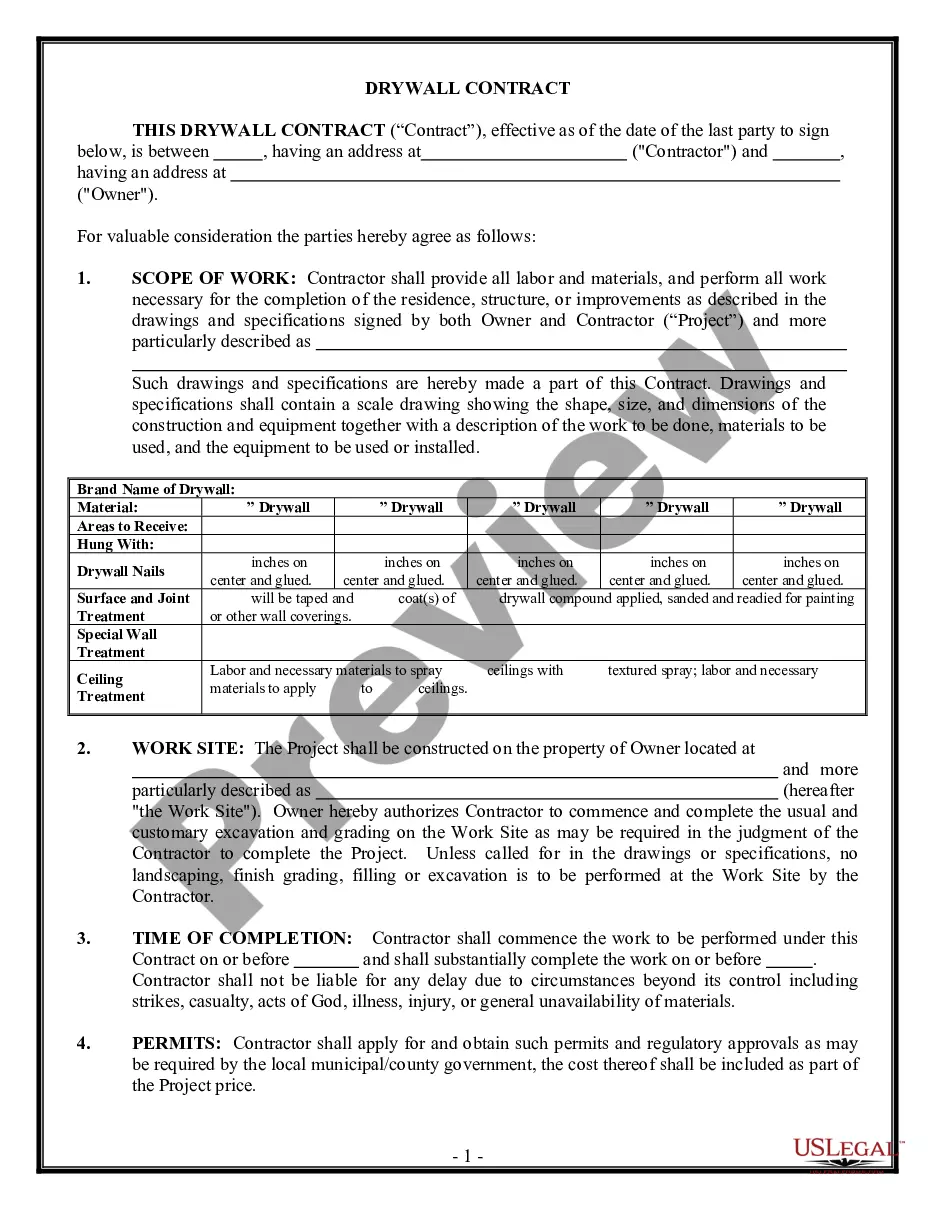

Puerto Rico Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund

Description

How to fill out Sample Purchase Agreement Between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund?

If you have to comprehensive, obtain, or print out legitimate record web templates, use US Legal Forms, the largest assortment of legitimate varieties, that can be found on the web. Take advantage of the site`s simple and easy convenient lookup to discover the files you will need. Numerous web templates for organization and personal purposes are sorted by classes and states, or key phrases. Use US Legal Forms to discover the Puerto Rico Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund in a handful of clicks.

If you are presently a US Legal Forms customer, log in for your profile and click on the Download key to have the Puerto Rico Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund. You can also accessibility varieties you previously acquired within the My Forms tab of your own profile.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape for that correct metropolis/nation.

- Step 2. Take advantage of the Review method to look over the form`s articles. Do not forget about to learn the outline.

- Step 3. If you are not happy using the type, utilize the Search discipline on top of the monitor to locate other variations in the legitimate type template.

- Step 4. Upon having found the shape you will need, click on the Get now key. Pick the prices program you prefer and add your credentials to sign up on an profile.

- Step 5. Process the transaction. You may use your credit card or PayPal profile to accomplish the transaction.

- Step 6. Choose the formatting in the legitimate type and obtain it on your own system.

- Step 7. Complete, revise and print out or sign the Puerto Rico Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund.

Every legitimate record template you acquire is your own forever. You possess acces to every single type you acquired with your acccount. Go through the My Forms section and select a type to print out or obtain again.

Contend and obtain, and print out the Puerto Rico Sample Purchase Agreement between Cell Pathways, Inc., MAS Funds Small Cap Value Portfolio, Van Kampen American Value Fund with US Legal Forms. There are millions of expert and status-certain varieties you can use for the organization or personal needs.