Puerto Rico Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Puerto Rico Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

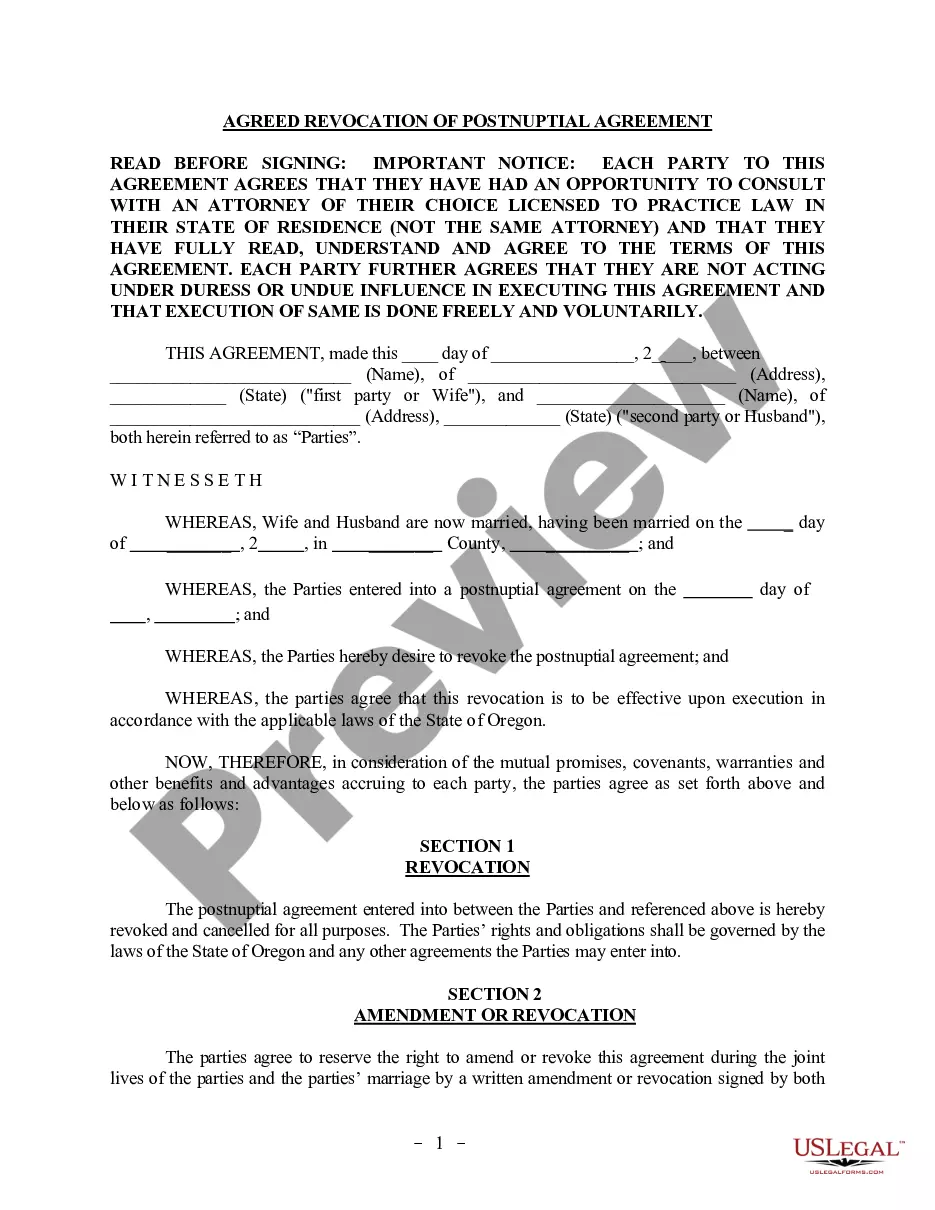

It is possible to commit several hours on the web attempting to find the legitimate document web template that fits the federal and state specifications you require. US Legal Forms gives 1000s of legitimate types that happen to be evaluated by pros. You can actually download or printing the Puerto Rico Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself from our services.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Down load option. After that, it is possible to comprehensive, modify, printing, or indication the Puerto Rico Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself. Each legitimate document web template you buy is your own property permanently. To get yet another duplicate of the obtained kind, go to the My Forms tab and click the related option.

Should you use the US Legal Forms web site the first time, keep to the easy recommendations under:

- Initially, ensure that you have selected the proper document web template for that area/metropolis of your liking. See the kind description to make sure you have chosen the proper kind. If offered, take advantage of the Preview option to appear with the document web template too.

- If you would like discover yet another edition of your kind, take advantage of the Look for industry to obtain the web template that fits your needs and specifications.

- Upon having discovered the web template you would like, just click Buy now to carry on.

- Pick the rates plan you would like, enter your references, and register for an account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal bank account to fund the legitimate kind.

- Pick the structure of your document and download it for your product.

- Make adjustments for your document if required. It is possible to comprehensive, modify and indication and printing Puerto Rico Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

Down load and printing 1000s of document layouts utilizing the US Legal Forms site, that offers the greatest assortment of legitimate types. Use specialist and status-distinct layouts to handle your small business or personal requirements.

Form popularity

FAQ

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) of this section that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

If, within the 30-day period, the consumer disputes in writing any portion of the debt or requests the name and address of the original creditor, the collector must stop all collection efforts until he or she mails the consumer a copy of a judgment or verification of the debt, or the name and address of the original

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.