Puerto Rico Natural Gas Inventory Forward Sale Contract is a financial agreement that allows buyers and sellers to trade natural gas inventory in Puerto Rico at a predetermined price and future date. It is a derivative contract used by energy companies, utilities, and investors to manage their exposure to price fluctuations in the natural gas market. This contract enables participants to secure a fixed price for the delivery of natural gas in the future, which helps them in planning and budgeting for their fuel needs. The primary goal of this forward sale contract is to mitigate price risk and ensure a stable supply of natural gas for the island of Puerto Rico. Key participants in the Puerto Rico Natural Gas Inventory Forward Sale Contract are natural gas producers, suppliers, distributors, and end-users. Producers aim to lock in prices to ensure profitability and secure demand for their production. Suppliers and distributors utilize the contract to ensure a consistent supply of natural gas to meet customer requirements. End-users such as power plants, industrial facilities, and residential consumers benefit from a stable and predictable fuel pricing structure. There are several types of Puerto Rico Natural Gas Inventory Forward Sale Contracts available, depending on the specific requirements and preferences of the participants: 1. Fixed-Volume Contracts: These contracts establish a fixed quantity of natural gas to be delivered at a predetermined price over a specified future period. Both the buyer and seller agree on the volume and price upfront, providing certainty in supply and cost. 2. Swing Contracts: Swing contracts enable buyers to have flexibility in the quantity of natural gas they can purchase within a specified range. This allows them to adjust their purchases based on fluctuating demand and consumption patterns. 3. Indexed Contracts: Indexed contracts tie the price of natural gas to a specific market index, such as the NYMEX (New York Mercantile Exchange) natural gas futures contract. This type of contract provides a benchmark price and allows participants to align their costs with prevailing market rates. 4. Heat Rate Contracts: Heat rate contracts establish the price of natural gas based on the efficiency of energy conversion from natural gas to electricity. This mechanism is particularly relevant for electricity generators or power plants. These various contract types cater to the diverse needs of participants in the Puerto Rico natural gas market, allowing them to effectively manage price volatility and ensure a reliable supply of energy.

Puerto Rico Natural Gas Inventory Forward Sale Contract

Description

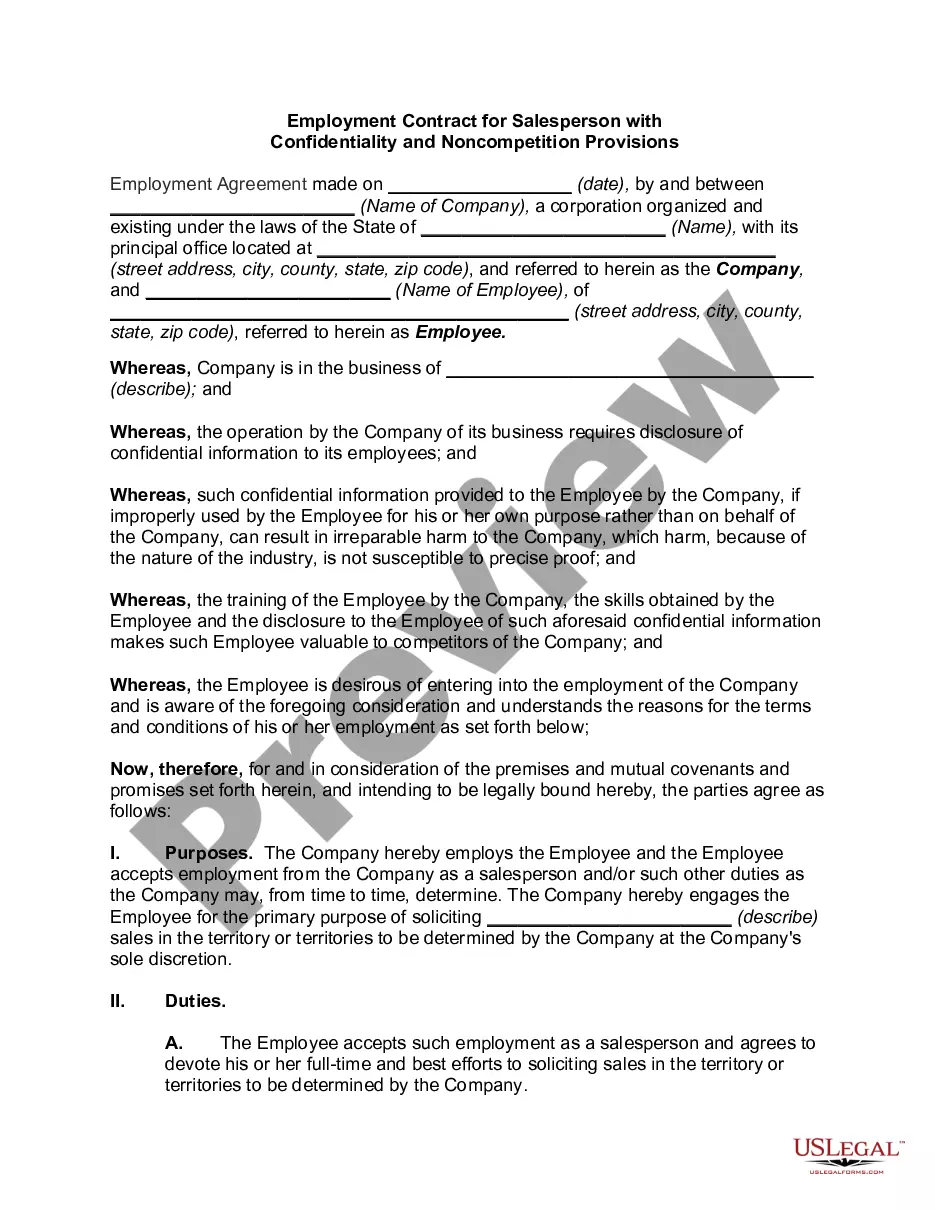

How to fill out Puerto Rico Natural Gas Inventory Forward Sale Contract?

If you have to full, down load, or print lawful file themes, use US Legal Forms, the largest assortment of lawful forms, that can be found on the web. Make use of the site`s easy and handy search to obtain the papers you want. Numerous themes for organization and specific reasons are categorized by categories and claims, or search phrases. Use US Legal Forms to obtain the Puerto Rico Natural Gas Inventory Forward Sale Contract within a handful of clicks.

In case you are presently a US Legal Forms customer, log in to the account and then click the Download key to find the Puerto Rico Natural Gas Inventory Forward Sale Contract. You may also access forms you earlier saved inside the My Forms tab of the account.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have selected the shape for the correct town/country.

- Step 2. Utilize the Review solution to examine the form`s information. Never forget about to read through the explanation.

- Step 3. In case you are not happy together with the kind, use the Search field towards the top of the display to discover other types in the lawful kind web template.

- Step 4. Upon having discovered the shape you want, select the Acquire now key. Pick the costs plan you favor and include your qualifications to sign up to have an account.

- Step 5. Approach the transaction. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format in the lawful kind and down load it in your device.

- Step 7. Total, change and print or sign the Puerto Rico Natural Gas Inventory Forward Sale Contract.

Every lawful file web template you buy is yours eternally. You have acces to each and every kind you saved inside your acccount. Click the My Forms section and choose a kind to print or down load again.

Compete and down load, and print the Puerto Rico Natural Gas Inventory Forward Sale Contract with US Legal Forms. There are millions of skilled and express-distinct forms you can utilize for the organization or specific requirements.