Complex Will - Income Trust for Spouse

Description

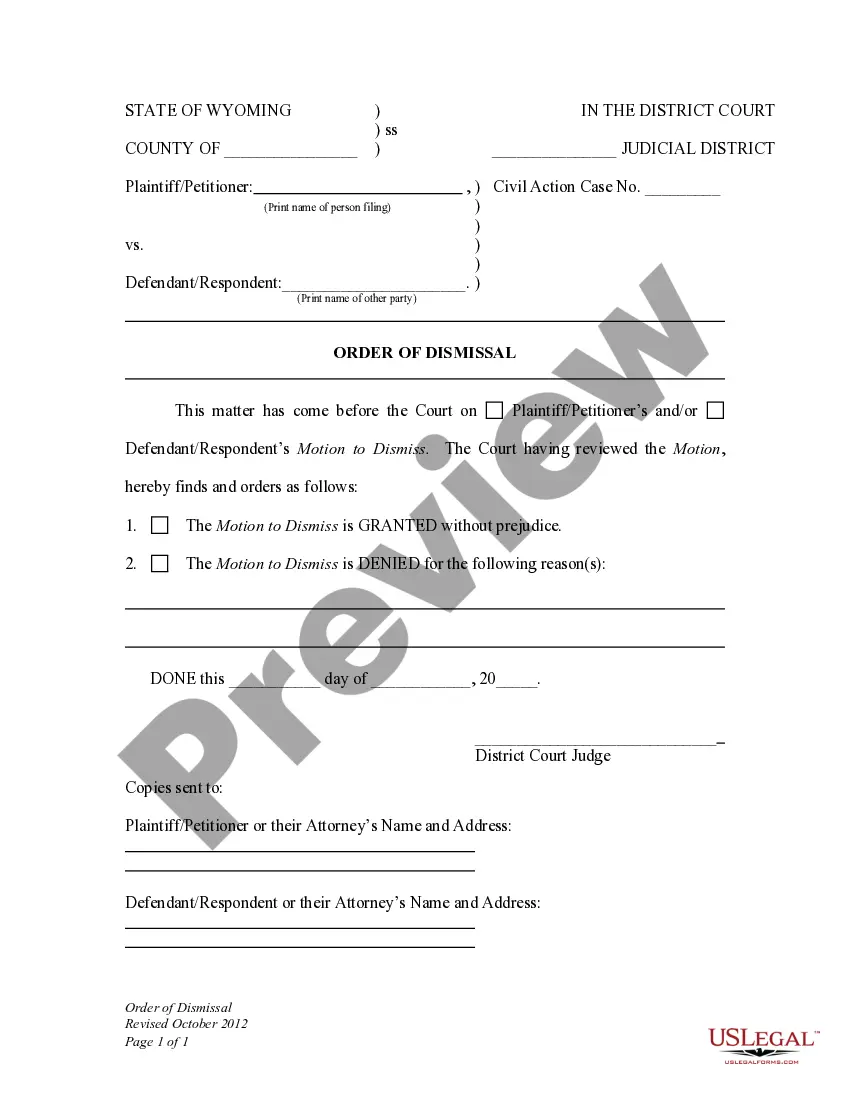

How to fill out Puerto Rico Complex Will - Income Trust For Spouse?

You may commit time on-line looking for the legal document design that suits the federal and state requirements you need. US Legal Forms offers a huge number of legal types that happen to be evaluated by experts. You can actually download or print out the Puerto Rico Complex Will - Income Trust for Spouse from my support.

If you already possess a US Legal Forms bank account, you can log in and click on the Obtain button. After that, you can comprehensive, revise, print out, or indicator the Puerto Rico Complex Will - Income Trust for Spouse. Every legal document design you purchase is the one you have for a long time. To have yet another version associated with a acquired kind, visit the My Forms tab and click on the corresponding button.

If you use the US Legal Forms web site initially, stick to the simple recommendations under:

- Initial, be sure that you have chosen the best document design for your county/area of your liking. See the kind outline to make sure you have selected the right kind. If readily available, use the Preview button to check through the document design also.

- If you wish to locate yet another model of your kind, use the Look for field to discover the design that meets your requirements and requirements.

- Upon having identified the design you desire, click Buy now to continue.

- Choose the costs strategy you desire, key in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can utilize your Visa or Mastercard or PayPal bank account to fund the legal kind.

- Choose the formatting of your document and download it in your system.

- Make modifications in your document if possible. You may comprehensive, revise and indicator and print out Puerto Rico Complex Will - Income Trust for Spouse.

Obtain and print out a huge number of document themes using the US Legal Forms website, which offers the greatest assortment of legal types. Use professional and state-certain themes to handle your business or personal requirements.

Form popularity

FAQ

All real estate in Puerto Rico is subject to the probate system. This system is based on a "forced heir" policy, that states that all children need to receive from the decedent (the person that died).

As long as the person disclaiming the asset is not the beneficiary, the Disclaimer Trust can be for any beneficiary. The one exception is that a surviving spouse can disclaim assets and then benefit from a trust into which the disclaimed assets pour.

A marital disclaimer trust has provisions (usually contained in a will) that allow a surviving spouse to leave assets in a trust for the benefit of their spouse by disclaiming ownership of a portion of the estate that the survivor would have inherited after the death of the first spouse.

Disadvantages. Surviving Spouse's Decision: The effectiveness of a Disclaimer Trust relies on the surviving spouse's decision to disclaim their inheritance. If the surviving spouse chooses not to disclaim their inheritance, the potential tax and asset protection benefits of the Disclaimer Trust may not be realized.

Many couples want to leave all trust property to the survivor. If you choose that option, we'll insert your spouse or partner's name (entered earlier) as beneficiary of all your trust property.

'Express trusts have been a part of the law of Puerto Rico since enactment of §§ 1-41 of the Act of April 23, 1928, No. 41, page 294.

Each spouse's Will leaves their estate to the surviving spouse. In addition, it directs that if the surviving spouse were to disclaim any assets, then those assets found can be used to fund a Disclaimer Trust.

A disclaimer trust is a type of trust that contains embedded provisions, usually included in a will, allowing a surviving spouse to put specific assets under the trust by disclaiming ownership of a portion of the estate. Disclaimed property interests are then transferred to the trust, without being taxed.