Puerto Rico Pledge Agreement between ADAC Laboratories and ABN AFRO Bank, N.V., is a legally binding contract that outlines the terms and conditions of a financial arrangement between these two entities in relation to collateral provided by ADAC Laboratories. Keywords: Puerto Rico, Pledge Agreement, ADAC Laboratories, ABN AFRO Bank, N.V., collateral, contract, financial arrangement. A Puerto Rico Pledge Agreement is a common type of contract used in financial transactions. It typically involves a debtor, in this case, ADAC Laboratories, offering collateral to a creditor, ABN AFRO Bank, N.V., to secure a loan or other forms of financial assistance. The agreement ensures that the creditor has a claim on the collateral provided by the debtor in case of default or non-payment. There can be different types of Puerto Rico Pledge Agreements based on the specific terms and conditions agreed upon by the involved parties. These variations may include: 1. Traditional Pledge Agreement: This is the standard form of the agreement, where ADAC Laboratories pledges a specific asset or assets as collateral to ABN AFRO Bank, N.V. The asset could be real estate, inventory, equipment, or any other valuable item acceptable to the creditor. 2. Floating Pledge Agreement: In this type of agreement, ADAC Laboratories pledges a fluctuating pool of assets as collateral. These assets may change over time due to inventory turnover, investments, or other factors defined in the agreement. This provides flexibility to the debtor while still ensuring collateral for the creditor. 3. Cross-Collateralization Agreement: This agreement involves ADAC Laboratories offering multiple assets as collateral, which may include real estate, stock holdings, accounts receivable, or any other valuable item. The creditor has a claim on all the collateral provided, regardless of its individual worth. 4. Intercreditor Agreement: In some cases, multiple creditors may be involved in a financial arrangement with ADAC Laboratories. An intercreditor agreement establishes the priority and rights of each creditor in relation to the pledged collateral. This ensures that ABN AFRO Bank, N.V. has a clear understanding of its position compared to other creditors. Regardless of the specific type of Puerto Rico Pledge Agreement, it is essential for both ADAC Laboratories and ABN AFRO Bank, N.V. to carefully review and negotiate the terms to ensure clarity, protection of rights, and to mitigate any potential risks or disputes in the future.

Puerto Rico Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V.

Description

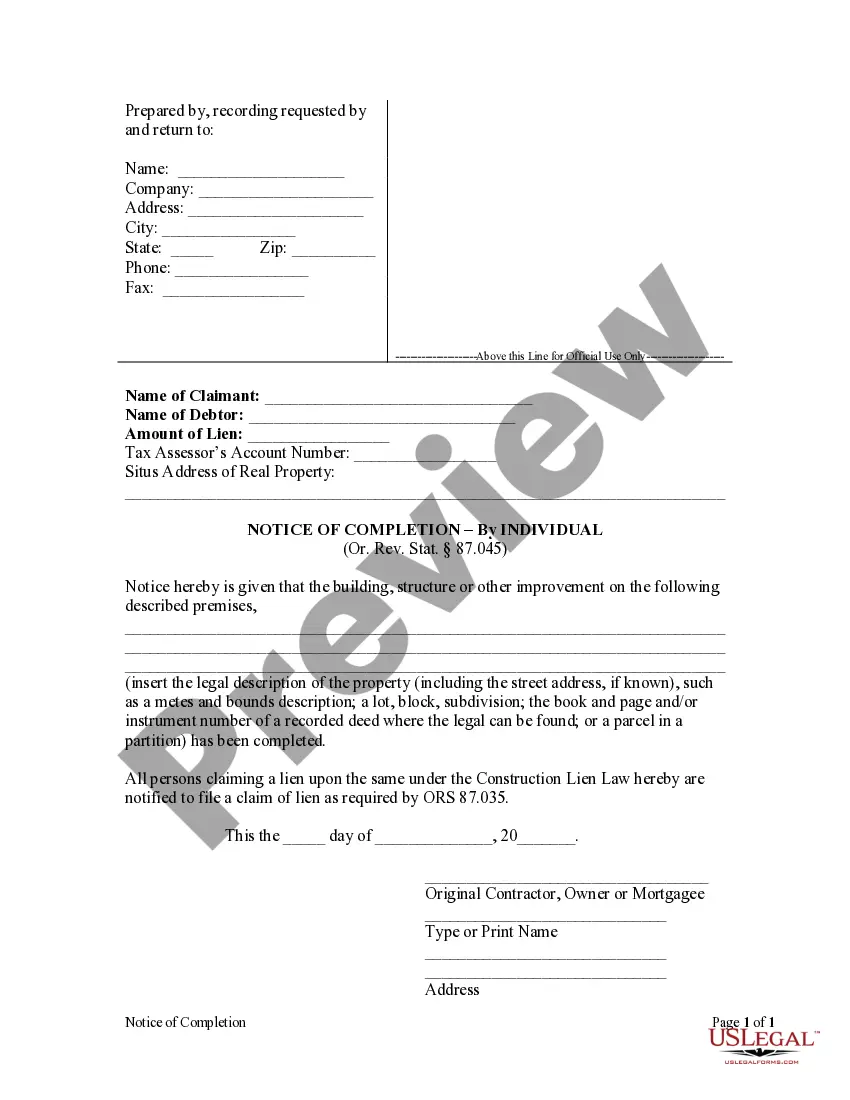

How to fill out Puerto Rico Pledge Agreement Between ADAC Laboratories And ABN AMRO Bank, N.V.?

Choosing the right legitimate papers web template can be a have difficulties. Needless to say, there are tons of templates available on the net, but how do you discover the legitimate kind you will need? Take advantage of the US Legal Forms website. The service provides a large number of templates, for example the Puerto Rico Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V., which can be used for organization and personal requirements. Every one of the forms are checked out by specialists and satisfy federal and state requirements.

In case you are previously authorized, log in to your account and click on the Down load option to get the Puerto Rico Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V.. Make use of account to appear through the legitimate forms you may have purchased in the past. Go to the My Forms tab of your respective account and get yet another duplicate from the papers you will need.

In case you are a fresh consumer of US Legal Forms, listed here are simple instructions so that you can comply with:

- Initially, be sure you have chosen the proper kind for your town/county. You may look over the form making use of the Review option and study the form description to make certain this is basically the best for you.

- In the event the kind is not going to satisfy your expectations, make use of the Seach field to find the appropriate kind.

- When you are sure that the form is suitable, go through the Acquire now option to get the kind.

- Choose the prices prepare you desire and type in the essential information and facts. Create your account and buy an order making use of your PayPal account or bank card.

- Opt for the submit formatting and acquire the legitimate papers web template to your device.

- Total, change and produce and indication the acquired Puerto Rico Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V..

US Legal Forms will be the biggest local library of legitimate forms in which you can find numerous papers templates. Take advantage of the service to acquire professionally-manufactured papers that comply with condition requirements.