Title: Understanding the Puerto Rico Credit Agreement between Southwest Royalties, Inc. and Bank One Texas: Types and Key Aspects Explained Introduction: The Puerto Rico Credit Agreement between Southwest Royalties, Inc. and Bank One Texas serves as a critical financial instrument that outlines the terms, conditions, and obligations for extending credit facilities to support Southwest Royalties' operations. This article aims to provide a comprehensive understanding of the agreement, its various types, and key components. 1. Types of Puerto Rico Credit Agreements: (a) Revolving Credit Agreement: A revolving credit agreement allows Southwest Royalties, Inc. to borrow funds up to a predetermined limit as needed, replenishing the credit line once borrowed amounts are repaid. This arrangement offers flexibility and ensures ongoing access to working capital. (b) Term Loan Agreement: A term loan agreement provides Southwest Royalties, Inc. with a lump sum amount, often repaid over a specified period, which can be utilized for capital investments, expansions, or other specific business purposes. Interest rates and repayment schedules are typically predetermined. 2. Key Components of the Puerto Rico Credit Agreement: (a) Loan Terms and Amounts: The agreement specifies the total credit facility limits, including the amounts available under each type of credit, outlining the terms, such as interest rates and repayment schedules. (b) Purpose and Utilization: The agreement clarifies how Southwest Royalties, Inc. can use the borrowed funds, whether for general operational expenses, capital investments, project financing, mergers and acquisitions, or other authorized purposes. © Collateral and Guarantees: The credit agreement may require Southwest Royalties, Inc. to provide collateral, such as property or assets, as security for the loan. Guarantees from the company's principals or third-party contributors may also be necessary. (d) Interest Rates and Fees: The agreement sets out the interest rates applicable to the borrowed amount, which may be fixed or variable based on market conditions. Additionally, fees for loan origination, processing, or any other associated services are detailed. (e) Repayment and Amortization: The agreement outlines the repayment terms, frequency, and any amortization schedules. It may include options for early repayment, partial prepayment, or refinancing arrangements. (f) Events of Default and Covenants: The agreement stipulates events that could trigger default, such as non-payment or violation of agreed-upon covenants. Covenants can include financial ratios, maintenance of insurance coverage, and compliance with laws and regulations. (g) Governing Law and Dispute Resolution: The agreement specifies the jurisdiction whose laws will govern the agreement and the mechanism for resolving disputes, such as through arbitration or court proceedings. Conclusion: The Puerto Rico Credit Agreement between Southwest Royalties, Inc. and Bank One Texas forms the backbone of their financial relationship. By understanding its types and key components, both parties can establish a mutually beneficial credit arrangement that supports Southwest Royalties' growth and ensures Bank One Texas's risk mitigation. It is essential for both parties to engage legal counsel to draft, review, and negotiate the terms of the agreement to safeguard their interests and maintain a thriving partnership.

Puerto Rico Credit Agreement between Southwest Royalties, Inc. and Bank One Texas

Description

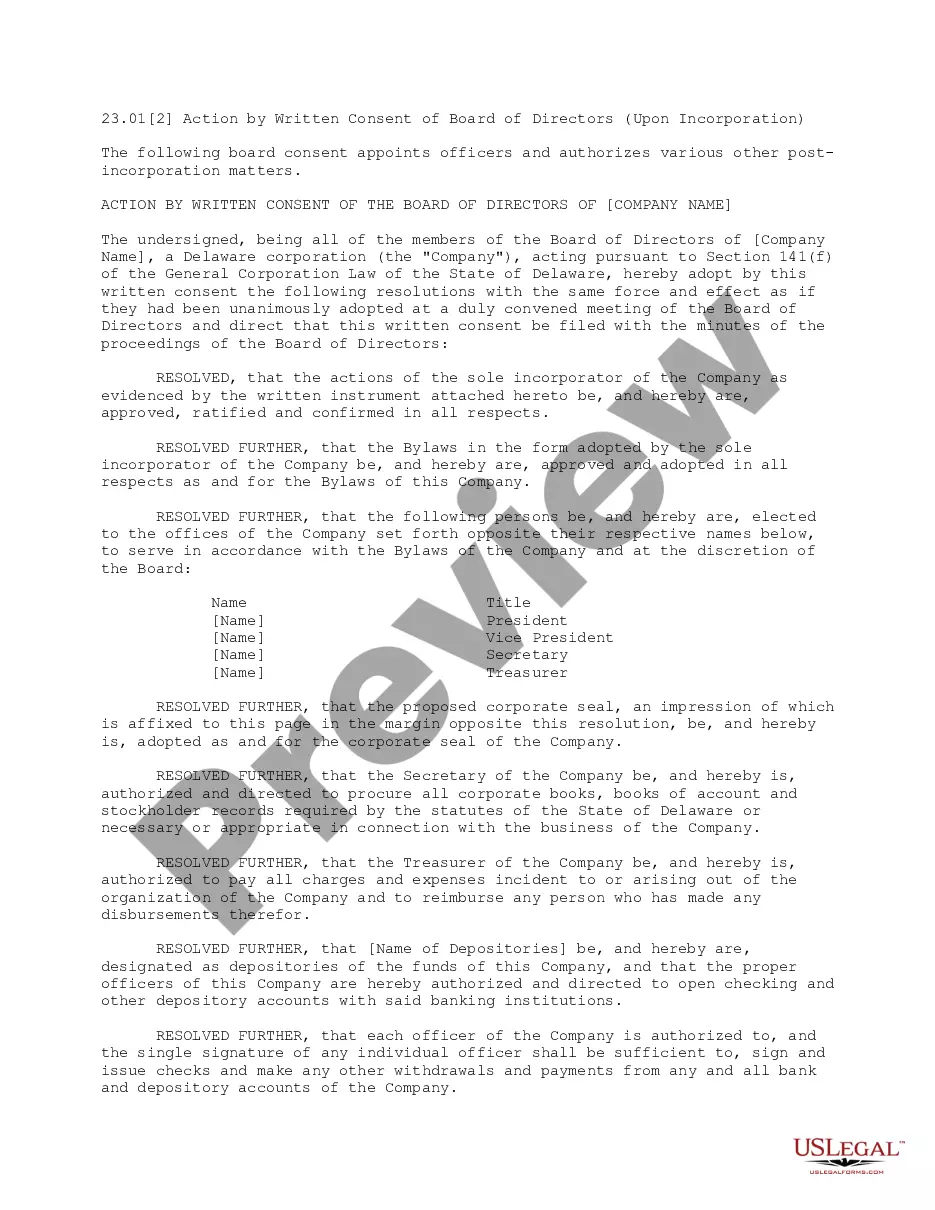

How to fill out Puerto Rico Credit Agreement Between Southwest Royalties, Inc. And Bank One Texas?

Choosing the right lawful file design can be a battle. Of course, there are a lot of layouts available on the net, but how do you discover the lawful form you need? Use the US Legal Forms internet site. The service provides thousands of layouts, such as the Puerto Rico Credit Agreement between Southwest Royalties, Inc. and Bank One Texas, that can be used for organization and personal requires. All the types are examined by specialists and meet state and federal demands.

When you are currently registered, log in in your account and click on the Obtain switch to get the Puerto Rico Credit Agreement between Southwest Royalties, Inc. and Bank One Texas. Make use of account to look from the lawful types you might have purchased previously. Go to the My Forms tab of the account and get yet another copy of the file you need.

When you are a fresh customer of US Legal Forms, listed below are simple instructions that you should adhere to:

- Initially, ensure you have selected the appropriate form for the city/county. You can look through the shape using the Preview switch and study the shape description to make sure it will be the best for you.

- When the form does not meet your needs, make use of the Seach discipline to get the right form.

- When you are certain the shape is suitable, click on the Get now switch to get the form.

- Opt for the pricing strategy you want and enter the essential details. Create your account and buy an order making use of your PayPal account or credit card.

- Choose the data file structure and acquire the lawful file design in your device.

- Comprehensive, change and print out and indication the attained Puerto Rico Credit Agreement between Southwest Royalties, Inc. and Bank One Texas.

US Legal Forms will be the largest catalogue of lawful types in which you will find numerous file layouts. Use the company to acquire appropriately-manufactured files that adhere to condition demands.