Title: Understanding the Puerto Rico Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. Introduction: The Puerto Rico Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. represents a strategic business move aiming to combine the resources, strengths, and market presence of these entities. This detailed description sheds light on the objectives, outcomes, and various types of mergers involved in this process. 1. Definition and Objectives: A merger is a corporate strategy where two or more companies come together to form a single new company, resulting in various synergies such as increased market share, cost efficiency, expanded product portfolio, and enhanced customer base. The Puerto Rico Plan of Merger aims to utilize these advantages to increase business competitiveness and maximize shareholder value for the involved entities. 2. Parties Involved: a) Food Lion, Inc., one of the largest supermarket chains in Puerto Rico, renowned for its quality products and customer-centric approach. b) Hanna ford Brothers Company, another prominent supermarket chain operating in Puerto Rico, known for its Fresh and Local philosophy and commitment to sustainability. c) FL Acquisition Sub, Inc., a specialized business entity formed for the merger, responsible for facilitating the merger process and ensuring a smooth transition. 3. Types of Mergers: a) Horizontal Merger: In this case, Food Lion, Inc., and Hanna ford Brothers Company belong to the same industry (supermarkets) and merge to form a new, more dominant organization. This merger allows the combined company to eliminate competition, increase market share, and exploit economies of scale. b) Strategic Merger: The merger between Food Lion, Inc., and Hanna ford Brothers Company is strategic in nature, driven by shared goals, complementary strengths, and mutual benefits in terms of market diversification and enhanced operational efficiencies. 4. Benefits and Outcomes: a) Increased Market Presence: The merger results in a stronger market presence within Puerto Rico, allowing the combined company to serve a broader customer base effectively. b) Operational Synergies: By integrating their supply chains, logistics, and processes, the merged entity can achieve cost savings, optimize operations, and provide improved customer experiences. c) Portfolio Diversification: Consolidating their product offerings and leveraging their respective strengths, the merged company can offer a wider range of high-quality products, meeting diverse customer needs. d) Enhanced Innovation: Pooling together their resources and expertise, the merger facilitates innovation by promoting the development of new products, services, and sustainable business practices. e) Shareholder Value: Through improved profitability and long-term growth prospects, the merger seeks to generate higher returns for shareholders and enable future investments and expansion. Conclusion: The Puerto Rico Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. represents a significant strategic move aimed at creating a stronger and more competitive single entity within Puerto Rico's supermarket industry. By combining their resources, market presence, and business strengths, the merging companies anticipate increased market share, operational efficiencies, portfolio diversification, and innovation, ultimately benefiting their shareholders and the local community.

Puerto Rico Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

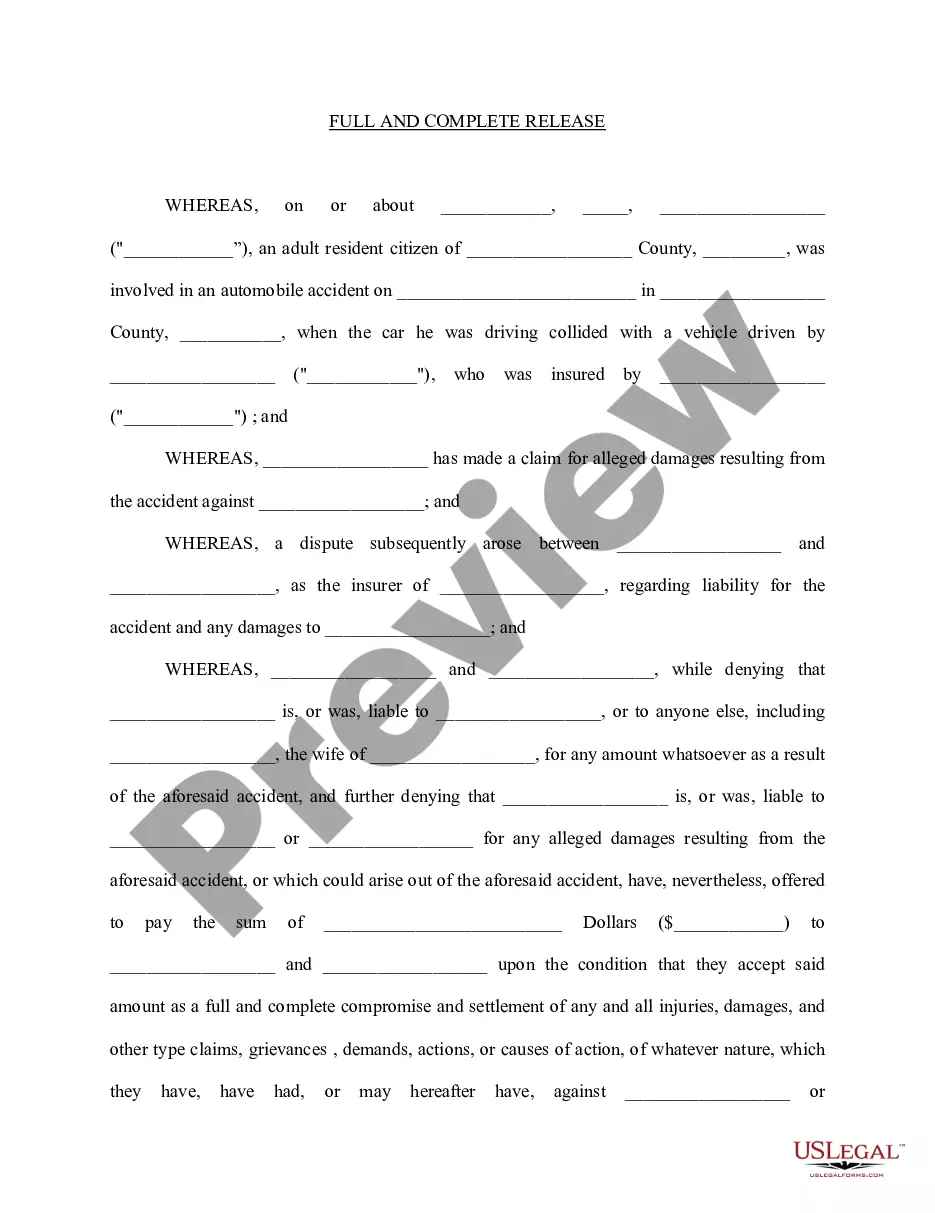

How to fill out Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

It is possible to devote hrs on the Internet attempting to find the legitimate record format that meets the state and federal demands you will need. US Legal Forms gives a large number of legitimate kinds which are examined by pros. It is possible to download or produce the Puerto Rico Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. from my services.

If you currently have a US Legal Forms profile, you may log in and then click the Obtain switch. Next, you may comprehensive, revise, produce, or signal the Puerto Rico Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.. Every single legitimate record format you get is your own forever. To have one more backup associated with a purchased develop, visit the My Forms tab and then click the related switch.

Should you use the US Legal Forms site for the first time, stick to the straightforward instructions listed below:

- Very first, make certain you have selected the right record format for that county/city of your choice. Read the develop outline to make sure you have picked the appropriate develop. If accessible, use the Preview switch to appear through the record format too.

- If you want to get one more version of your develop, use the Look for field to obtain the format that meets your requirements and demands.

- Upon having identified the format you desire, click on Buy now to proceed.

- Choose the pricing prepare you desire, type in your accreditations, and register for a free account on US Legal Forms.

- Complete the deal. You can use your credit card or PayPal profile to purchase the legitimate develop.

- Choose the format of your record and download it in your gadget.

- Make adjustments in your record if necessary. It is possible to comprehensive, revise and signal and produce Puerto Rico Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

Obtain and produce a large number of record layouts utilizing the US Legal Forms site, which offers the largest selection of legitimate kinds. Use skilled and condition-particular layouts to take on your company or specific needs.

Form popularity

FAQ

Food Lion's parent company is Ahold Delhaize, the same owners since 1974. Delhaize merged with Ahold in 2015 and holds a wide range of retail stores in 10 different countries. In the United States, they also own the popular online grocery service FreshDirect, as well as my beloved hometown grocery store Giant.

In 2000, Delhaize America bought Hannaford; the purchase both eliminated an emerging competitor to its Food Lion chain in the Southeast and expanded Delhaize operations into the Northeast. Some Hannaford locations in North Carolina were sold to Lowes Foods upon the buyout by Delhaize while others were closed.

Founded and based in Salisbury, N.C., since 1957, Food Lion is a company of Ahold Delhaize USA, the U.S. division of Zaandam-based Ahold Delhaize. For more information, visit foodlion.com.

The Food Town chain was acquired by the Belgium-based Delhaize Group grocery company in 1974. The Food Lion name was adopted in 1983; as Food Town expanded into Virginia, the chain encountered several stores called Foodtown in the Richmond area.