A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Puerto Rico Notice to Debt Collector - Falsely Representing a Document's Authority

Description

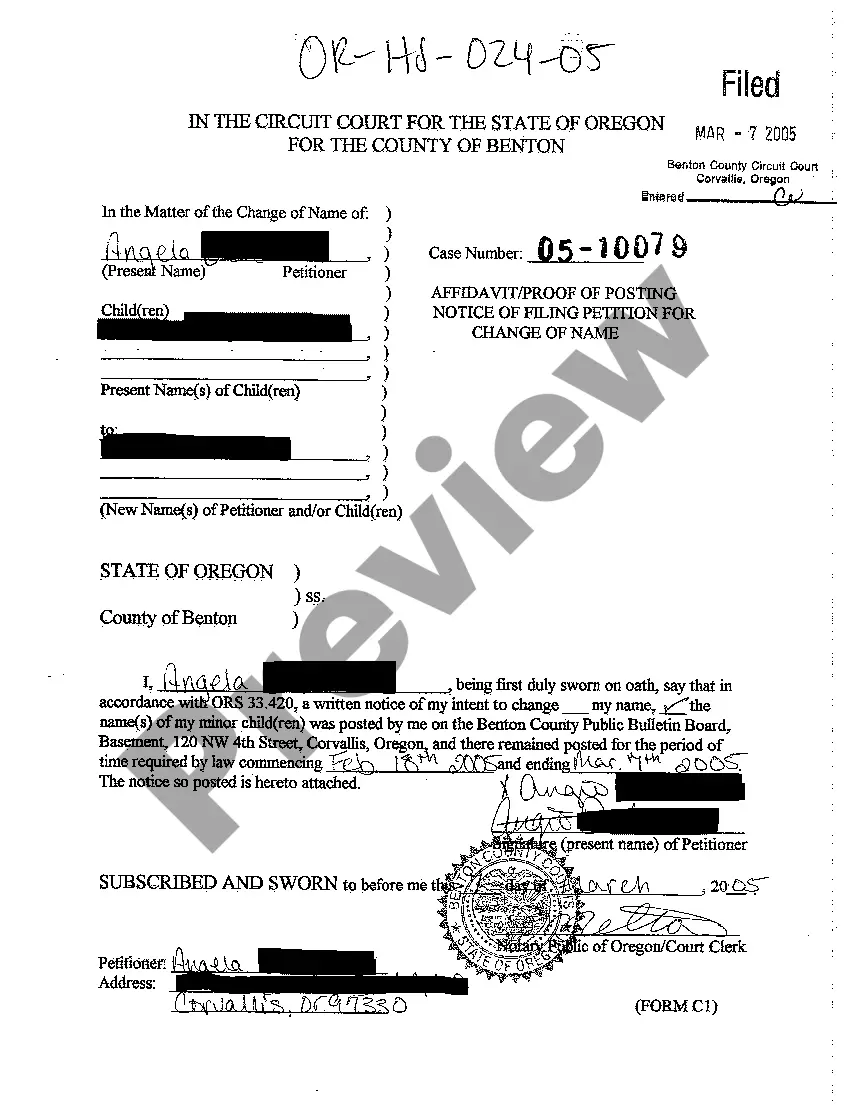

How to fill out Puerto Rico Notice To Debt Collector - Falsely Representing A Document's Authority?

You may devote hours online searching for the authorized file web template that suits the federal and state requirements you will need. US Legal Forms supplies 1000s of authorized forms which can be reviewed by specialists. You can easily down load or print the Puerto Rico Notice to Debt Collector - Falsely Representing a Document's Authority from my assistance.

If you currently have a US Legal Forms profile, you are able to log in and click on the Down load option. Next, you are able to full, modify, print, or indicator the Puerto Rico Notice to Debt Collector - Falsely Representing a Document's Authority. Every authorized file web template you buy is the one you have eternally. To obtain yet another backup of any purchased form, check out the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms site the very first time, adhere to the simple recommendations beneath:

- Initially, make sure that you have selected the best file web template for that area/city that you pick. Read the form information to make sure you have picked out the right form. If accessible, use the Preview option to check throughout the file web template as well.

- If you want to get yet another model of your form, use the Research area to obtain the web template that meets your needs and requirements.

- Once you have discovered the web template you would like, simply click Purchase now to carry on.

- Choose the rates prepare you would like, type in your qualifications, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your charge card or PayPal profile to purchase the authorized form.

- Choose the formatting of your file and down load it to the system.

- Make modifications to the file if possible. You may full, modify and indicator and print Puerto Rico Notice to Debt Collector - Falsely Representing a Document's Authority.

Down load and print 1000s of file templates while using US Legal Forms Internet site, that provides the most important collection of authorized forms. Use skilled and status-specific templates to handle your organization or person requirements.

Form popularity

FAQ

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Here are a few suggestions that might work in your favor:Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.