Puerto Rico Joint Filing of Rule 13d-1(f)(1) Agreement

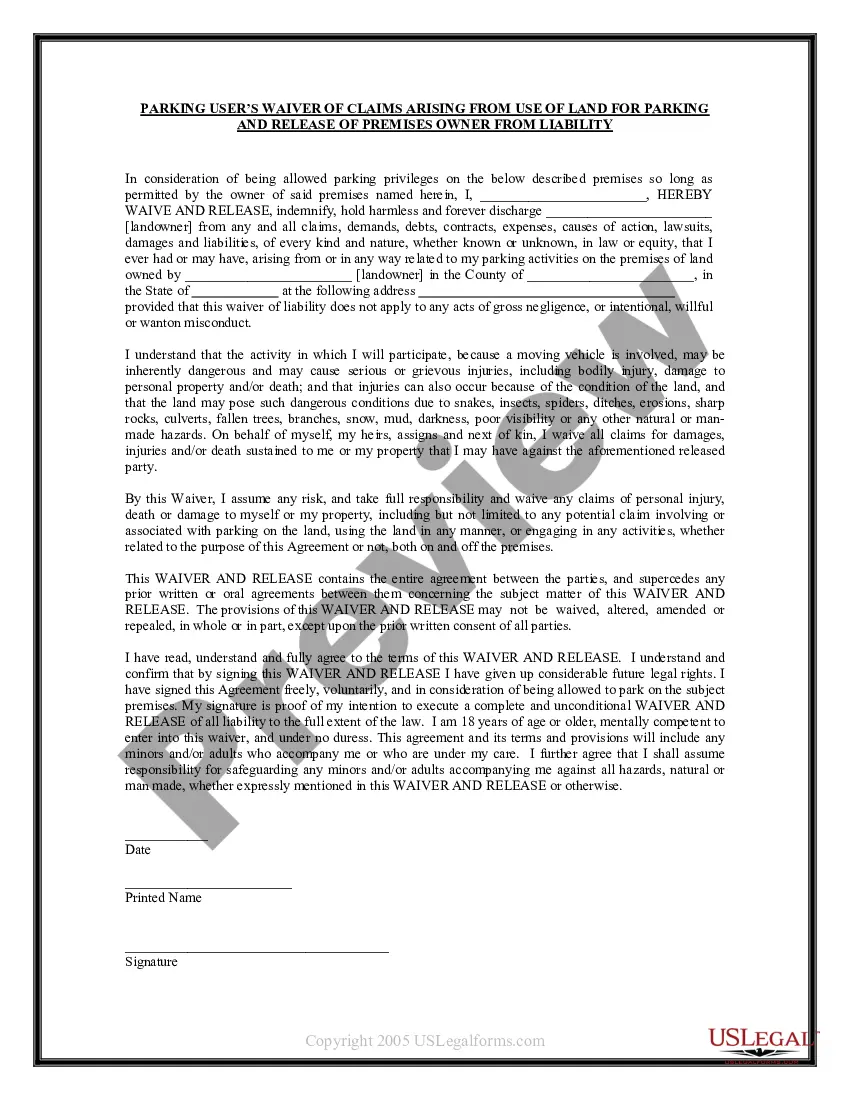

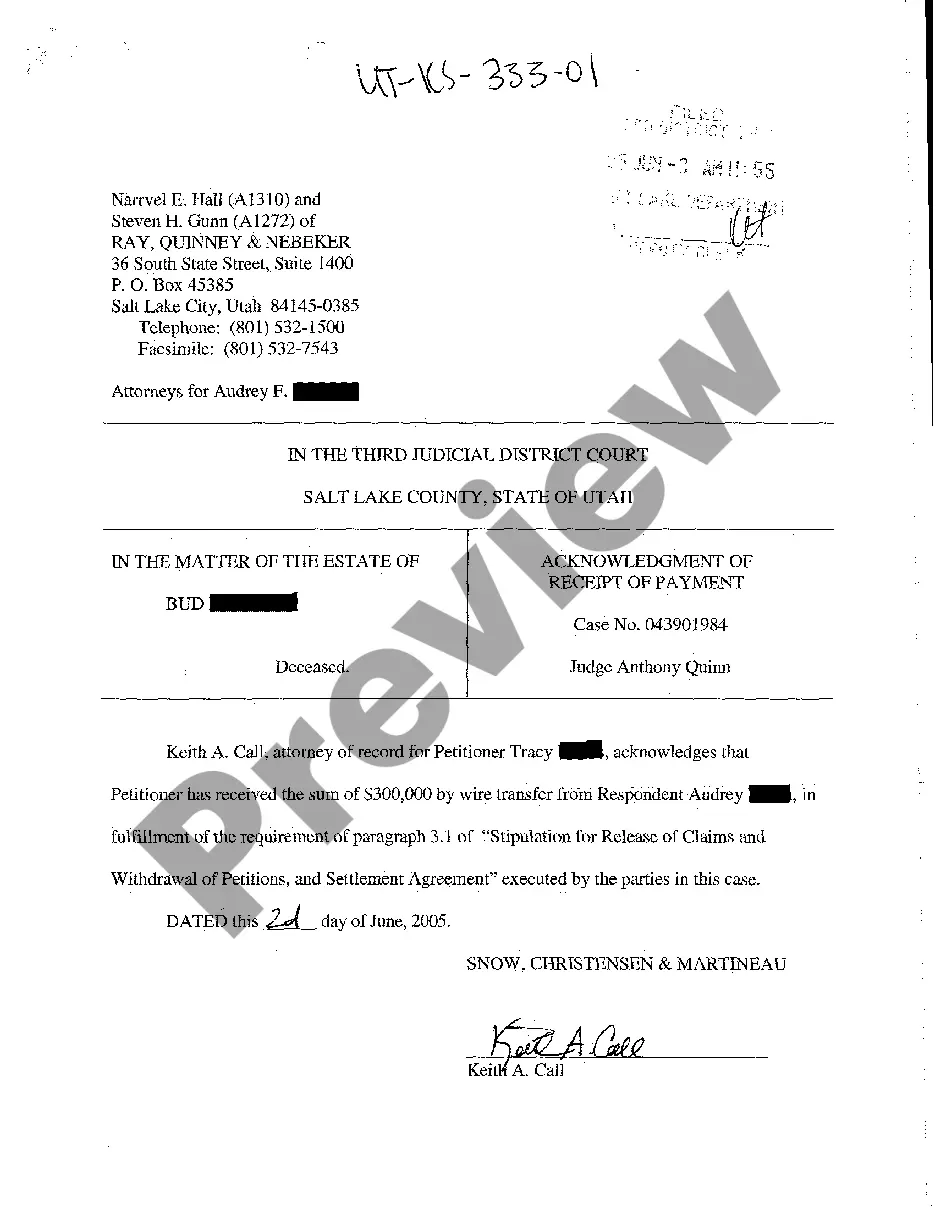

Description

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

Discovering the right lawful record web template can be a have a problem. Obviously, there are a variety of layouts available on the net, but how do you find the lawful develop you will need? Make use of the US Legal Forms internet site. The assistance provides 1000s of layouts, like the Puerto Rico Joint Filing of Rule 13d-1(f)(1) Agreement, which you can use for company and personal needs. All the kinds are checked out by specialists and fulfill federal and state needs.

If you are currently registered, log in to the profile and click the Obtain switch to find the Puerto Rico Joint Filing of Rule 13d-1(f)(1) Agreement. Use your profile to look with the lawful kinds you have purchased in the past. Visit the My Forms tab of your respective profile and get another version of the record you will need.

If you are a new consumer of US Legal Forms, listed below are basic directions that you can comply with:

- First, ensure you have selected the right develop for the metropolis/state. You are able to check out the form while using Preview switch and look at the form description to ensure it is the right one for you.

- When the develop will not fulfill your requirements, make use of the Seach discipline to obtain the right develop.

- When you are positive that the form is acceptable, go through the Buy now switch to find the develop.

- Choose the rates plan you would like and enter the necessary information. Create your profile and buy the order making use of your PayPal profile or charge card.

- Select the data file file format and acquire the lawful record web template to the gadget.

- Total, edit and printing and indicator the acquired Puerto Rico Joint Filing of Rule 13d-1(f)(1) Agreement.

US Legal Forms is definitely the most significant catalogue of lawful kinds in which you can see various record layouts. Make use of the service to acquire appropriately-manufactured documents that comply with state needs.

Form popularity

FAQ

Exchange Act Sections 13(d) and 13(g) and the related SEC rules require that an investor who beneficially owns more than five percent of a class of voting equity securities registered under Section 12 of the Exchange Act ("covered securities") report such beneficial ownership and certain changes in such ownership by ...

? Any person who acquires beneficial ownership of more than 5% of a class of equity. securities registered under Section 12 of the Securities Exchange Act of 1934, as amended. (the ?Exchange Act?) must report that acquisition on a Schedule 13D within 10 calendar. days of crossing the 5% threshold (Rule 13d-1(a)).

Item 4: Purpose of Transaction. This section of Schedule 13D alerts investors to any change of control that might be looming. Among other disclosures, beneficial owners must indicate whether they have plans involving a merger, reorganization, or liquidation of the issuer or any of its subsidiaries.

Section 13(d), for example, requires those acquiring a stake of 5% or more to make certain disclosures. Section 14(d) governs tender offers. And, Section 16(a) requires, among other things, 10% shareholders to make certain disclosures.

When a person or group of persons acquires beneficial ownership of more than five percent of a voting class of a company's equity securities registered under the Securities Exchange Act, they are required to file a Schedule 13D with the SEC.

Securities Act Rule 13d-3 defines ?beneficial owner? as ?any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (1) Voting power which includes the power to vote, or to direct the voting of, such security; and/or, (2) Investment power which ...

What Is Schedule 13D? Schedule 13D is a form that must be filed with the U.S. Securities and Exchange Commission (SEC) when a person or group acquires more than 5% of a voting class of a company's equity shares. Schedule 13D must be filed within 10 days of the filer reaching a 5% stake.

These beneficial owners must file with the SEC a Schedule 13D (or Schedule 13G if certain conditions are met), often referred to as beneficial ownership reports.