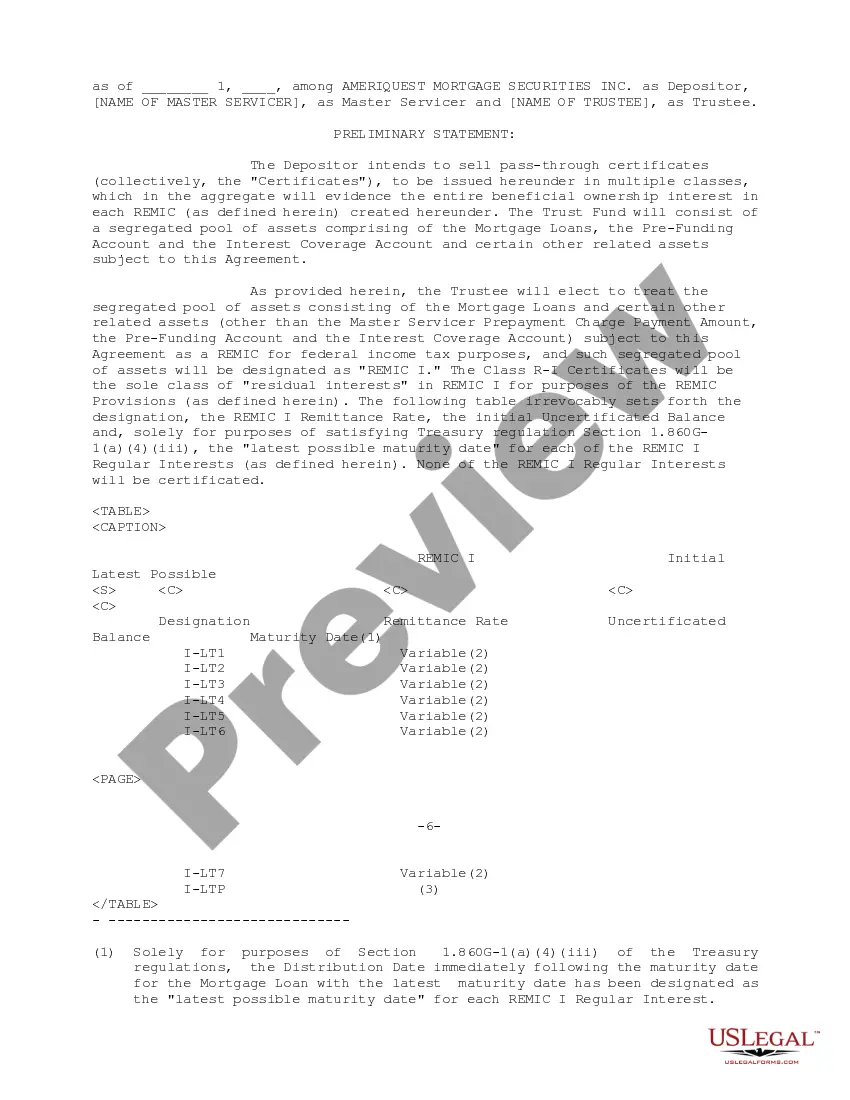

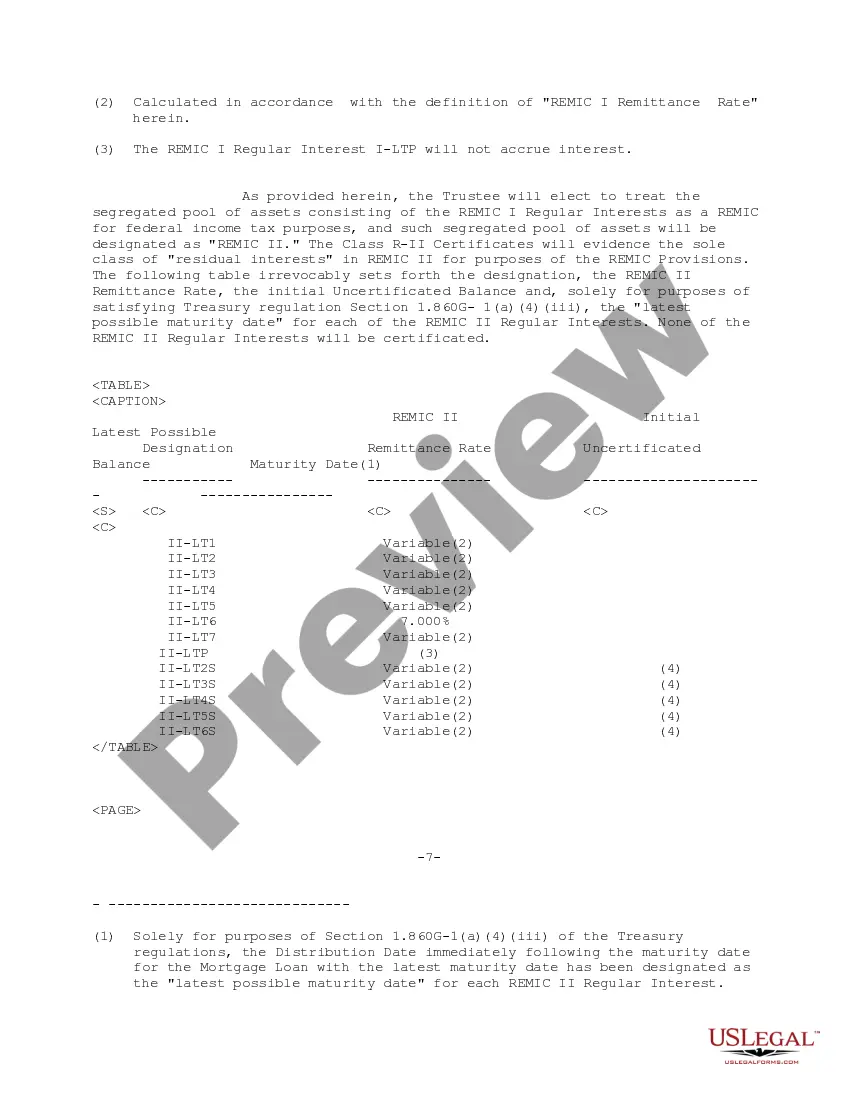

Puerto Rico Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

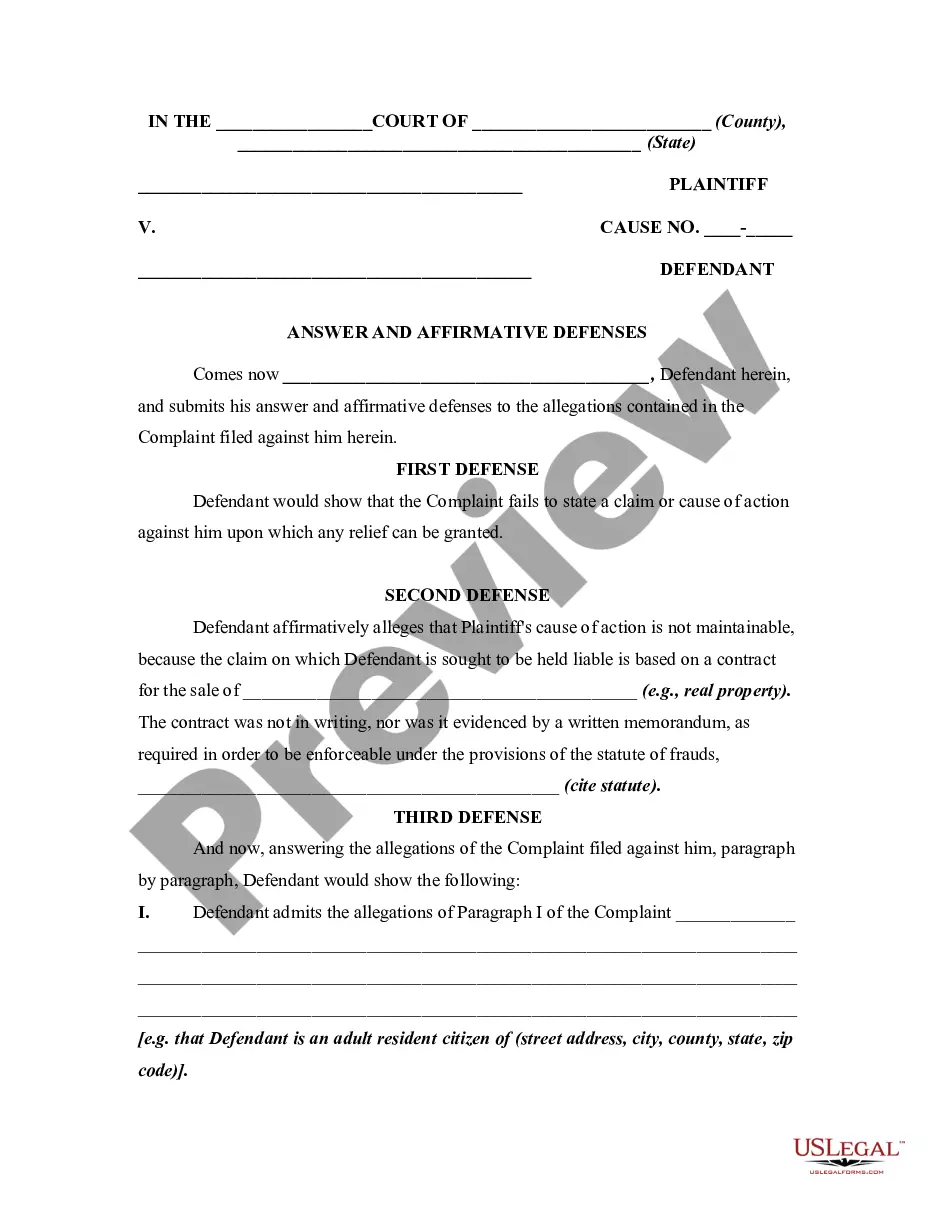

It is possible to spend hrs on the web looking for the legitimate record template that fits the state and federal needs you want. US Legal Forms provides a huge number of legitimate types which can be reviewed by specialists. It is simple to download or print the Puerto Rico Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. from my assistance.

If you already possess a US Legal Forms profile, you may log in and click on the Down load option. Next, you may comprehensive, edit, print, or indication the Puerto Rico Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.. Each legitimate record template you buy is your own permanently. To have yet another duplicate for any bought type, check out the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms website the first time, stick to the easy recommendations below:

- First, make sure that you have chosen the right record template for the state/city of your choice. Browse the type description to ensure you have selected the proper type. If readily available, make use of the Preview option to appear from the record template also.

- If you would like discover yet another version in the type, make use of the Search discipline to discover the template that fits your needs and needs.

- Upon having located the template you desire, just click Purchase now to proceed.

- Select the rates plan you desire, enter your qualifications, and register for an account on US Legal Forms.

- Comprehensive the purchase. You should use your bank card or PayPal profile to fund the legitimate type.

- Select the file format in the record and download it for your product.

- Make adjustments for your record if necessary. It is possible to comprehensive, edit and indication and print Puerto Rico Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc..

Down load and print a huge number of record layouts while using US Legal Forms website, which provides the most important collection of legitimate types. Use skilled and status-specific layouts to tackle your organization or individual needs.

Form popularity

FAQ

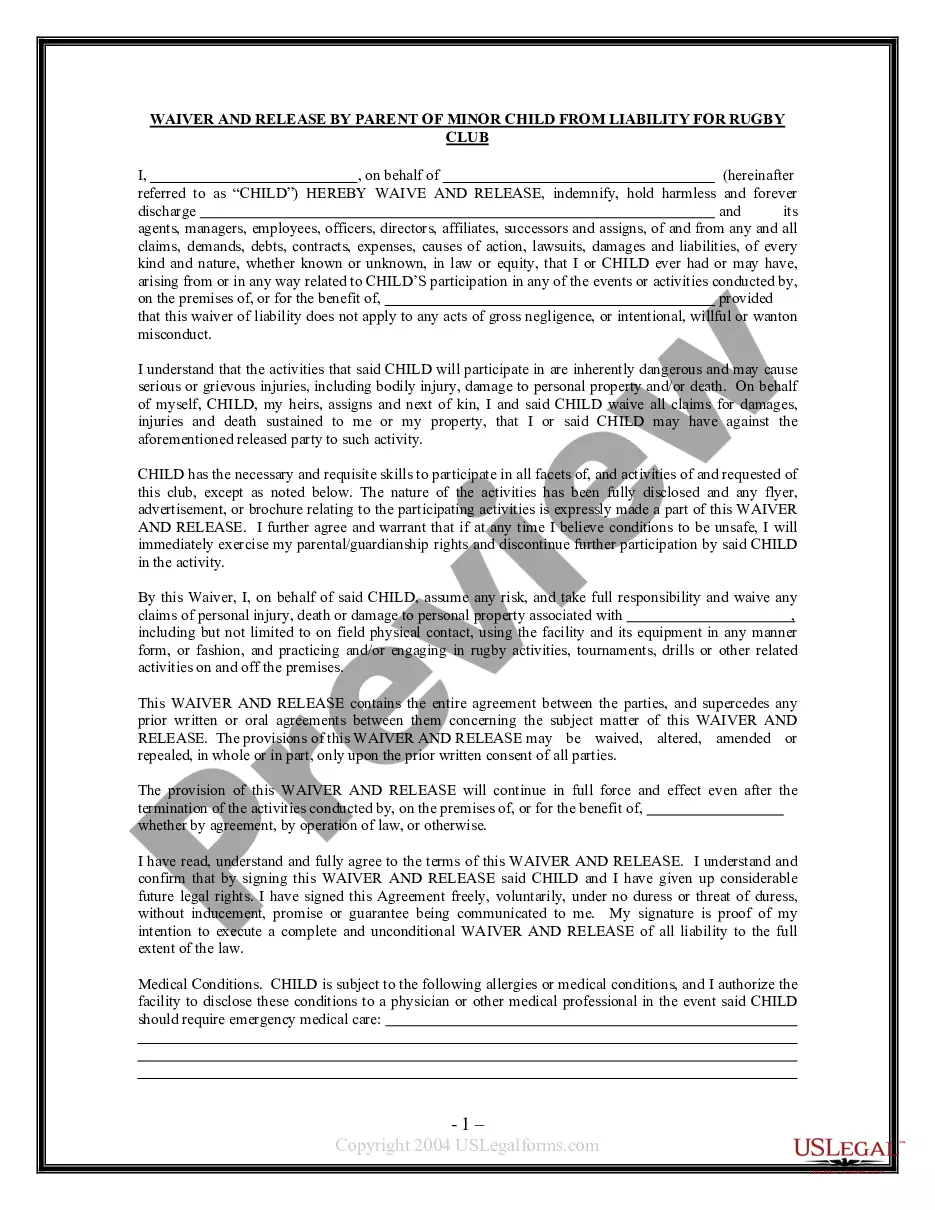

Tranches are segments created from a pool of securities?usually debt instruments such as bonds or mortgages?that are divvied up by risk, time to maturity, or other characteristics in order to be marketable to different investors.

Mortgage-backed securities (MBS) are variations of asset-backed securities that are formed by pooling together mortgages exclusively. The investor who buys a mortgage-backed security is essentially lending money to home buyers. An MBS can be bought and sold through a broker.

What Is a Mortgage Pool? A mortgage pool is a group of mortgages held in trust as collateral for the issuance of a mortgage-backed security. Some mortgage-backed securities issued by Fannie Mae, Freddie Mac, and Ginnie Mae are known as "pools" themselves. These are the simplest form of mortgage-backed security.

NOTE: Another way to find a PSA is to go to the SEC EDGAR search index page: .

Types of Tranches Senior Tranches. Senior tranches, often called the 'A-Tranche,' represent the most secure portions of a debt security. ... Mezzanine Tranches. ... Junior Tranches. ... Risk Profile. ... Yhield and Return. ... Credit Ratings. ... Tranche Slicing. ... Cash Flow Waterfall.

A collateralized mortgage obligation (CMO) is a fixed-income security with a pool of mortgage loans that are similar in a variety of ways, like credit score or loan amount, and are combined and resold as a single packaged investment to investors called a security.

Lenders mortgage insurance (LMI), also known as private mortgage insurance (PMI) in the US, is a type of insurance payable to a lender or to a trustee for a pool of securities that may be required when taking out a mortgage loan.

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.