Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement?

US Legal Forms - one of the biggest libraries of legal varieties in the USA - provides an array of legal record layouts it is possible to down load or print. While using site, you can find a huge number of varieties for business and specific reasons, sorted by categories, says, or search phrases.You will discover the most recent types of varieties such as the Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement within minutes.

If you have a subscription, log in and down load Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement through the US Legal Forms catalogue. The Acquire button can look on each and every develop you see. You have accessibility to all earlier saved varieties in the My Forms tab of your own accounts.

If you want to use US Legal Forms the very first time, listed here are simple guidelines to get you started out:

- Be sure to have selected the best develop to your town/region. Click on the Preview button to analyze the form`s content. Browse the develop description to actually have chosen the appropriate develop.

- In case the develop doesn`t fit your demands, use the Look for industry towards the top of the monitor to find the one which does.

- When you are happy with the form, confirm your selection by clicking the Purchase now button. Then, pick the costs plan you like and give your accreditations to register to have an accounts.

- Process the deal. Utilize your bank card or PayPal accounts to finish the deal.

- Select the file format and down load the form on your own device.

- Make adjustments. Fill out, change and print and indicator the saved Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement.

Each and every design you included with your bank account does not have an expiry time and is also your own forever. So, if you would like down load or print one more version, just go to the My Forms segment and then click in the develop you need.

Gain access to the Puerto Rico Nonqualified Defined Benefit Deferred Compensation Agreement with US Legal Forms, one of the most comprehensive catalogue of legal record layouts. Use a huge number of specialist and condition-particular layouts that fulfill your organization or specific demands and demands.

Form popularity

FAQ

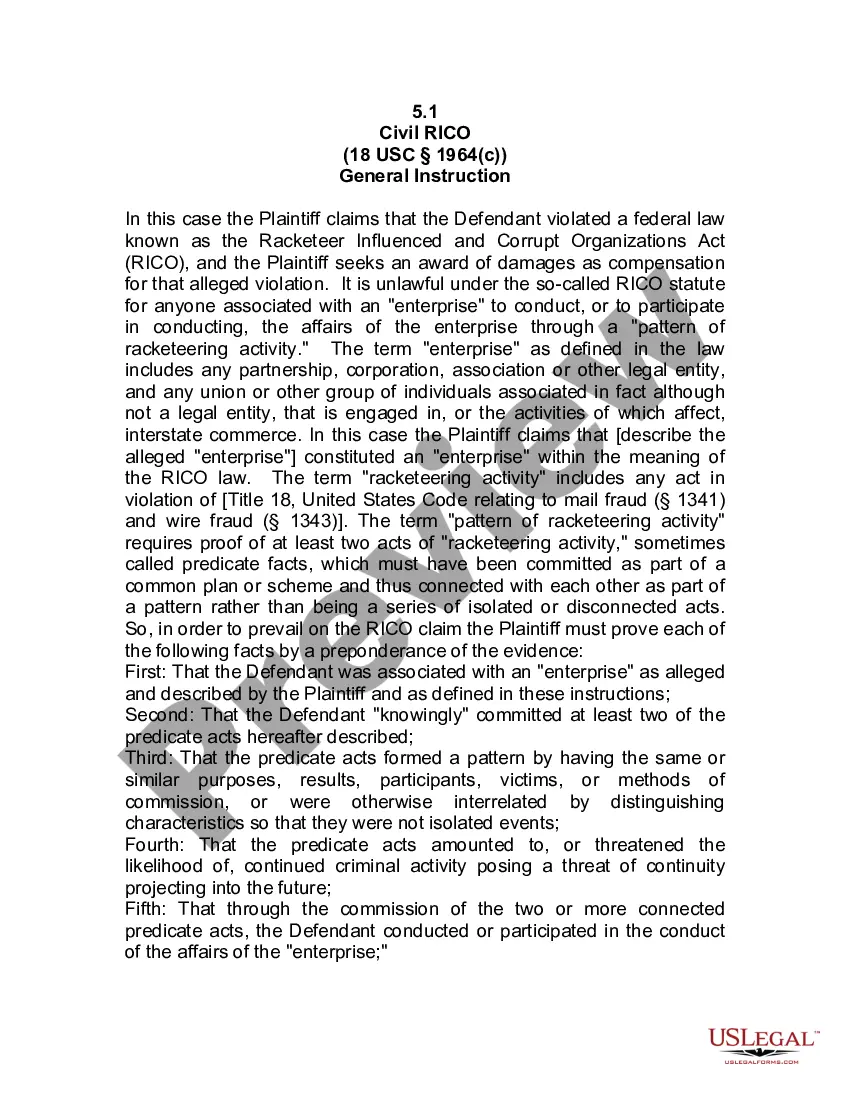

NQDC plans (sometimes known as deferred compensation programs, or DCPs, or elective deferral programs, or EDPs) allow executives to defer a much larger portion of their compensation and to defer taxes on the money until the deferral is paid.

Section 409A applies to anyone subject to U.S. federal income taxation who receives nonqualified deferred compensation, including (1) U.S. tax residents and (2) nonresidents of the United States who earn U.S.-source compensation.

Under Section 409A, deferral elections must be made by the end of the taxable year before the year in which deferrals are made. Companies generally hold open enrollment periods at the end of a year during which employees make their deferral elections for the following year.

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income. Unfortunately, it's challenging to project future tax rates. This takes analysis, projections, and assumptions.

The two main types of qualified employee benefit plans are a defined benefit and defined contribution structure. In a defined benefit structure, benefits are fixed with a guaranteed payout amount and the employer assumes the risk of investing.

Like a 401(k) plan, an NQDC plan allows employees to defer compensation until retirement or some other predetermined date. In addition to avoiding current income taxes on contributions, employees enjoy tax-deferred growth of accumulated earnings.

Definition of Nonqualified Deferred Compensation Plan 2022 A nonqualified deferred compensation plan is any plan that provides for the deferral of compensation. defined benefit SERPs) being one of those nine categories. Section 409A rules do not apply to qualified defined benefit plans.

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.

AND DOES ERISA APPLY TO RETIREMENT PLANS IN PUERTO RICO? Yes, it does! In fact, retirement plans intended to be qualified in Puerto Rico must comply with the applicable provisions of ERISA as a requisite for obtaining or maintaining such tax qualified status.