Puerto Rico Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

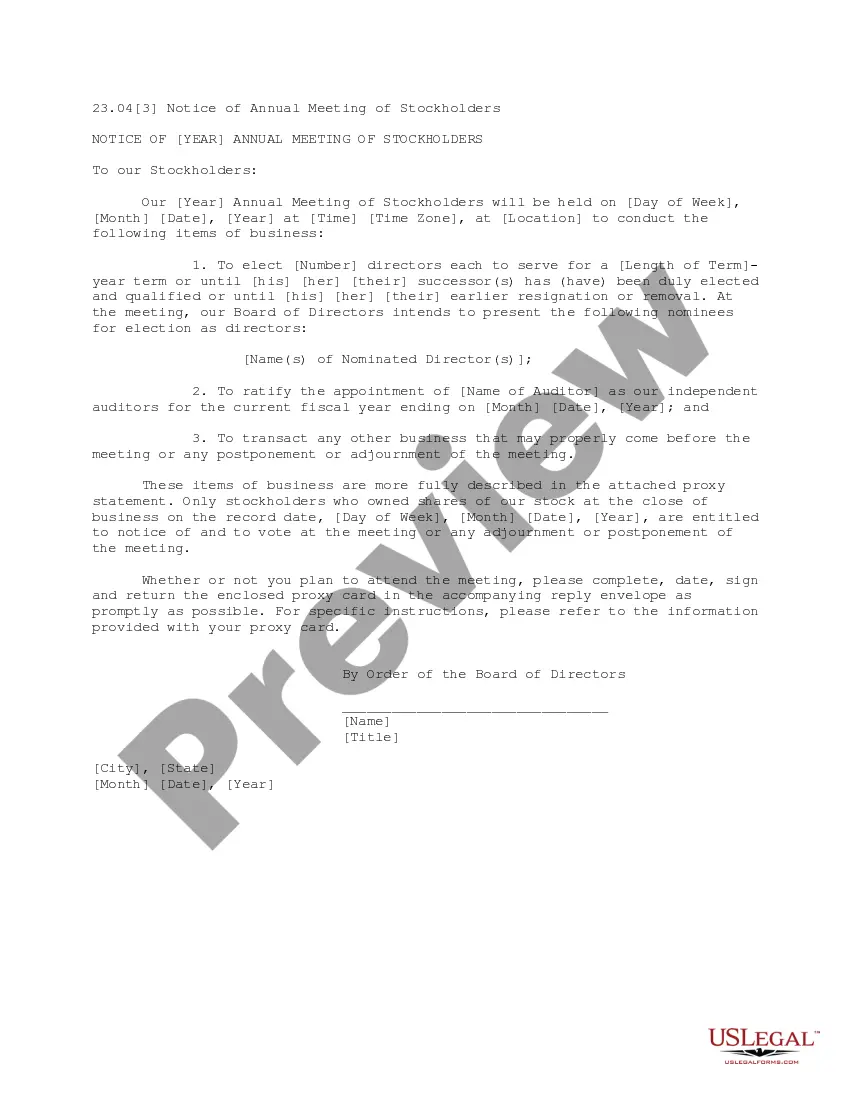

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

Choosing the right legitimate papers template can be quite a have difficulties. Naturally, there are tons of themes available on the net, but how do you get the legitimate type you require? Take advantage of the US Legal Forms web site. The assistance offers a large number of themes, like the Puerto Rico Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P., which you can use for organization and personal requires. Every one of the kinds are examined by pros and satisfy federal and state specifications.

Should you be currently authorized, log in to the accounts and click the Download key to get the Puerto Rico Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.. Use your accounts to check throughout the legitimate kinds you have acquired earlier. Proceed to the My Forms tab of your accounts and have one more duplicate of the papers you require.

Should you be a fresh user of US Legal Forms, listed here are easy guidelines that you can follow:

- First, make certain you have chosen the right type for your personal area/area. You are able to look through the shape while using Review key and study the shape explanation to guarantee it is the best for you.

- If the type fails to satisfy your requirements, make use of the Seach area to discover the appropriate type.

- Once you are certain the shape is suitable, click on the Acquire now key to get the type.

- Choose the prices prepare you desire and type in the needed information. Create your accounts and buy your order making use of your PayPal accounts or bank card.

- Pick the submit formatting and download the legitimate papers template to the gadget.

- Complete, edit and printing and sign the attained Puerto Rico Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

US Legal Forms will be the greatest collection of legitimate kinds that you can see different papers themes. Take advantage of the service to download appropriately-created paperwork that follow condition specifications.