Puerto Rico Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors

Description

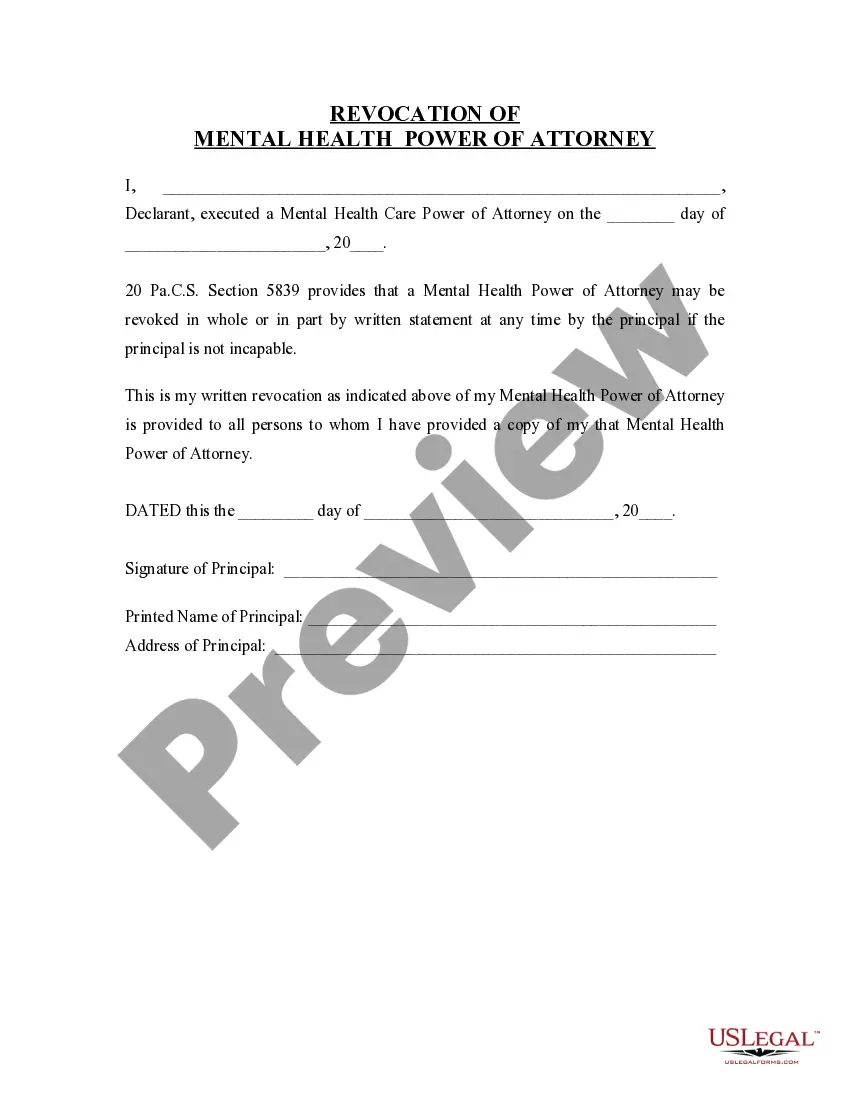

How to fill out Stockholders Agreement Between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, And Rollover Investors?

US Legal Forms - one of many largest libraries of legal kinds in America - delivers a wide array of legal record layouts you may download or print. Utilizing the internet site, you may get a large number of kinds for organization and individual functions, sorted by categories, says, or key phrases.You can get the most recent versions of kinds like the Puerto Rico Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors in seconds.

If you have a monthly subscription, log in and download Puerto Rico Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors from the US Legal Forms library. The Acquire button will show up on every single develop you see. You gain access to all in the past downloaded kinds inside the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, here are straightforward guidelines to help you get started:

- Be sure you have picked the proper develop for your personal metropolis/county. Click on the Preview button to check the form`s content material. Look at the develop information to actually have chosen the appropriate develop.

- In case the develop does not match your specifications, take advantage of the Lookup discipline on top of the display to discover the one that does.

- When you are happy with the shape, validate your option by visiting the Acquire now button. Then, select the costs program you like and give your qualifications to register to have an bank account.

- Process the financial transaction. Make use of Visa or Mastercard or PayPal bank account to accomplish the financial transaction.

- Find the file format and download the shape on your gadget.

- Make alterations. Complete, edit and print and signal the downloaded Puerto Rico Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors.

Every web template you added to your account does not have an expiry particular date which is your own property for a long time. So, if you would like download or print an additional backup, just visit the My Forms section and click on the develop you require.

Obtain access to the Puerto Rico Stockholders Agreement between Unilab Corp., Kelso Investment Associates VI, LLP, KEP VI, LLC, EOS Partners, LP, Pequot Scout Fund, LP, and Rollover Investors with US Legal Forms, probably the most comprehensive library of legal record layouts. Use a large number of professional and condition-particular layouts that meet your small business or individual demands and specifications.